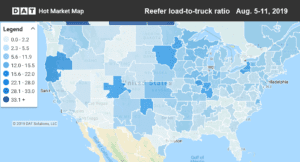

Reefer rates still stuck in a rut

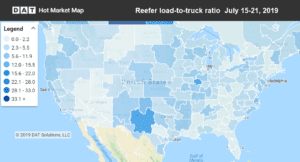

This summer, reefer markets have felt the woes of reduced harvests due to harsh weather. That’s kept rates from climbing,

This summer, reefer markets have felt the woes of reduced harvests due to harsh weather. That’s kept rates from climbing,

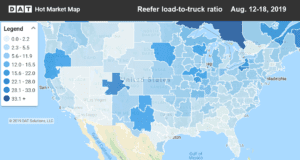

Reefer markets have been waiting for an uplift from late summer fruit and vegetable harvests, but so far, that hasn’t

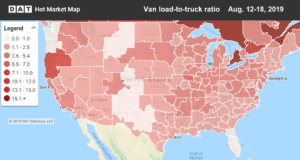

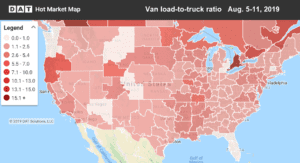

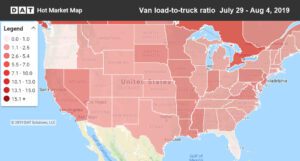

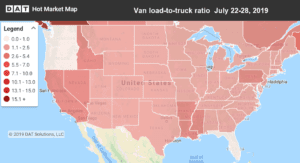

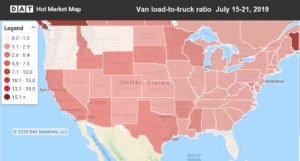

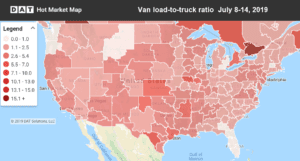

Van freight trends have been muted for nearly all of 2019 – we haven’t seen many sharp spikes or large

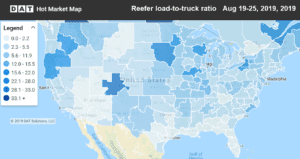

Reefer demand trailed off in California and Texas last week, and the majority of high-traffic reefer lanes paid lower rates

With the threat of new tariffs on Chinese imports, there was uncertainty over how truckload markets will react heading into

Truckload demand got a boost at the end of July, but that urgency slowed by the start of August. That

Even as the summer slump continues, July is still on pace to beat May volumes, with a national average van

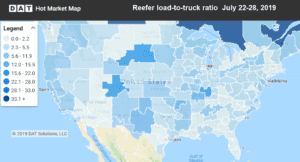

Last week halted the slide in reefer rates that we’ve been seeing since the Fourth of July. Improvements out of

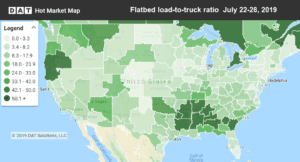

Spot market flatbed rates normally peak in Q2, but this year they hit their high mark in early July. Since

The summer slowdown has arrived for spot market truckload freight. It’s typical for prices to drop around this time of

Reefer rates and volumes continued their summer slide. The load-to-truck ratio was down 16.8% last week, meaning there’s a lot

It’s typical for rates to fall after the Fourth of July, and this year was no different. Now that the holiday