The U.S. freight market experienced a slight dip in May, with trucking activity decreasing by 0.1% after a 0.5% gain in April. This “seesaw freight demand pattern” makes it challenging to identify a clear trend, according to Bob Costello, ATA Chief Economist. He noted that the goods market is inconsistent, with soft construction, fluctuating manufacturing, and cautious consumers, all impacting freight levels.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index, based on 2015 as 100, registered 113.8 in May, a slight decrease from 113.9 in April. This represents a 1.3% decline from May of last year, marking the first year-over-year decrease in 2025. Despite this, year-to-date tonnage remains up by 0.1% compared to the same period in 2024.

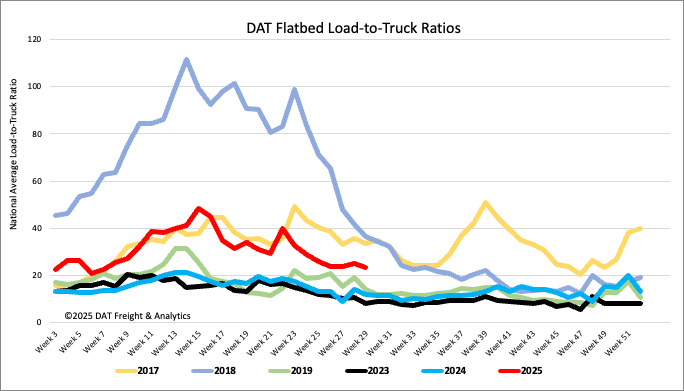

Load-to-Truck Ratio

Flatbed volume remained dropped last week, reporting a 28% decrease in load posts but remaining almost 40% higher year-over-year. Despite a 23% decrease in carrier equipment posts, the flatbed load-to-truck ratio fell by 7% to 23.49.

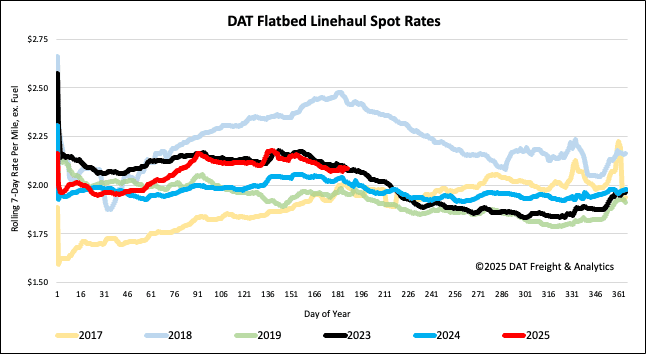

Spot rates

The national average flatbed spot rate, excluding fuel, saw a $0.02 per mile decline last week, settling just over $2.10/mile. This marks the third consecutive weekly decrease, aligning with typical seasonal patterns. Despite this drop, the current rate is still $0.07 per mile higher than the corresponding week in 2024.