KPMG’s latest Consumer Pulse Summer 2025 report paints a sobering picture of the consumer: more cautious, more cost-conscious, and more selective than they’ve been in years. Amid inflation, shrinking incomes, and growing tariff concerns, the report’s findings suggest a “make it count” mindset is taking hold — and reshaping everything from retail to travel to wellness.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

In a nationally representative survey of 1,516 U.S. consumers, nearly 4 in 10 consumers report a decline in household income — nearly double last year’s figure — while over 70% say a recession is likely within the next 12 months. The KPMG report finds consumers expect to spend 7% less each month on restaurants this summer impacted by inflation, declining incomes and concerns over the potential price impacts of tariffs.

At-home meal occasions could increase at the expense of restaurants. Sixty-nine percent of consumers said they are eating more at home, and 85% of that cohort said they are doing so to save money. Thirty-nine percent of consumers said their incomes declined, roughly double that of last year’s report. A majority (79%) said they expect tariffs to increase prices.

“We see a more selective and cost-conscious summer ahead,” Duleep Rodrigo, KPMG Consumer & Retail Leader, wrote in an email. “People aren’t just pulling back—they’re recalibrating. We’re seeing a more selective and cost-conscious summer travel season, vacations are still in the budget—but nearly everything else is on the chopping block.”

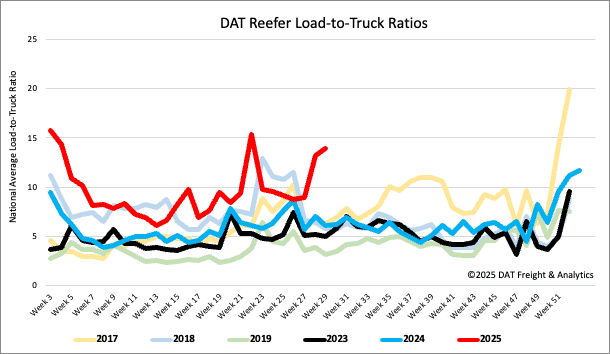

Load-to-Truck Ratio

Following the prior week’s surge in reefer load post volume, the market cooled following last week’s 10% decrease in volume, impacted by California’s 2% decrease in loads of fruit and vegetables. This decrease in load volume, coupled with a 15% drop in reefer equipment postings, led to the reefer load-to-truck ratio, increasing by 5% to 13.90.

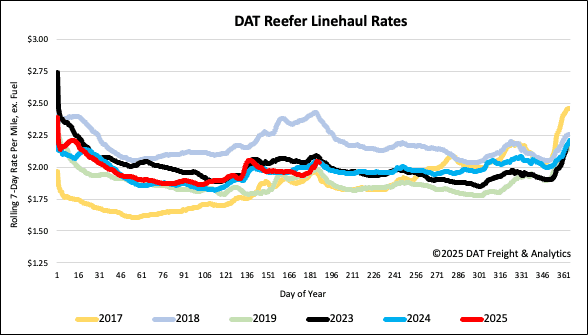

Spot rates

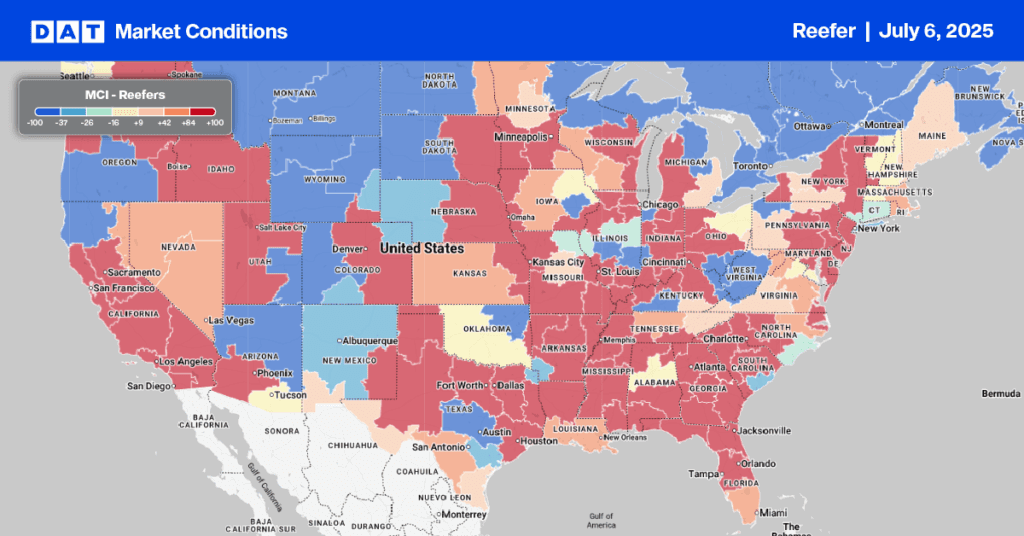

Last week saw a rapid tightening of available capacity, with the Southeast experiencing solid gains. Outbound reefer loads from Atlanta, for example, were up by $0.22 per mile compared to the previous week, averaging $2.87 per mile for carriers.

Nationally, the average reefer rate increased by almost $0.10 per mile last week, reaching an average of $2.05 per mile. This figure is $0.01 per mile lower than last year and $0.04 lower than 2023.

In California, despite a 23% decrease in produce volumes compared to last year, outbound loads paid reefer carriers an additional $0.05 per mile last week, averaging $2.46 per mile. However, this is still $0.27 lower than last year’s rates.