A few trends started to solidify this week, and each of the three major segments had a separate story to tell:

Memphis and Los Angeles were the top-gaining markets for vans and reefers, respectively, while flatbed rates declined out of Chicago, in the seven days ending November 17. As a national average, spot market rates rose for vans and reefers and declined for flatbeds during that week.

VAN – Got trucks? Go to Memphis.

Van freight availability was stable, but truck postings increased 5%. That’s a significant change, and the extra capacity can be put to good use, moving holiday traffic. Across the country, there was not much of a shift in van rates – only 0.2% on average – but individual markets were more volatile. Stockton declined 2.9%, signaling an end to the late fall produce season. Memphis, on the other hand, saw a 1.9% increase in van rates. Memphis is a major distribution hub, especially for UPS and Fed Ex package and LTL shipments. The rate increase most likely consists of consumer goods moving from warehouses to retail prior to the holiday season.

REEFER – Turkeys are on the move.

There was a lot of activity in the refrigerated segment last week, and we saw both freight volume and rates rising in advance of Thanksgiving. Rate from Los Angeles picked up 1.2%, as regional movements intensify. Reefer rates outbound from Chicago, on the other hand, lost 2% compared to the previous week. Chicago has been a pricing leader in recent months, but as meat processing has shifted closer to the source, the Windy City is reverting to its role as a major consumption market. Turkeys are on the move now, soon to be consumed. We expect to see more reefer traffic into major markets this week.

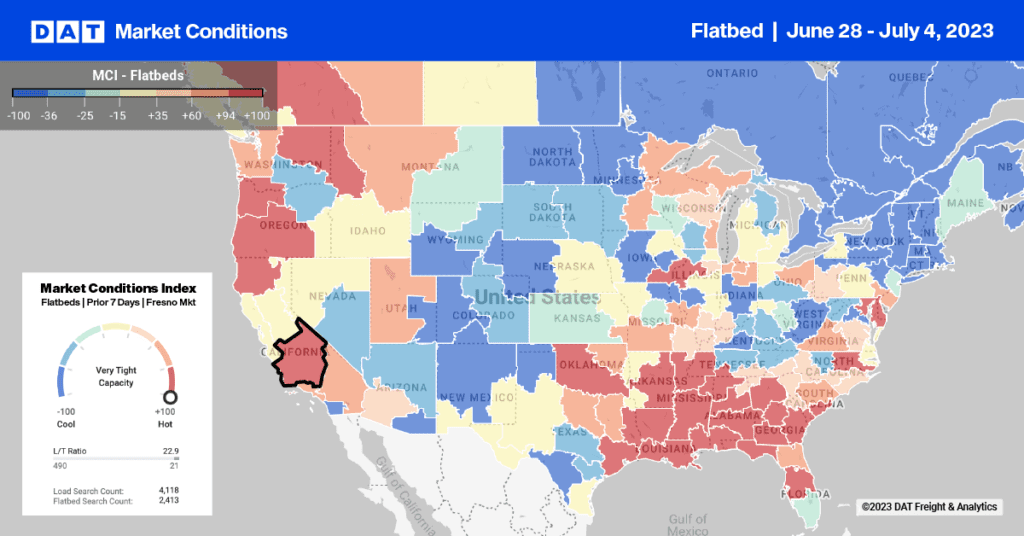

FLATBED – Texas is hot. Chicago is not.

The weather is getting cold, and flatbeds are losing their luster. Flatbed rates dipped 1% and spot market freight volume declined substantially – a 9% dip in the week ending November 12. Chicago was the biggest loser, with a 3% dip in rates. Countering this trend, flatbed rates rose 3.3% out of Dallas. Forbes reported this week that Dallas and nearby Fort Worth led the nation in new housing starts in the third quarter. Among the top 20 cities for new construction permits, the two were second and thirteenth, respectively. Three other Texas cities joined them in the top 15, including Houston in the number-one position. In light of this report, it makes sense that we are seeing an increase in flatbed traffic in and out of major markets in the Lone Star State.

For more spot market freight volume and rate information, see TransCore Trendlines.

Spot market rate data is derived from TransCore’s Truckload Rate Index.