Florida’s citrus industry has ended the 2024-2025 growing season with its lowest production in over a century, mainly due to hurricanes and citrus greening disease, according to the U.S. Department of Agriculture.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Orange production dropped by 32.7%, grapefruit by 27.4%, and tangerines and tangelos by 11%, resulting in a total of 14.52 million boxes of citrus, including lemons. This is the lowest total since the 1919-1920 season. Specifically, growers produced 12.15 million boxes of oranges, 1.3 million boxes of grapefruit, 400,000 boxes of tangerines and tangelos, and 670,000 boxes of lemons. Overall, production was 28.5% lower than the previous season and down 75% from five years ago.

In response to these challenges, the Florida Legislature approved a $124.5 million aid package for the industry in the 2025-2026 budget, which includes $100 million for new disease-resistant trees, grove management, and rehabilitation of existing trees.

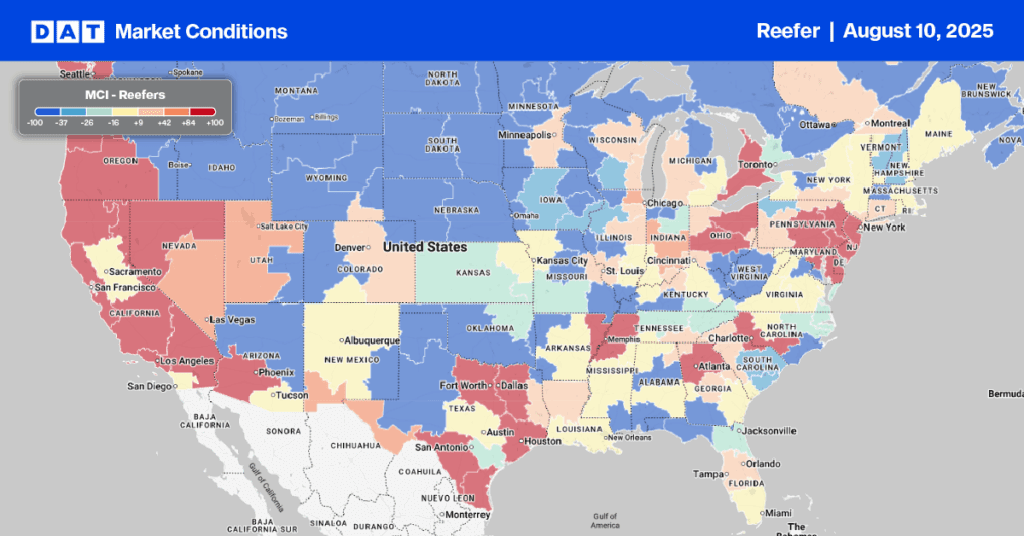

Load-to-Truck Ratio

Last week, reefer load post volumes saw a significant drop of nearly 20%, largely due to a 3% decrease in domestic produce shipments. This continues the year-to-date trend of summer produce volumes remaining 7% lower, which is negatively impacting truckload volumes in the reefer spot market. Concurrently, carrier equipment posts fell by 4% week-over-week, leading to a reduction in the reefer load-to-truck ratio to 9.57.

Spot rates

National reefer rates, after holding steady through the latter half of July, saw a one-cent decline last week, settling at just over $1.95 per mile. This rate is $0.02 lower than the previous year but $0.01 higher than in 2023.