The freight industry operates in a constant state of controlled chaos. Market volatility swings wildly, capacity tightens and loosens without warning, and pricing decisions happen at lightning speed. Yet for all the digital transformation happening across logistics, one critical piece of information has remained frustratingly opaque: What are shippers actually paying on the spot market?

This visibility gap creates real problems. Brokers find themselves guessing at what shippers will pay, often leaving money on the table or losing deals to competitors. Meanwhile, shippers lack the validation tools they need to evaluate freight quotes, unsure whether they’re getting fair market rates or being taken advantage of during peak demand periods.

In the past, freight pricing tools only showed half the story. This incomplete picture forces everyone to make decisions with partial information — never ideal in a margin-sensitive industry where a few percentage points can make or break profitability.

Enter DAT’s new shipper spot rate insights: a game-changing benchmark that finally reveals shipper-paid spot rates. This isn’t guesswork or directional data — it’s real transaction information that gives both brokers and shippers the market intelligence they need for smarter, more confident pricing decisions.

What is the Shipper Spot Rate?

The industry has never had something like Shipper Spot Rate: a market-wide benchmark of what shippers actually pay their providers for spot transportation, not the final carrier rates that include broker margin.

Built from aggregated, anonymized transaction data across DAT’s ecosystem, this benchmark provides an independent view into real freight pricing. The data captures actual payments from shipper to broker, giving users unprecedented visibility into market dynamics from the buyer’s perspective. You’ll get:

- Independent baseline: Unlike potentially biased or anecdotal sources, the Shipper Spot Rate is derived from a comprehensive and impartial collection of data, providing an unbiased market view.

- Margin transparency: When combined with DAT’s existing broker spot rates, users can finally understand the full picture — what carriers receive, what shippers pay, and the spread between them. It’s a 360-degree market view with no gaps.

- Contextual views: The benchmark includes 13-month historical lookbacks and peer comparisons, enabling users to spot trends and validate current pricing against historical norms.

- Integrated experience: Available through DAT iQ RateView, API integration, and Snowflake data sharing, making it accessible across different workflow preferences.

