As of March 2025, recent data from the U.S. Census Bureau indicates that housing starts have experienced a significant decline, dropping by 11.4% compared to the previous month. This reduction marks the sharpest decrease in a year, suggesting a challenging start to the spring home-building season. High home prices and mortgage rates have deterred potential buyers, leading builders to offer incentives and discounts to attract contracts. This has resulted in a slowdown in new project initiations.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

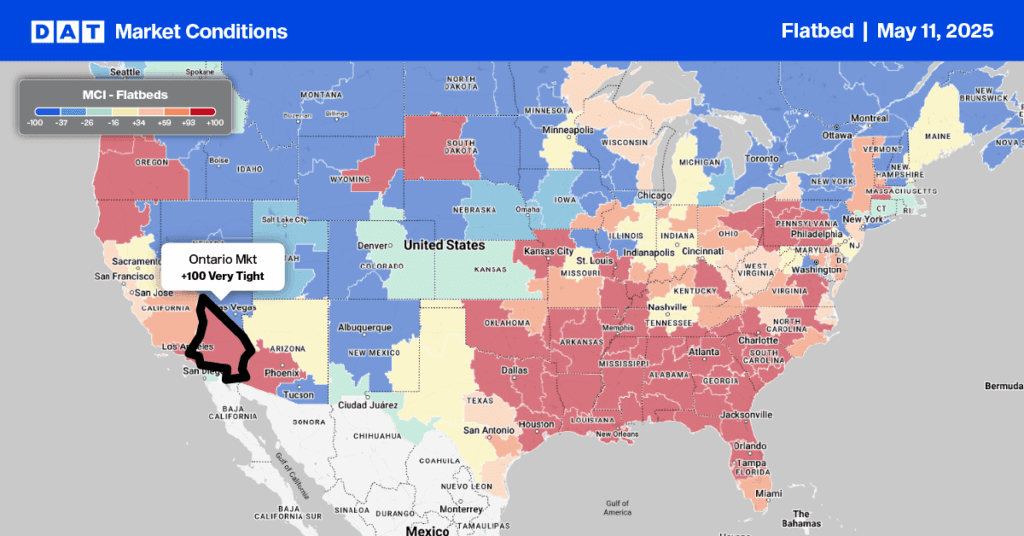

Single-family home construction was particularly hard-hit in March, with a decline of 14.2% month-over-month and a 9.7% drop year-over-year. Despite this downturn, the number of newly built homes still reflects the highest number observed in 16 years. In contrast, the West region showed a notable 5.2% increase from the previous month and a 4.7% increase compared to last year.

This performance indicates resilience in the West region compared to other regions experiencing more significant declines. The primary factors contributing to the increase in housing starts in the West region include elevated demand for single-family homes to help address the chronic housing shortage and, more recently, natural disasters that have devastated several regions. In addition to development in the Los Angeles metro, the Inland Empire (Riverside, San Bernardino Counties) is a fast-growing region for new homes where land is cheaper as people move further inland where housing is more affordable.

