I look at freight transportation statistics all day long, and I am astonished by the rapid growth of the past few months, especially in the truckload spot market. It seems as though every week sets a new record for something: highest-ever rate or load-to-truck ratio for vans, greatest-ever number of load posts, one after another, until we run out of superlatives.

Even with all those records and peaks, one statistic stands out for me:

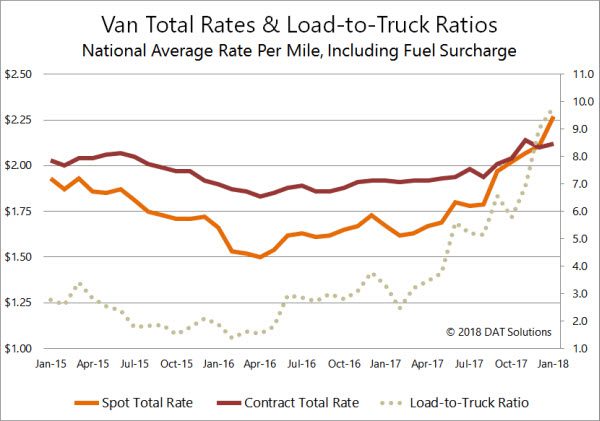

As 2017 drew to a close, national average rates were higher for spot market trucks than for their contract fleet counterparts, for all equipment types. That pattern is continuing, three weeks into January, according to DAT RateView. In fact, the gap between spot and contract rates has widened in recent weeks. This is true for all three major equipment classes: van, reefer, and flatbed.

That simply never happens.

Anticipate Freight Rate Changes

Prices on the spot market change quickly, but with freight rate tools like DAT RateView, your business won’t be caught off guard. Based on $45 billion in actual transactions, RateView is the most trusted freight rates resource in the trucking industry.

But here it is, the most unlikely scenario: brokers are paying more than shippers, on average — even for dry van freight. Contract rates were only a few cents higher than spot rates, beginning in September, and then spot rates were suddenly a penny higher than contract rates by December. Now the end of January is less than a week away, and trucks are getting paid more for brokered freight than for shipper-direct freight, by an average of 5¢ per mile. Spot rates may drop back a bit in the next few days, or they may rise as shippers tend to move more freight at the end of the month.

Either way, in a three-year time span, the last few months create a very rare picture:

Van rates declined through 2015, but rebounded in mid-2016. Spot market rates rose slowly at first, then rocketed up in the summer of 2017, surpassing contract rates in December. Load-to-truck ratios rose sharply from January 2017 until now, giving early warning of the rate trends to follow.

Why is this trend so important? Spot market rates, by definition, are paid by a broker or 3PL, who is paid by the shipper or receiver to arrange transportation. Contract rates are paid directly by the shipper to the carrier, with no intermediary. You would expect the carrier to make more money on shipper-direct freight, and usually you would be correct. But this environment is beyond different. Economic growth, e-commerce expansion, and disruptive weather events (including hurricanes) in 2017 caused a big surge in demand for freight transportation, just as the ELD mandate and a looming driver shortage slammed the brakes on available truck capacity. One result: For most spot market transactions, it’s a carrier’s market.

Spot Rates Exceed Contract Rates for Reefers, Starting in September

In past years, spot market rates exceeded contract rates only in June, and then only for refrigerated (“reefer”) trucks. That hasn’t happened since 2014, probably because of lower crop yields during the multi-year drought in California, but before then, it was a typical pattern.

In 2017, spot market reefer rates rose above the contract averages in September, and they kept rising until the end of the year and beyond. There was a gap of 18¢ per mile between the two in December, and by this week, that gap has widened to 37¢. Spot market reefers are being paid an average of $2.69/mile and contract carriers are getting $2.37.

Here’s how that looks on a graph:

Reefer spot market rates surpassed contract rates in September 2017, and then kept rising. Before 2015, spot reefer rates typically exceeded contract rates in June only.

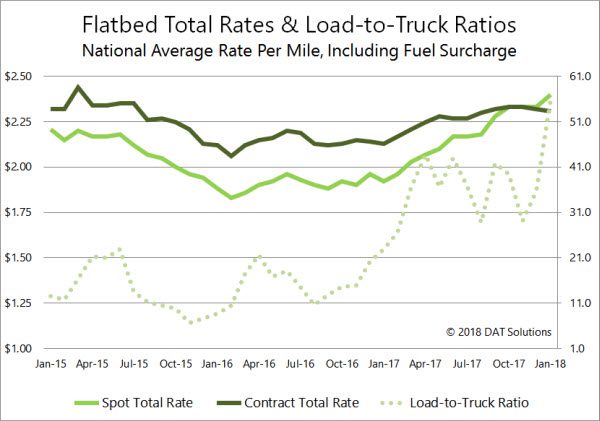

When it comes to flatbeds, this should be the off-season. There’s not as much demand for drilling or construction equipment and materials when the ground is frozen, and other cargo types don’t do well on open decks in cold weather. Nevertheless, flatbed load-to-truck ratios have been bouncing up and down since the spring, and they’re now at the highest levels we’ve seen in recent years. Load-to-truck ratios anticipate rate changes, and national average rates for flatbeds are as high as we can remember. Spot market rates edged up above contract rates by a penny in December, but spot rates are still rising as contract rates start dropping back to seasonal norms.

What happens next? February is usually the quietest month for trucking, so spot rates might come partway back down to earth, at least for a few weeks. But transportation contracts are often renegotiated in January and February, so we expect an increase in contract rates. This trend will be most noticeable over the spring and summer, as shippers may need to bring a little more to the table if they want to secure enough trucks for the busy season.

There are some wild cards in the mix, including weather. Rates could go much higher in February and March if recent weather patterns get any worse, turning the intermittent ice and snow from a “bomb cyclone” into an ongoing “snowpocalypse.”

Once the weather is no longer a threat, there is an enforcement deadline looming for ELDs on April 1. From then on, drivers will be put out of service if they are caught without a valid electronic log.

Economic growth is beginning to look like a wild card, too. Continued expansion looks like a near certainty, but are all shippers fully prepared for the impact on every link in the supply chain? Meanwhile, manufacturing continues to expand, inventories are lower than they’ve been in years, employment is increasing, and purchasing is on the rise for businesses and consumers alike, even before the new tax plan gets going. These are the kinds of trends that generate freight.

How Will Trucking Respond in 2018?

So far, it looks like contract fleets are turning down more loads, at least until they renegotiate their rates. Many fleets will need to rethink driver pay, as drivers won’t agree to be paid the same amount per mile when they drive fewer miles per week, a common outcome of the ELD mandate.

When contract carriers turn down loads, they are often assigned to freight brokers and 3PLs, and spot market rates are rising along with demand. Owner-operators are making more money, at least on a per-mile basis. Like the company drivers, however, their total miles — and revenues — may be constrained by ELDs. O-Os can change their pricing to compensate, and that’s another reason why spot market rates are rising so fast.

For freight brokers, the rapid increase in spot market rates can be a double-edged sword. Brokers are being offered more loads, and they’re paying carriers a higher rate, so total revenues are way up. But those higher rates can also squeeze brokers’ margins, especially if they are operating under long-term contracts with their shipper customers.

So far, 2018 is shaping up to be even more extraordinary than 2017. That’s saying a lot.

Don’t be taken by surprise. Get all the latest details of rate trends in the lanes that matter most to your business, with DAT RateView.