Flatbed report: How AI changed the deadhead

In 1980, finding a backhaul was a slow, costly process rooted in physical presence and scattered information.

In 1980, finding a backhaul was a slow, costly process rooted in physical presence and scattered information.

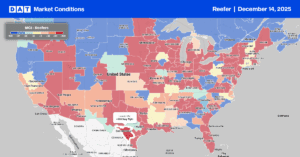

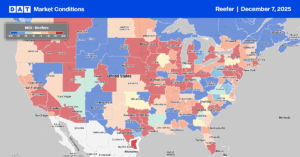

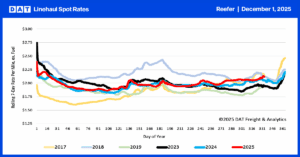

The storm that crippled the Midwest in late November created a sudden and intense spike in demand for refrigerated trailers.

The November Logistics Manager’s Index (LMI) reported a reading of 55.7, continuing a recent slowdown driven by a market correction across inventory and warehousing.

If there’s one thing logistics has taught us, it’s that you don’t need more data – you just need the

The recent weak earnings performance reported by Home Depot, stemming from softer home improvement demand and a slowdown in the

The Hass Avocado Board shows total avocado volume in the U.S. market is on track to exceed 3 billion pounds

The outlook for freight volumes remains challenging, as the Truckload Ton-Mile Index, updated through August 2025 with revised industrial production

The November 2025 ISM Manufacturing PMI fell to 48.2%, marking a 0.5-point drop from October’s level and signaling another month

The end of the farmer and trucker protests on the Mexican side of the southern U.S. border at Thanksgiving is

The latest data from the American Trucking Associations (ATA) confirms what many in our industry are feeling: the freight market

September 2025 data from the Association of Equipment Manufacturers (AEM) brought positive news for the specialty light-duty agricultural sector, with

The annual surge of refrigerated (reefer) truckload demand is underway in the Philadelphia region, driven by the start of the