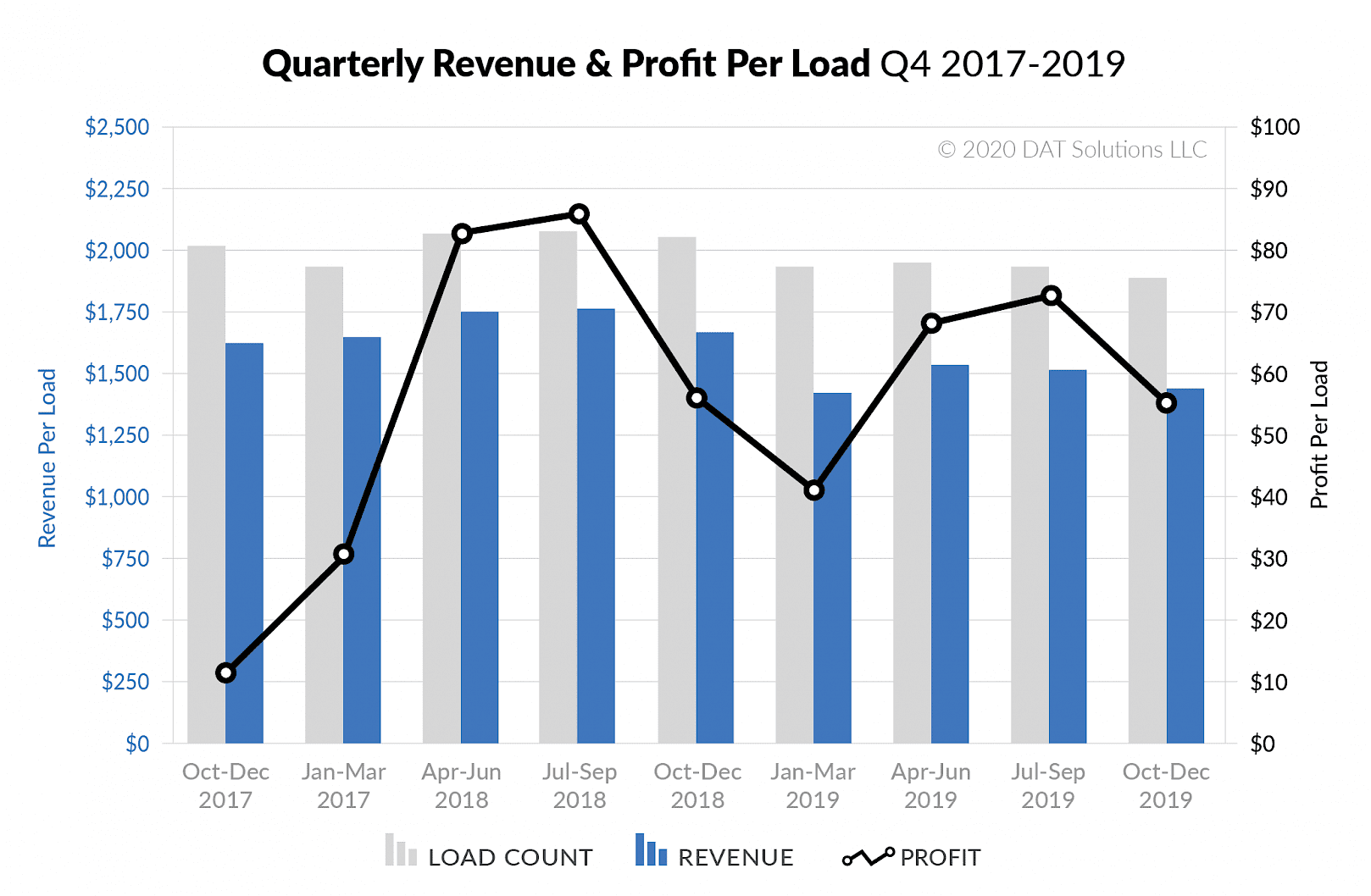

For small and mid-sized brokerages, quarterly load volumes were lower than they had been in more than two years, based on benchmark data from DAT Broker TMS. Spot market rates remained low, which was a mixed blessing, as it reduced revenues as well as costs. At least gross margins held up, at an average of 15.8% for the benchmark group.

This benchmark data is drawn from the TMS systems of nearly 100 small and mid-sized freight brokers and 3PLs with average 2019 revenue of $11.4 million. That was an 18% decline from the record highs of 2018, but those were some tough comparables.

This graph tells a compelling story about 2019. It was actually a pretty good year, although it looks weak in comparison to the glorious results of 2018.

In that year-over-year comparison, load counts were down in 2019 and top-line revenues dropped even more than load counts because rates were down, too. So they moved fewer loads at less money per load. That’s never a good thing.

However, if you look to the left of the chart and compare the last three months of 2019 to Q4 2017, it’s apparent that the brokers are more profitable now than they were two years ago. Sure, they moved fewer loads in Q4 2019 than in Q4 2017, and the average revenue per load was lower, but they got to keep more of that money.

On the upside, gross margins held firm, so bottom-line profits were better than pretty much any year except 2018.