The latest data reveals a worrying trend in U.S. single-family homebuilding, which experienced a decline in April. This downturn is largely driven by persistent tariffs on imported materials and soaring mortgage rates, both of which are creating substantial roadblocks for the housing market. According to the Commerce Department’s Census Bureau, single-family housing starts totalled 927,000, dropping by 2.1% in April and almost 11% lower than last year. For truckload carriers, that’s the equivalent of hauling 83,000 fewer truckloads last month.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Builders are grappling with tariffs, particularly on critical resources like lumber and steel. While a recent de-escalation in the trade war between the United States and China has provided a temporary reprieve, significant uncertainty looms over the future. Key tariff decisions, postponed until July, leave builders in a state of anxiety regarding material costs. A survey from the National Association of Home Builders (NAHB) paints a dire picture, indicating that builder confidence has hit a 1.5-year low in May. A staggering 78% of builders reported facing challenges in pricing their homes due to the unpredictability surrounding material expenses.

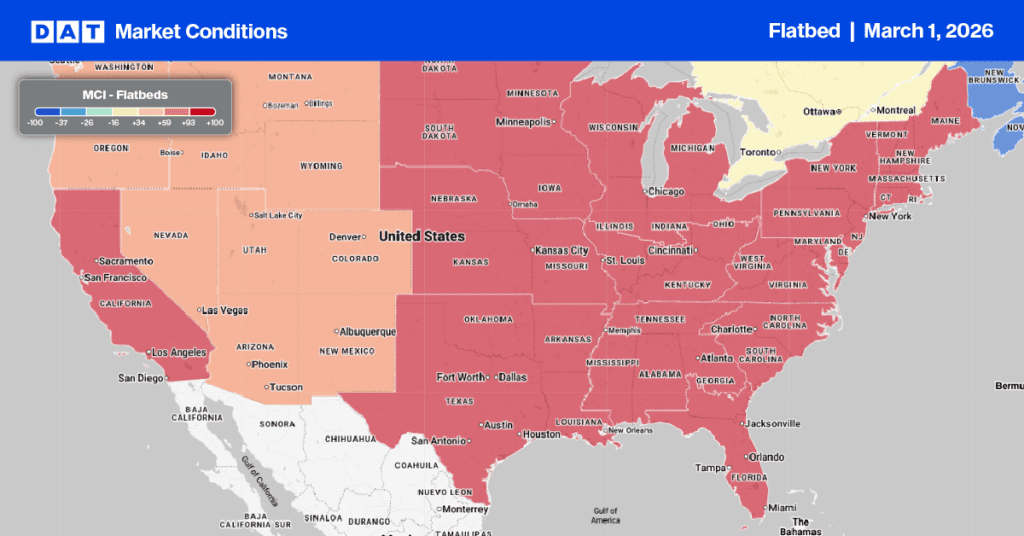

Single-family permits for new housing construction, an indicator of future flatbed demand, decreased 5.1% in April and down 6.2% compared to April 2024.