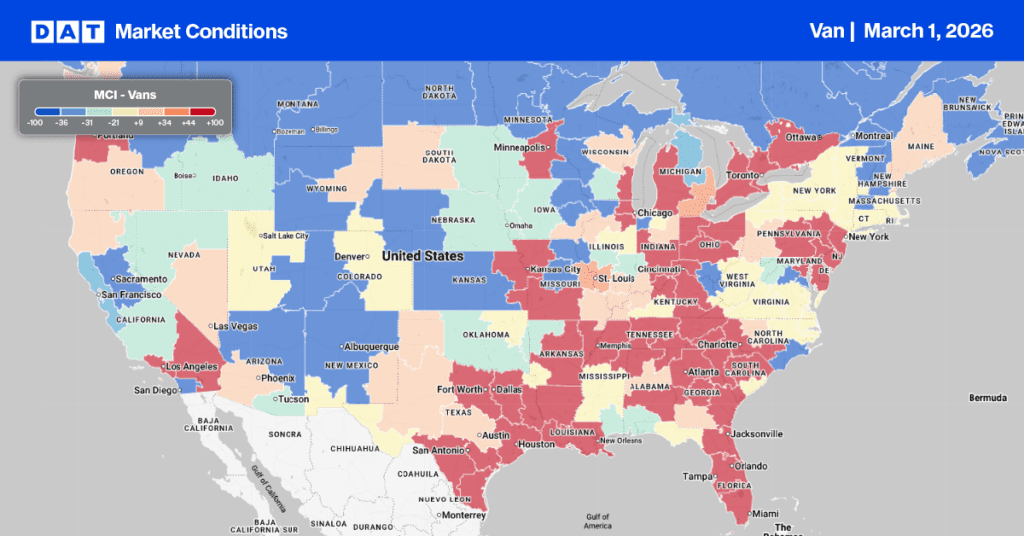

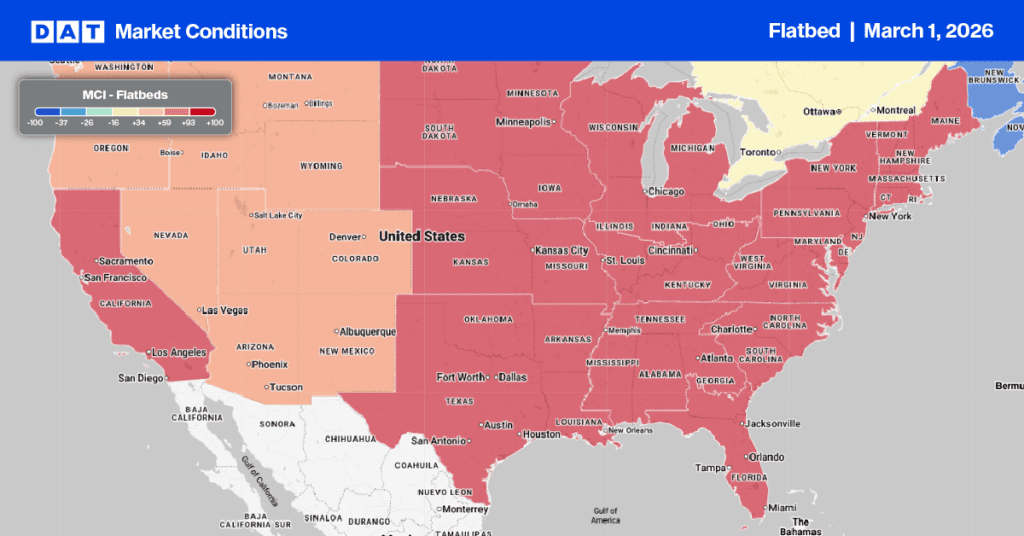

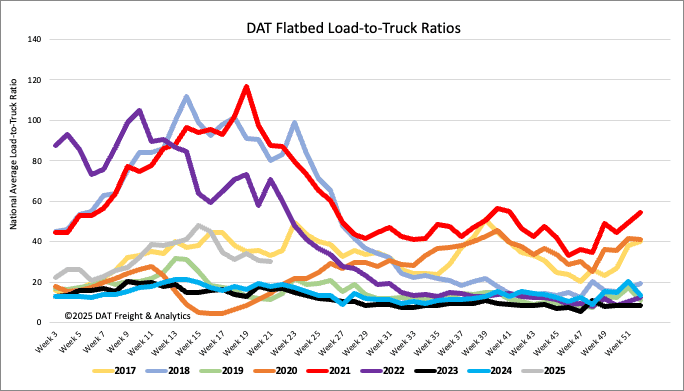

Load-to-Truck Ratio

Last week, flatbed load posting volumes decreased by 5%. After experiencing significant seasonal activity in March and April, there was a noticeable softening last week, even though volumes remain 14% higher than they were last year. Additionally, equipment costs dropped by 5% week-over-week, leading to a 2% decrease in the flatbed load-to-truck ratio (LTR), which now stands at 30.32.

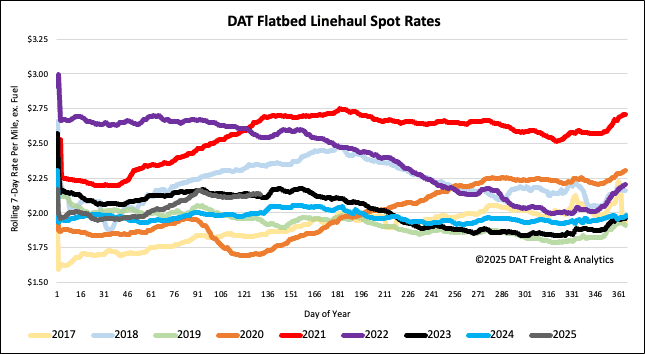

Spot rates

After being flat the week prior, flatbed spot rates decreased by just over a penny per mile last week, averaging $2.15/mile on a 2% lower volume of loads moved. Compared to last year, the flatbed 7-day rolling average is $0.13/mile higher, $0.02/mile higher than 2023, but $0.21/mile lower than the flatbed bull market in 2018.