I was feeling confident that rates would go up at the end of June, with a dual-purpose rush to close the quarter on a high note and boost retail inventories before July 4th. In fact, spot market rates did rise in the week ending June 30th — but, to my surprise, they rose again in the first week of July.

There are two possible explanations: (1) The midweek holiday put pressure on shippers to get freight out the door on Monday and Tuesday, so they were willing to pay a little extra; (2) Some shippers were unable to move all their freight in time for the quarter close on Saturday June 30th, and the excess went out at the previous week’s higher rate.

Either way, the uptick did not affect reefers, which declined slightly after a 19-week upward trend. Temperature-sensitive cargo moves tend to coincide more with produce harvests and pre-holiday retail needs than with fiscal quarters.

VAN rates increased 1% in top markets, as a national average.

– Philadelphia was “most improved” with a 3.1% increase to $1.46, in a back haul market. Columbus, up 2.7% to $1.69, and Los Angeles, up 2.4% to $2.10, also showed significant growth.

– Memphis is down 1.1% for the week, but rates were up 5.9% for the month and at $2.20 per mile, they are still the highest for a major market. Rates from Charlotte were unchanged at $2.06.

– Hell freezes over! A lane from Denver is this week’s “most improved” at $1.45, up 13%, partly due to southbound beer shipments. I kid you not. Philadelphia to Atlanta gained 15% to $1.28 while the northbound lane from Atlanta to Philly was up 6.8% to $2.67 per mile, for an attractive round trip. Charlotte to Philadelphia also improved 4.7%, to $3.38 per mile.

– Trending downward, the lane from Columbus to Philly slipped 8.5% to $2.49 per mile, and out west, Stockton to Portland OR slid 5.6% off its recent high to $2.87 per mile.

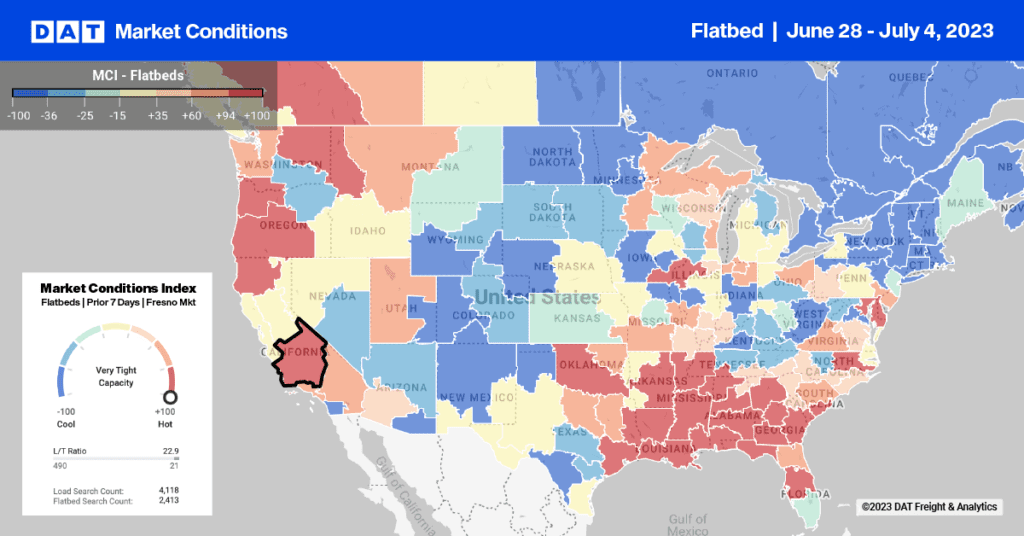

FLATBED gained 2.2% for the week — up 4.9% for the month — in major markets, an unexpectedly strong result for a holiday.

– Highest long-haul rates came from Memphis, at an average of $2.79; the short-haul leader was Savannah, which rose 8.0% to $2.78 per mile. Cleveland jumped 7.9%, Atlanta rose 6.7%, and Houston was up 5.8%.

– Declining markets included Baltimore, down 6.4% for the week, but up 2.2% for the month. Both Jacksonville FL, down 4.6% for the week, and Fort Worth, down 2.1%, declined for the month, as well.

– Flatbeds were getting more than $3.00 per mile on high-volume lanes in every region: Phoenix to El Paso in the Southwest spiked by more than a dollar to $3.45 per mile, while in the Southeast, flatbeds got $3.15 for hauls from Atlanta to Nashville. South Central saw a $3.10 rates from Houston to New Orleans, and up North, the lane from Cleveland to Harrisburg PA rose 23% to $3.24 per mile.

REEFER rates were down a penny nationwide, as noted above, but a surge of freight from Southern California (Ontario) came close to offsetting declines from Fresno and Lakeland FL. Overall volume was up but drought in the Upper Midwest is hurting multiple markets, including those in Michigan and Wisconsin.

– Several markets gained 2% on their average outbound rates, however, including Ontario CA (up 2.2% to $2.61 per mile), Phoenix (up 1.8% to $2.71) and Twin Falls ID (up 1.7% to $1.80.) Salt Lake City reefer rates rose 10% to $1.40, but it’s a small market so it didn’t affect national trends.

– On the down side, rates slid 6.5% to $1.51 from Lakeland, where harvest season has passed its peak, Fresno rates lost 2.5% to $2.41, and nearby Sacramento stayed fairly steady at $2.88.

– Sacramento to Salt Lake City rose $0.62 (23%) to $3.27, because California trucks needed an extra incentive to venture out of state during the holiday week. Atlanta to Lakeland rose 9.8% to $3.03, as Lakeland’s status as a reloading point continues to weaken.

– Lakeland to Brooklyn NY slid 18% to $2.11 per mile, and Fresno to Joliet dropped 17%, also landing at $2.11. Sacramento to Los Angeles was a popular lane during the holiday week, driving prices down 13% to $2.02 per mile including fuel.