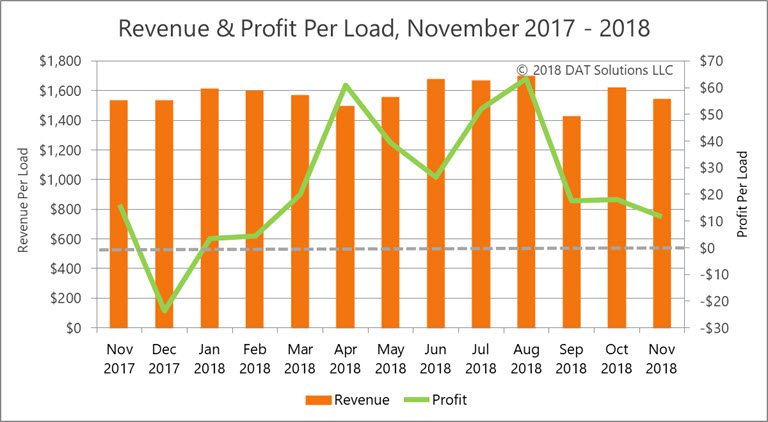

Although revenues and profits improved for freight brokers in November compared to 2017, the month-over-month results were disappointing. Load counts declined for the third consecutive month, and rising labor expenses took a bite out of net profits.

This report is derived from the monthly financial results of more than 100 freight brokerage companies. Their 2017 average annual revenue was $19.5 million, and the group is on track to exceed $30 million in 2018.

Get the full report delivered to your inbox. Subscribe to the DAT Broker Benchmark Report.

Brokers’ gross revenues beat November 2017 results by 20%, even after a 9% dip month over month. For the year to-date, revenues are up 59% compared to the same period in 2017. High spot market freight rates contributed to the increase.

Gross margins averaged a tepid 12.8% in November, which was an improvement over October’s 12.3%. Compared to November 2017, the margin percentage was lower but the dollar amount was 14% higher. Brokers took in almost $320,000 in net revenue, which is what’s left after they paid their carriers.

Rising labor costs were the big reason for a 14% decline in net operating profit, compared to November 2017. Labor expense rose 21% on a 43% increase in headcount, as the brokers staffed up to handle business growth. As a percentage of net revenue, labor expense rose to 71%, non-labor expense accounted for 19%, and 3% went to interest, taxes, depreciation and amortization, leaving less than 6% net operating profit.

Revenue per employee lost 9% in November month over month, with no change in the average headcount. Compared to November 2017, revenue per employee dropped 15% and profit per employee fell 39%, due mostly to a 43% increase in headcount for the year.

Year-over-year load counts were up 19% and revenue per load held steady, but profit per load lost 28% to just under $12. But compared to the previous month, the numbers trended in the opposite direction: 5% fewer loads moved in November, with 5% less in revenue and a 36% cut in profit per load compared to October.

DAT Broker TMS grows with your business. Call us for a demo: 800.728.7305.