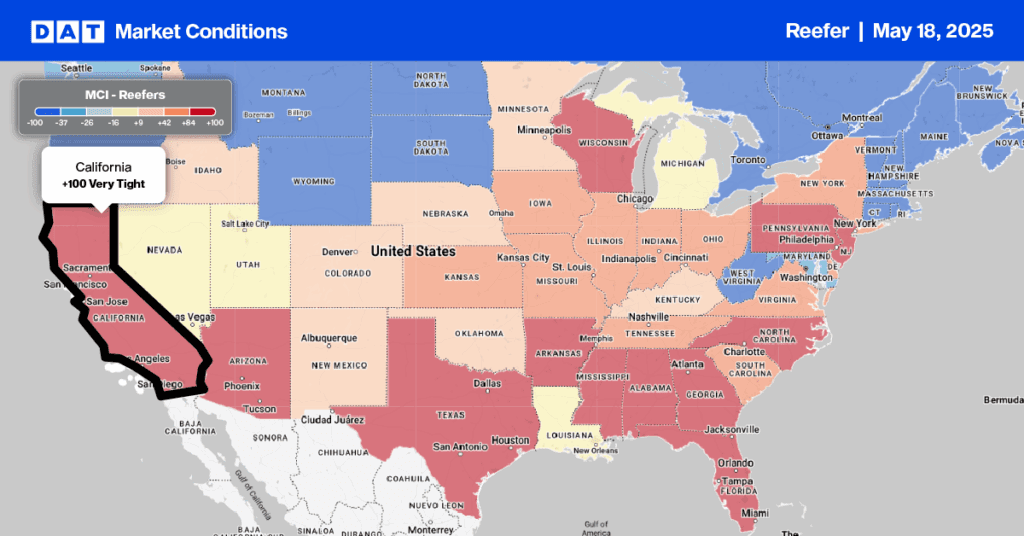

Contributing to lower truckload volumes in the fresh fruit and vegetable industry, is lower California volumes at the start of May. According to the USDA, California truckload produce volumes were 30% lower in April compared to last year, although there was a much-welcome 12% increase on volumes at the end of the month to kick-start the 2025 produce season. Part of the reason for the slow start has been cooler weather reducing strawberry volumes by about 6 million trays or roughly 1,400 fewer truckloads (a standard tray of strawberries typically weighs between 8 and 10 pounds) in California according to the Watsonville-based California Strawberry Commission.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

However, California shipments were already headed upward by late April, according to Strawberry Commission vice president Chris Christian. “We should be back at weekly levels similar to last year within a couple of weeks.” At the start of May, outbound refrigerated truckload volume from the San Francisco market, which includes the Salinas-Watsonville produce region, were up 3% compared to last week, resulting in spot rates increasing by $0.10/mile y/y averaging $2.18/mile last week.

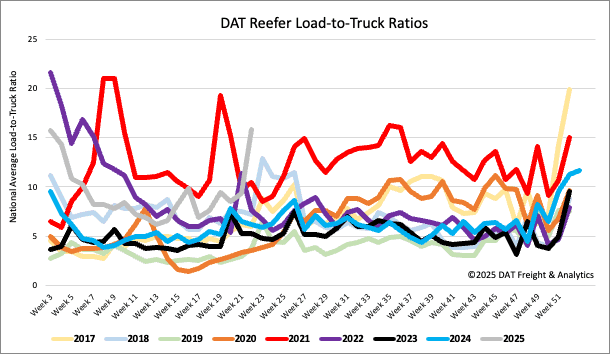

Load-to-Truck Ratio

Reefer load post volumes continue to improve, boosted by a 2% w/w increase in produce truckloads and shortage of trucks due to Roadcheck Week. Reefer load post volumes surged last week, increasing by 40% and the highest in four years for Week 20. Reefer equipment posts dropped 18% w/w as carriers took time off during the CVSA safety blitz, resulting in the reefer load-to-truck ratio (LTR) increasing by 70% to 15.83, the highest in nine years for Week 20.

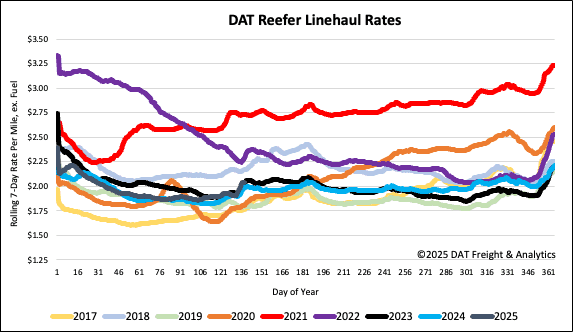

Spot rates

The CVSA safety blitz-driven capacity crunch impacted the reefer market the most last week, driving up spot rates by $0.14/mile, the highest in three years for Week 20. At a national average of $2.05/mile, reefer spot rates are $0.06/mile higher than last year.