How it compares to existing benchmarks

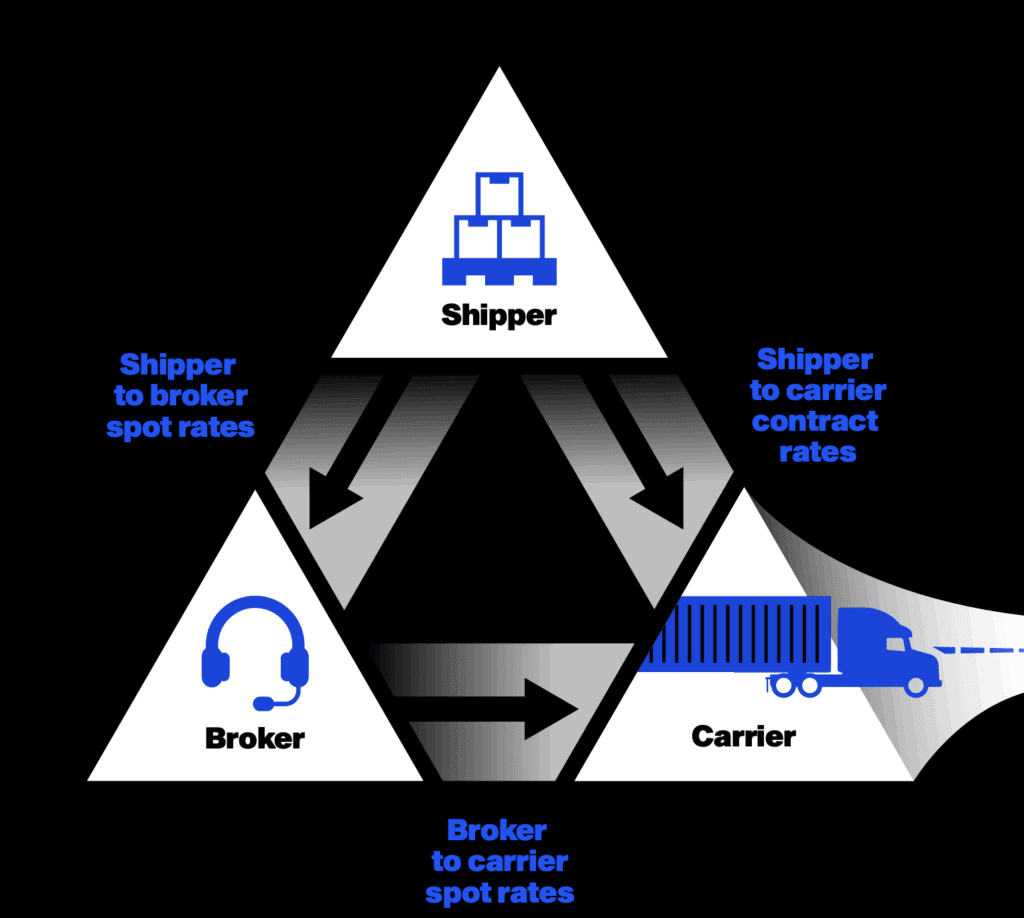

To understand the Shipper Spot Rate’s value, consider how it fits alongside other freight pricing benchmarks:

- Broker spot: Shows average rate paid to carriers — the buy side of broker transactions

- Shipper contract: Reflects longer-term agreements but doesn’t capture spot market volatility

- Shipper spot: Average rate shippers pay for spot shipments — the sell side for transportation providers

This three-dimensional view of freight pricing creates opportunities for freight margin analysis and spot rate benchmarking that simply weren’t possible before.

Why brokers need a shipper spot benchmark — now

For freight brokers, the shipper spot rate solves several critical business challenges that have persisted for decades.

Margin visibility changes everything

Understanding what shippers actually pay transforms how brokers approach pricing strategy. Instead of relying on gut instinct or taking the price paid to carriers and simply adding a percentage, brokers can now see exactly where their prices stand relative to market reality.

This freight margin analysis capability helps brokers identify opportunities to improve profitability without losing competitive positioning. When you know the market is bearing higher rates than you’re charging, you can adjust accordingly. Conversely, if your prices are above market, you can make strategic decisions about whether to maintain premium positioning or adjust to improve win rates.

Smarter pricing reduces guesswork

Quote accuracy directly impacts broker success. Too high, and you lose the business. Too low, and you win business but lose profit. The shipper spot rate eliminates much of this guesswork by providing real market data for pricing decisions.

This data-driven approach to freight quotes improves win rates while protecting margins. Brokers can enter sales conversations with confidence, knowing their pricing reflects actual market conditions rather than assumptions.

Competitive defense against digital disruptors

Digital-first competitors often leverage technology advantages to win business through superior market intelligence. Traditional brokers relying on relationships and tribal knowledge find themselves at a disadvantage when data-driven competitors can offer more competitive, accurate pricing.

With this info, you level the playing field. This freight pricing transparency becomes a competitive weapon rather than a vulnerability.

Move beyond tribal knowledge

Many brokerage operations still rely heavily on individual experience and relationships for pricing decisions. While this knowledge has value, it becomes a liability when key personnel leave or when entering new lanes without historical context.

Shipper spot rate data creates institutional knowledge that transcends individual experience. Sales teams can reference objective market data in client conversations, and leadership can make strategic pricing decisions based on comprehensive market intelligence rather than anecdotal evidence.

Why the shipper spot rate is essential for shippers

Transportation managers and procurement professionals face their own set of challenges that shipper spot rate insights directly address.

Quote validation creates negotiating power

When routing guides fail or capacity tightens, shippers often find themselves facing broker quotes without solid benchmarks for evaluation. Being able to see the average shipper spot rate on any lane changes this dynamic by providing an independent reference point for what the market is actually paying.

