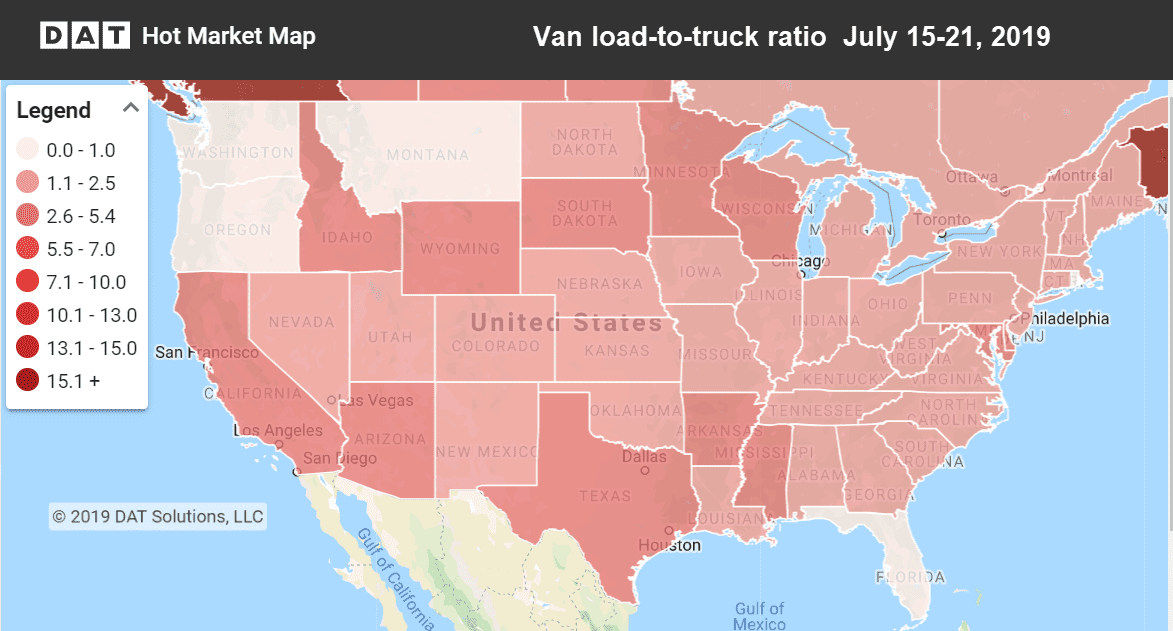

The summer slowdown has arrived for spot market truckload freight. It’s typical for prices to drop around this time of year, as urgency slows after the Fourth of July.

Declines in reefer freight and oil field activity are also adding a drag on van rates this summer. The lower demand for reefers has led to more trucks competing for dry van freight, while the energy sector is often a key driver for truckload demand.

In the top 100 lanes, 71 had lower prices last week. While a few markets remain neutral, most are losing pricing power, though most changes in price last week were relatively slight. The national average van rate for July sits at $1.86, down 3¢ from the June average but still 7¢ above May.

Rising

A few lanes saw a notable rise last week, though they were on lanes that typically see low rates. The smaller markets of Buffalo (+13%) and Denver (17%) posted strong gains in volumes.

- Columbus, OH, to Atlanta rose 10¢ to $1.98

- Denver to Stockton, CA climbed 11¢ to 1.24¢

Falling

The Southeast region is currently facing a slide in volumes, with declines in Atlanta, Memphis and Charlotte. Also, Houston’s outbound volumes were down 8% last week, due to the slowdown in Texas oil fields.

- Atlanta to Philadelphia dropped 13¢ to $2.34

- Memphis to Charlotte was down 14¢ to $2.04

- Chicago to Detroit fell 12¢ to $2.85

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.