Dry van report: Economic uncertainty is weighing on retailers and consumers

A significant decline in the volume of corrugated cardboard shipments is a major warning sign for the trucking industry, as

A significant decline in the volume of corrugated cardboard shipments is a major warning sign for the trucking industry, as

Each holiday season, a tree, typically 60 to 85 feet tall, is chosen from one of the 154 National Forests

Each Fall, the Willamette Valley in Oregon, a hub for North America’s Christmas tree production and helicopter harvesting, transforms into

The U.S. Bank National Shipments Index experienced a 2.9% decline in the third quarter, negating the 2.4% gain from the

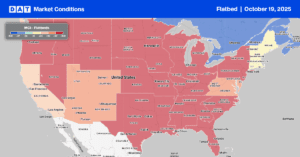

Owyhee Produce’s Shay Myers recently stated in a social media post that they opt for flatbed trucks over reefers when

The latest ISM Manufacturing PMI report for October confirms a challenging outlook for truckload carriers, signaling that the “freight recession”

The National Restaurant Association’s Restaurant Performance Index (RPI) registered a moderate decline in September, reflecting the continuation of challenging business

Brandon Dawson, a manufacturing engineer from Santa Rosa, California, won the 52nd World Championship Pumpkin Weigh-Off at the 2025 Half

U.S. shippers are increasingly turning to private, in-house truck fleets to transport goods, despite favorable rates in the for-hire market.

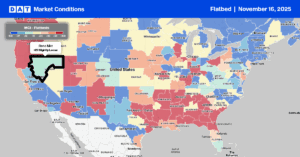

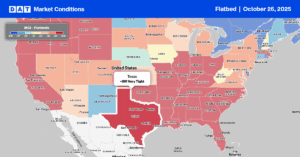

Flatbed carriers serving the Texas oil patch are seeing a slackening in demand as drilling in the Permian Basin slows

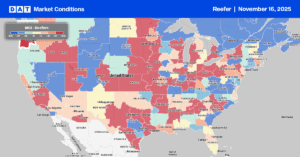

The Peruvian imported blueberry program is now in full swing, driving significant U.S. truckload activity at key American ports. The

U.S. manufacturing new order backlogs have dramatically normalized over the past two years, moving from historic highs to a slow