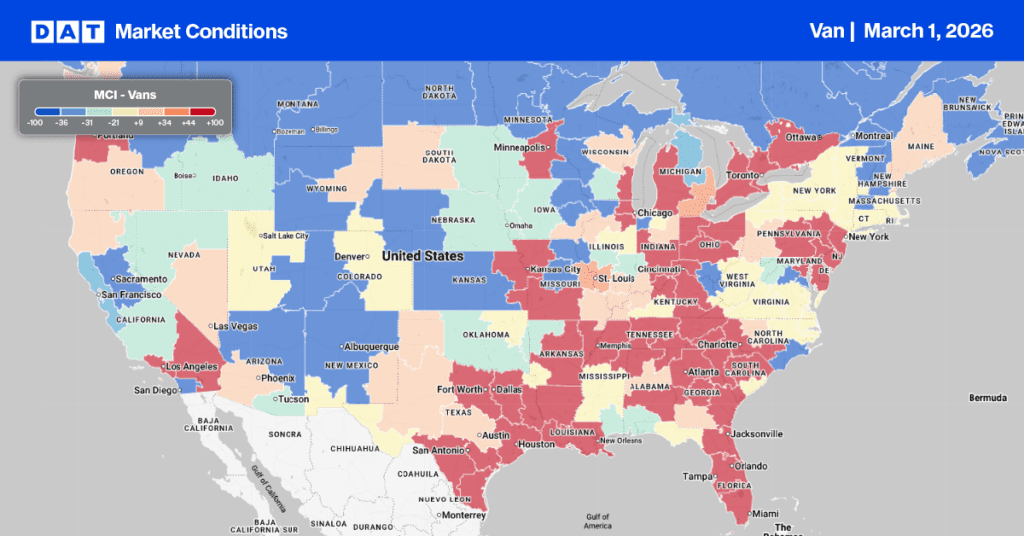

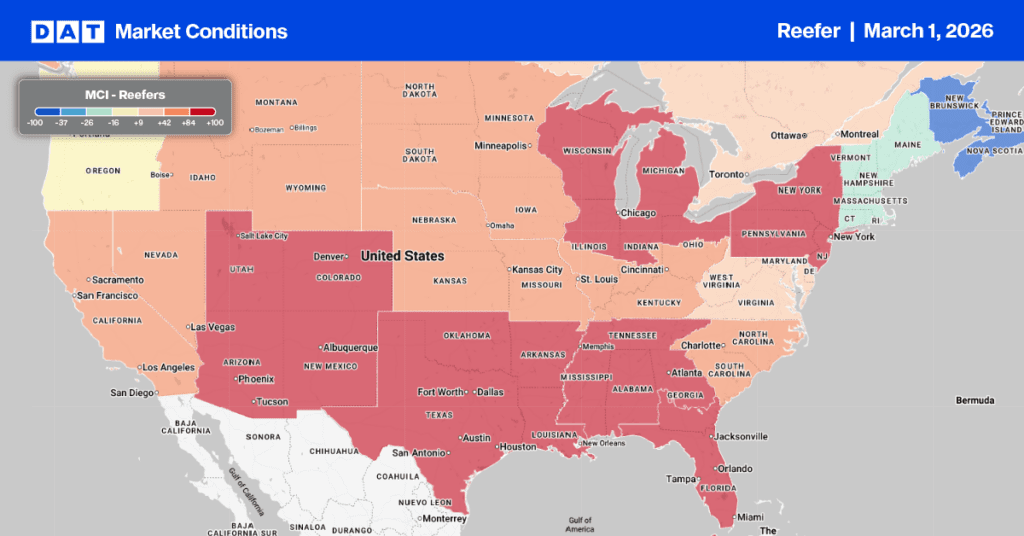

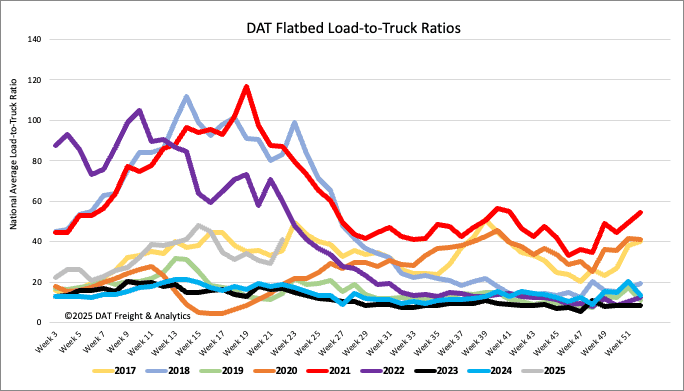

Load-to-Truck Ratio

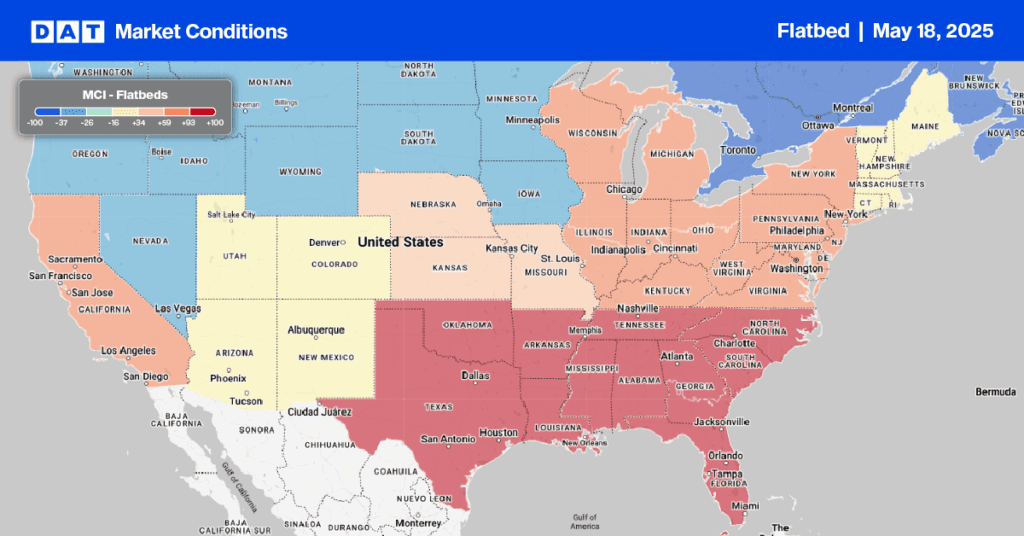

Last week’s CVSA safety blitz, commonly known as Roadcheck Week, resulted in 20% fewer flatbed carriers posting their trucks on the DAT load board, the highest weekly decrease of the three equipment types tracked by DAT. The resulting capacity crunch caused an 11% w/w increase in load post volumes and a 40% w/w increase in the flatbed load-to-truck ratio (LTR), which now stands at 41.01.

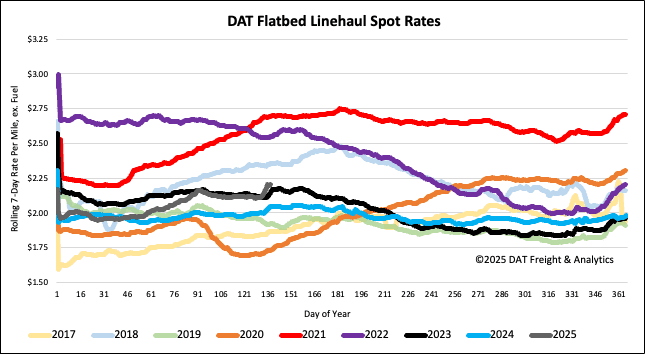

Spot rates

The CVSA safety blitz caused a capacity crunch in the flatbed market, leading to a $0.06/mile spot rate increase last week. The national 7-day average reached $2.21/mile, which is $0.16/mile higher than last year and the highest Week 20 rate in three years.