I look at freight transportation statistics all day long, and I am astonished by the rapid growth of the past few months, especially in the truckload spot market. It seems as though every week sets a new record for something: highest-ever rate or load-to-truck ratio for vans, greatest-ever number of load posts, one after another, until we run out of superlatives.

Even with all those records and peaks, one statistic stands out for me:

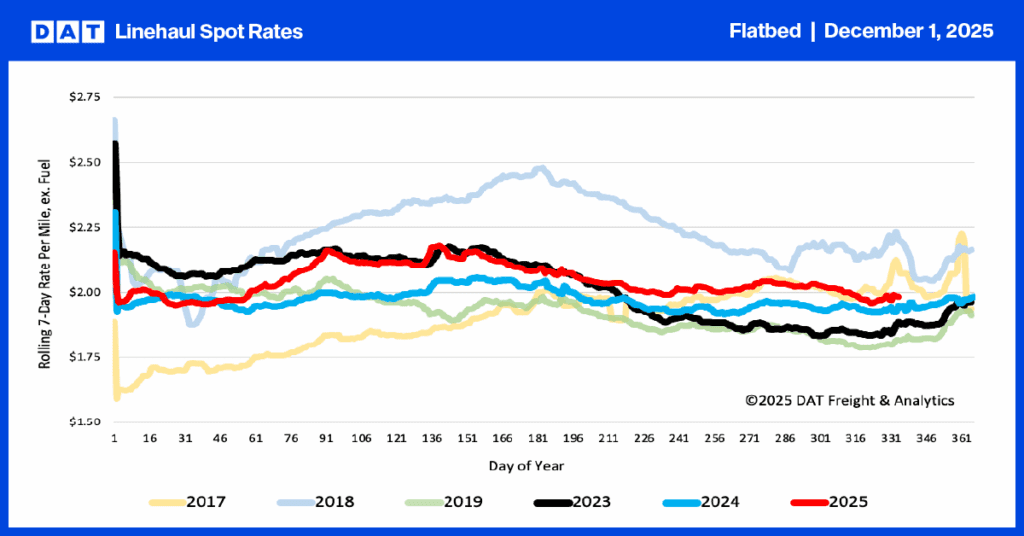

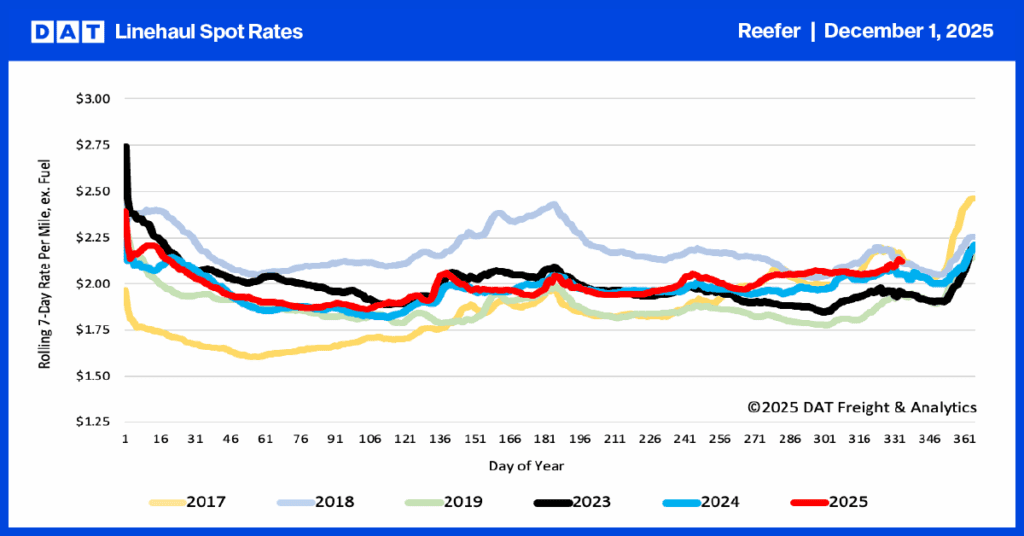

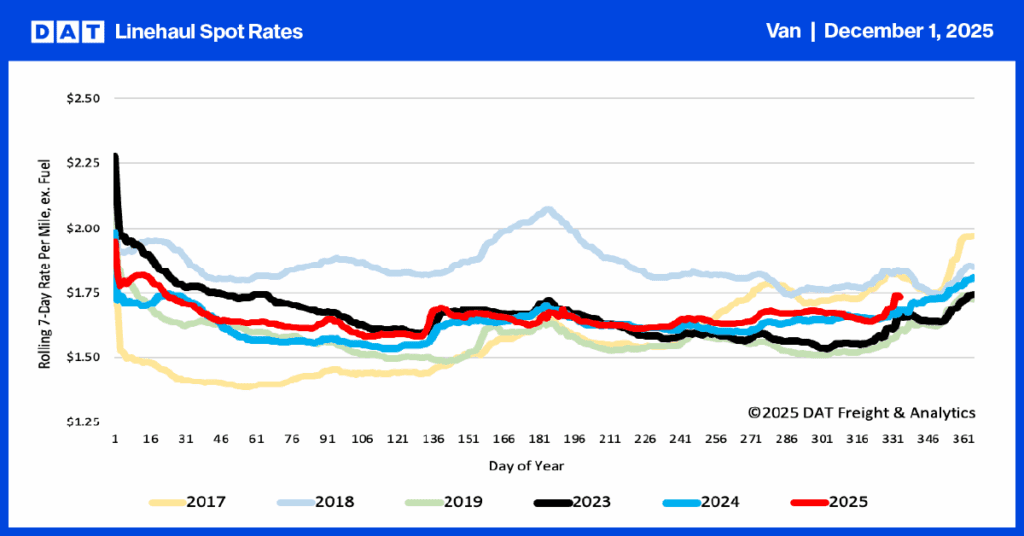

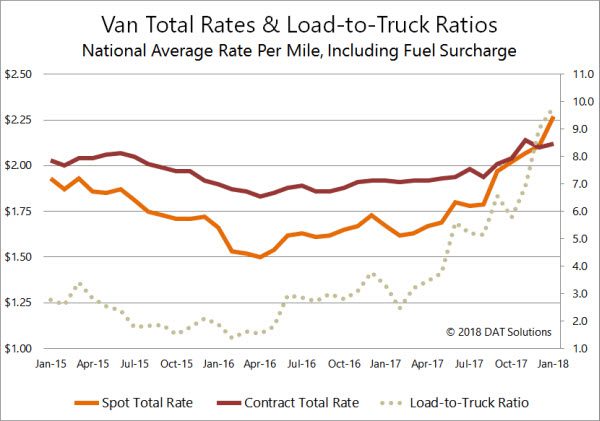

As 2017 drew to a close, national average rates were higher for spot market trucks than for their contract fleet counterparts, for all equipment types. That pattern continues through mid-January, according to DAT RateView. In fact, the gap between spot and contract rates has widened in recent weeks. This is true for all three major equipment classes: van, reefer, and flatbed. That simply never happens.

But here it is, the most unlikely scenario: brokers are paying more than shippers, on average for dry van freight transportation. Contract rates were only a few cents higher than spot rates, beginning in September, but in December, spot rates were a penny higher. Now, we’re less than a week away from the end of January, and brokers are paying more than shippers, by 5¢ per mile. Spot rates may drop back a bit in the next few days, or they may rise as shippers tend to move more freight at the end of the month. Either way, this a very rare picture:

What does that mean? Spot market rates, by definition, are paid by a broker or 3PL, who is paid by the shipper or receiver to arrange transportation. Contract rates are paid directly by the shipper to the carrier, with no intermediary. You would expect the carrier to make more money on shipper-direct freight, and usually you would be correct. In past years, spot market rates exceeded contract rates only in June, and then only for refrigerated (“reefer”) trucks. That hasn’t happened since 2014, probably because of the drought in California. but before then, it was a typical pattern.

In 2017, spot market reefer rates rose above the contract averages in September, and they kept rising until the end of the year and beyond. There was a gap of 18¢ per mile between the two in December, and by this week, that gap has widened to 37¢. Spot market reefers are being paid an average of $2.69/mile and contract carriers are getting $2.37.

Here’s how that looks on a graph: