The restaurant industry faces a challenging outlook as consumers cut back on discretionary spending. This downturn is reflected in the broader food service sector, particularly with Sysco, the Houston-based supplier that serves restaurants, hospitals, schools, hotels, and cafeterias. Sysco is the intermediary between farms, manufacturers, and dining establishments, making it a good indicator of trends in the refrigerated truckload sector.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

In its earnings report released on Tuesday, Sysco reduced its sales growth forecast 2025 by nearly 30%. The company reported a 2% decline in total case volume (shipments) as customers decreased their orders and Sysco halted select business investments. Factors contributing to these challenges include California wildfires, severe weather conditions, and, more recently, a decline in consumer confidence, negatively impacting foot traffic to restaurants.

According to the National Restaurant Association, the Restaurant Performance Index (RPI) experienced a significant drop in February, driven by decreased same-store sales and a pessimistic outlook among operators for future business conditions. The RPI, a monthly composite index tracking the health of the U.S. restaurant industry, decreased to 98.8 in February, down 2.3% from 101.1 in January. Many restaurant operators reported declines in same-store sales and customer traffic during February.

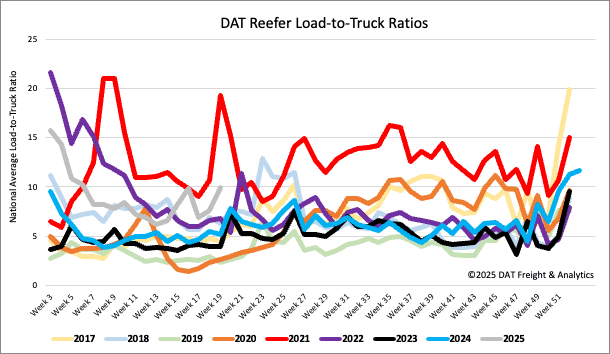

Load-to-Truck Ratio

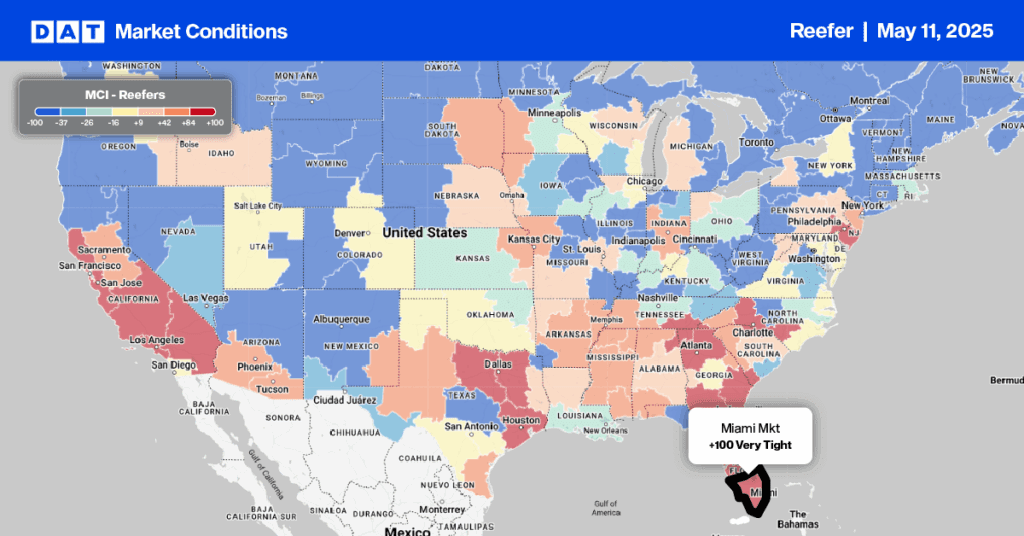

After dropping the week prior, reefer load post volumes bounced back last week as demand ahead of Mother’s Day and early produce volumes boosted spot market demand, especially in Florida, where the USDA reported a shortage of trucks for the third week. Load and equipment posts were up 7% and down 7%, respectively, last week, resulting in the reefer load-to-truck ratio (LTR) increasing 15% to 9.73, the second-highest in nine years for Week 19.

Spot rates

Available reefer capacity loosened slightly last week, with the national average reefer spot rate ending the week at $1.91/mile, down almost a penny per mile. Reefer spot rates are $0.02/mile lower than last year and $0.05/mile lower than 2023. Peak floral shipments drove up spot rates in Miami; outbound reefer spot rates were the highest in three years, up $0.54/mile to $2.43/mile last week on a 28% higher w/w volume. The high-volume lane from Miami to Atlanta paid carriers an average of $2.84/mile, up $1.33/mile or 88% in the last month.