This validation capability transforms negotiations. Instead of accepting quotes at face value, shippers can pressure-test pricing against market reality. When brokers know shippers have access to market data, it encourages more competitive initial pricing.

Budget accuracy improves financial planning

Many shippers struggle with spot market budget variance because they lack reliable benchmarks for how much shippers pay for freight in volatile conditions. Contract rates provide stability for core lanes, but spot exposure can create significant budget surprises.

Referencing shipper spot rates enables more accurate financial planning by providing realistic cost benchmarks for spot market exposure. Finance teams can model scenarios and set appropriate contingencies based on actual market data rather than inflated estimates.

Real-time market intelligence

Market conditions change rapidly in freight, and shippers need current information to make smart procurement decisions. Historical contract data becomes less relevant during volatile periods, while real-time spot market intelligence helps shippers understand current market dynamics.

This visibility helps shippers:

- React faster when market conditions shift

- Avoid overpaying during urgent capacity needs

- Build internal confidence for spot market procurement decisions

- Negotiate with data-backed conviction

Existing RateView customers gain complete freight rate visibility by adding shipper-paid rates to their existing broker-paid rate data.

Target users across the organization

Shipper spot rate insights serves benefit many roles within shipping organizations:

- Transportation managers use it for routing guide coverage decisions and spot move evaluation.

- Procurement & finance leaders leverage it for approvals, benchmarking, and strategic spend planning.

- Data analysts and consultants integrate it with other DAT iQ tools for comprehensive freight market analysis.

Use cases

Understanding the practical applications of shipper spot rate analytics helps illustrate its value across different freight management scenarios.

Broker workflow applications

Lane-level margin analysis: Brokers can now analyze profitability across specific lanes by comparing buy rates (what they pay carriers) against sell rates (what the market pays shippers) and their own pricing.

Sales enablement: Sales teams enter client conversations armed with current market data, improving credibility and pricing accuracy during negotiations.

Leadership pricing strategy: Executive teams can make informed decisions about pricing strategy, capacity allocation, and market positioning based on comprehensive margin visibility.

Shipper workflow applications

Quote validation during emergencies: When routing guides fail and shippers need immediate capacity, they can validate broker quotes against market benchmarks in real-time.

Lane benchmarking: For lanes without contract coverage, shippers can use spot market data to understand realistic pricing expectations and evaluate broker proposals.

Procurement support: During RFP processes or contract negotiations, procurement teams can reference actual market data to validate proposed rates and terms.

The workflow benefits extend beyond individual transactions:

- Validate spot quotes in real-time during capacity crunches

- Act fast when routing guides fail with confidence in pricing decisions

- Justify decisions with clean, third-party data to internal stakeholders

- Compare broker rates without margin guesswork during vendor evaluations

How to access the Shipper Spot Rate insights

Getting started with the Shipper Spot Rate is straightforward for existing DAT customers and new users alike.

Access options

The benchmark is available as a RateView add-on for both broker and shipper users through multiple channels:

- Rate lookup API: Integrate shipper spot rate data directly into existing TMS, procurement, or pricing systems for automated decision-making.

- DAT iQ RateView: Access single-lane lookups through the familiar RateView interface, with multi-lane functionality coming soon.

Implementation support

DAT provides comprehensive support for implementing the Shipper Spot Rate metric into existing workflows. Whether you’re looking for simple UI access or complex API integration, the DAT team can help optimize the implementation for your specific use case.

Real market truth for smart decisions

The freight industry has operated with incomplete pricing information for too long. Brokers have guessed at what shippers would pay, shippers have accepted quotes without solid benchmarks, and everyone has made decisions with partial market visibility.

Shipper spot rate data from DAT iQ changes this dynamic fundamentally. For the first time, both sides of freight transactions have access to the same market truth. This freight pricing transparency creates opportunities for better decision-making, improved margins, and more efficient market functioning. Ready to see it in action? Reach out to your account manager to get started.