I watch load board trends and truckload rates for a living. That’s what I do. I’m not on the road myself, and I don’t hire trucks, but I’m watching the numbers every day.

Recently, I’ve seen crazy high load-to-truck ratios and rates for reefers in a number of key freight markets in Indiana, Illinois and Missouri, mostly in the area near where those three state borders touch.

I asked Mark Montague what’s going on for reefers in that region. Mark is our industry pricing analyst here at DAT, and he’s been in transportation and logistics for more than 30 years. He’s seen it all.

Last week, Mark answered me with one word: “Melons.”

I looked at the Hot Market Maps in the DAT Power load board, and confirmed that there is still pressure in Southern Indiana.

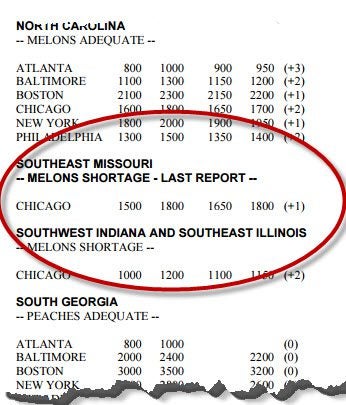

The USDA confirmed that there was a shortage of trucks in Southwest Indiana, Southeast Missouri, and Southeast Illinois.

The report is generated by USDA’s Agricultural Marketing Service in Fresno, CA. They publish a weekly fruit and vegetable truck rate report, which Mark follows regularly. The USDA also publishes a National Watermelon Report.

The report is generated by USDA’s Agricultural Marketing Service in Fresno, CA. They publish a weekly fruit and vegetable truck rate report, which Mark follows regularly. The USDA also publishes a National Watermelon Report.

I was pleased to see that the rates published by USDA are consistent with the rates in DAT RateView, although USDA-reported rates tend to run a little higher. That’s because the Agency blends contract and spot market rates, where DAT maintains separate databases. Our purpose is to help our customers understand what they’re likely to pay — or get paid — for a truck, and that depends on who’s paying, and the terms of the contract, as well as the season, location, direction and distance of the haul.

DAT products include a lot more lanes, though. The USDA cites total rates on anywhere from 20-some origins to 1-9 destinations. USDA also publishes five categories of weekly truck availability, from “surplus” to “shortage,” where DAT loadboards give a detailed, daily count of load and truck posts.

On the other hand, USDA data includes the commodity, which is information that DAT doesn’t receive consistently from our rate contributors.

That brings me back to melons. They’re still being harvested, but there are enough trucks — from an “adequate” supply to a “slight surplus” according to the USDA — in places like the San Joaquin Valley in California, along the East Coast from Delaware to Maryland and Virginia, and in Sourthern Texas.

On the other hand, onions are a hot commodity right now. You can find a load of sweet onions in their namesake locations of Vidalia, GA and Walla Walla, WA, or various other types of onions in New Mexico, Eastern Oregon and Southern Idaho, and (again) the San Joaquin Valley, which includes the Fresno and Stockton markets.

Onions don’t always require temperature controls, so you may be able to haul them on a van or even a flatbed.