This summer, reefer markets have felt the woes of reduced harvests due to harsh weather. That’s kept rates from climbing, and reefer trucks have also been competing for dry van freight.

The summer slump continued last week, as a few key gains were not enough to offset the losses in other regions. While California saw volume increases, load counts in Sacramento took a hit, which kept prices from rising out of the state. The Upper Midwest has paced pricing in late summer, though demand in that region declined last week. Rates out of Texas saw another dip last week as well.

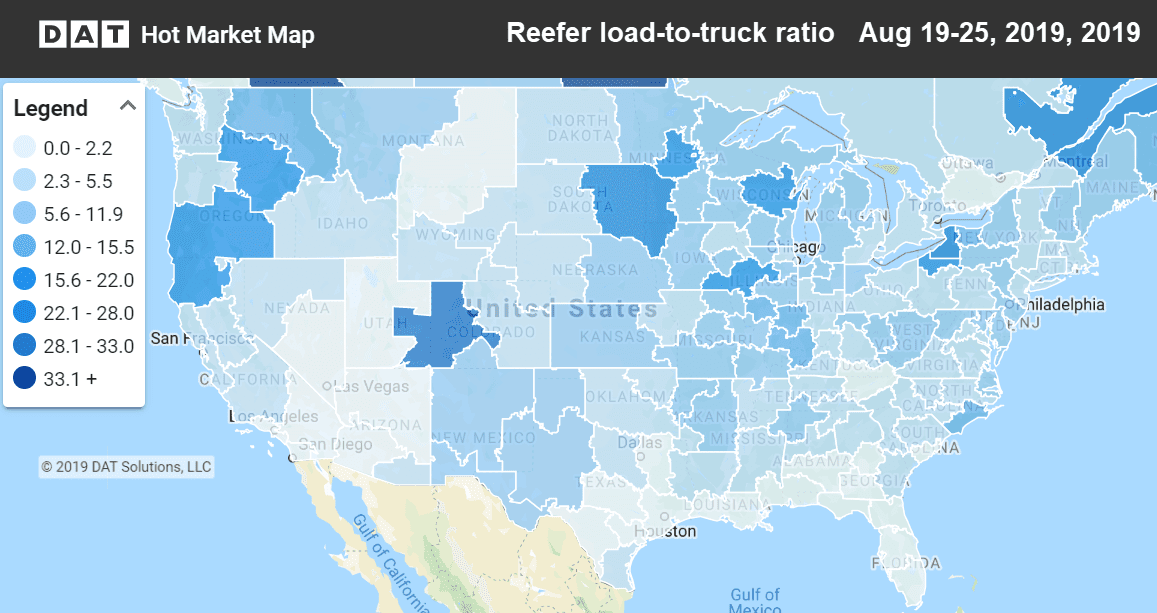

Hot Market Maps are available in the DAT Power load board and DAT RateView.

Rising

Of the few lanes that saw higher rates last week, the biggest increases were on relatively low volume lanes. Out of Grand Rapids, MI, the lane to Cleveland stayed especially volatile. An offseason boost in demand gave Miami to Baltimore an increase.

- Grand Rapids to Cleveland shot up 69¢ to $4.01/mi. (after falling 36¢ the previous week)

- Grand Rapids to Philadelphia increased 28¢ to $2.46/mi.

- Miami to Baltimore added 14¢ to $1.64/mi.

Falling

Many of the top lanes faced a decline in rates last week, though few were significant. Green Bay has seen instability in outbound rates, following the trend of several Midwest states this summer.

- Green Bay to Philadelphia dropped 17¢ to $2.96/mi. (after rising 21¢ the previous week)

- Fresno to Seattle was down 12¢ to $2.76/mi.

- Los Angeles to Portland declined 16¢ to $2.61/mi.