The first in a series of articles on trends and events that shaped trucking in 2011 and will affect the industry in 2012.

Going into 2011, one year ago, various experts speculated on 2011 rate increases. Shippers hoped to hold rate increases to the 4-5% range, but other industry sources thought rates could rise by 8% or more. So who was right?

Rates spiked seasonally on the spot market in 2011, followed by steady increases in contract rates. (Illustration by Eric Savage of Savage Creative)

Contract rate increases landed between those two predictions with a 6.5% increase through November, while spot market rates rose a full 7.4%. Spot market rates rose at an uneven pace throughout the year, especially for vans. In the first quarter, van rates advanced 14% over the year-earlier numbers but the gain slowed to 7.5% in the 2nd quarter. Rate growth further slowed to 2.6% in the 3rd quarter before charging back for a 6% gain in Q4, compared to the same period in 2010.

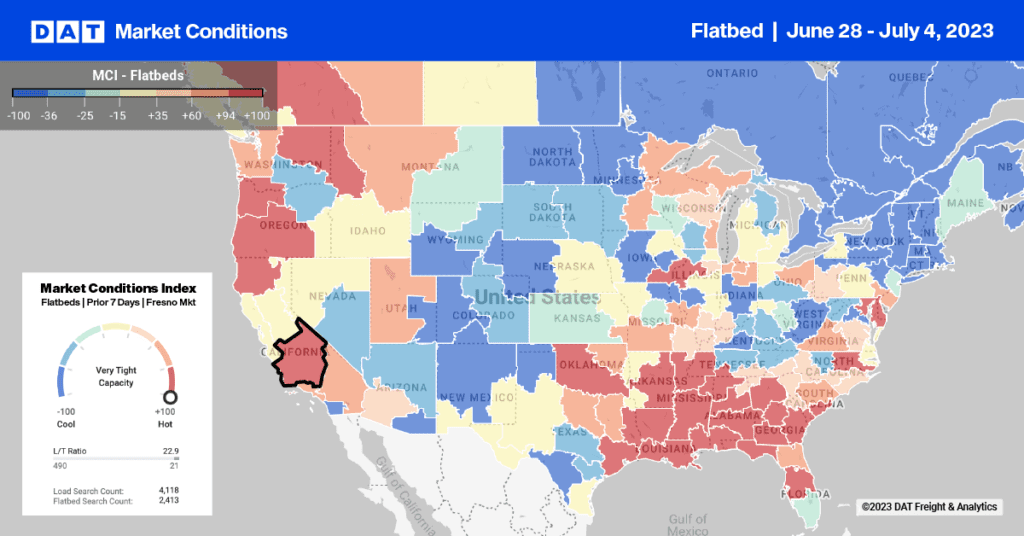

While spot market rate increases for both vans and reefers slowed in the second half, flatbed rates continued to beat their 2010 comparables well into the 2nd half of the year. Flatbed rate increases didn’t slow down until mid-November.

Shippers showed a typical reluctance to raise rates, but their contract rates eventually followed the spot market’s lead. Increases in contract rates were spread evenly among equipment types. Van rates moved up 6.5% while flatbed and reefer rates increased 6.4% compared to 2010. Contract rates did not increase until the second half of the year for vans, the most common mode of trucking freight transportation. Flatbed and reefer rates changed gradually throughout the year.

Extreme weather also shaped the news and disrupted regional freight flows throughout 2011. Cold snaps, floods, tornadoes and drought devastated large areas of the country, but the effects on freight and rates were mostly localized and short-lived. Overseas events, most notably the earthquake in Japan, destroyed property and lives. In the U.S., the disaster damaged some ports and disrupted trade.

The Road Ahead: Expect Additional Rate Increases in 2012

Rates will continue to rise in 2012, as carriers’ costs increase. Contributing factors include prices for fuel, insurance, labor, tires and equipment. If the economy improves, the demand will increase pressure on scarce capacity. If the economy stalls, carriers will park more trucks or exit the market entirely. Either way, expect rates to head up as soon as mid-March.