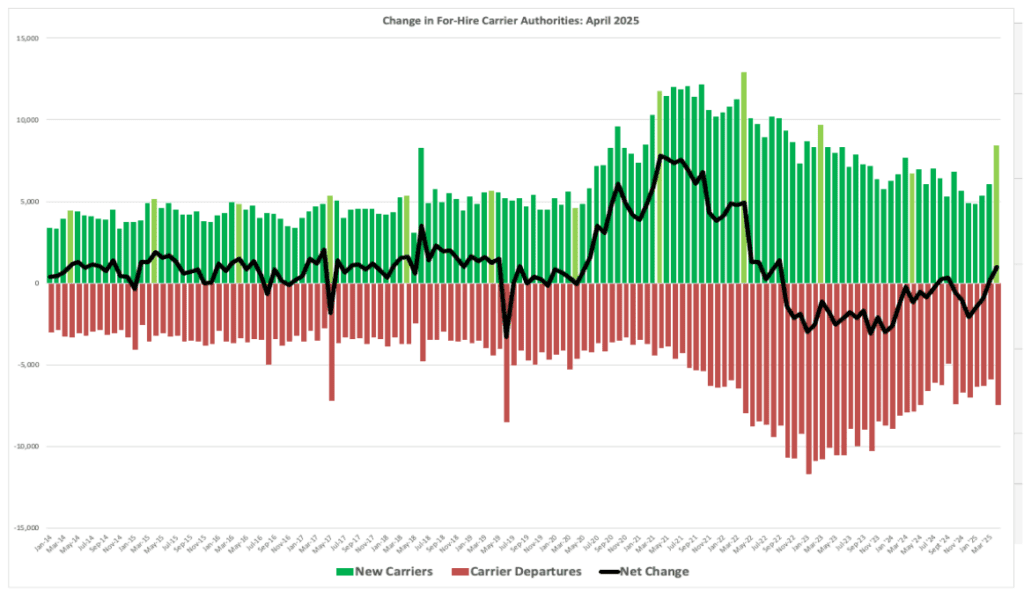

Spring is typically when the spot market sees more carriers join; last month was no exception. Surprising most analysts, small fleet capacity turned positive for the second month in April, as the most new carriers entered the market in two years. New carrier authorities jumped by 48% m/m and 30% y/y. Compared to the pre-pandemic April average (highlighted), last month’s new entrant levels were 49% higher.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Carrier exits came in at 7,474, the highest in 12 months and 26% higher than the prior month. Even though total trucks active in U.S. commerce increased slightly in March, the 300 to 1,000 and 5,000 plus fleet size reported a 1% and 3.3% m/m decline, respectively. A surge in spot market demand as shippers rush to avoid tariffs has no doubt contributed to the surge in new truckload capacity across all other fleet size categories. Bill Cassidy from the Journal of Commerce noted that higher U.S. tariffs are driving a surge in demand for bonded warehousing, leading to significant disruption in inland truck routes and changes in freight flows. Despite the market uncertainty created by the trade war, April was a better-than-expected month for spot market carriers.

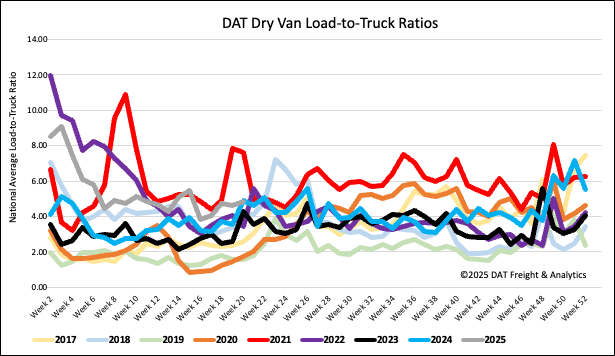

Load-to-Truck Ratio

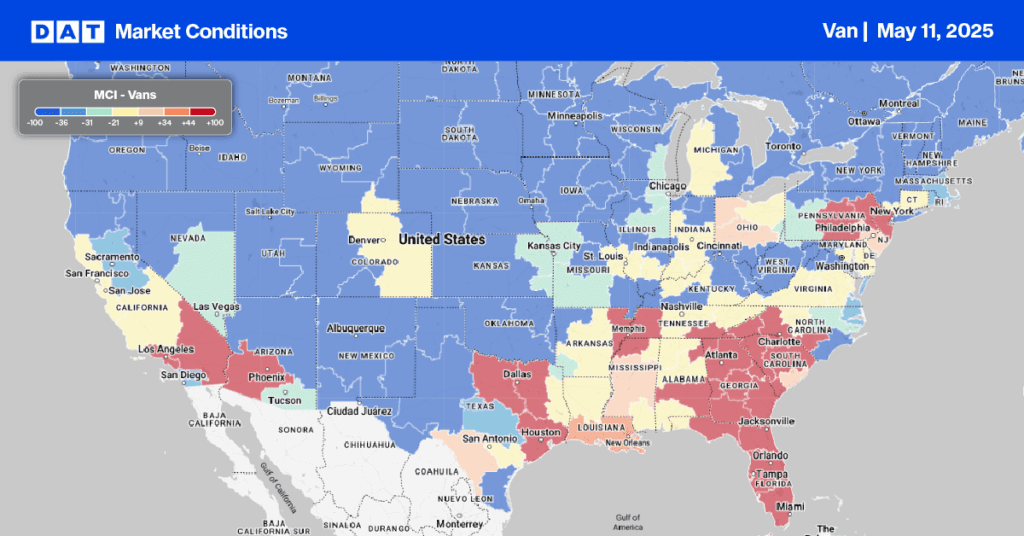

Dry van load post volumes were mostly flat for the second week and around 1% higher than last year, while equipment posts were down by 5%. As a result, last week’s dry van load-to-truck ratio (LTR) was up 5% to 4.84, the second-highest in nine years for Week 19 (surpassed only by 2021 at 7.83).

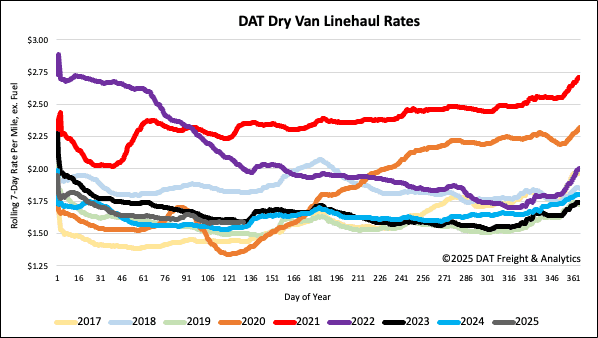

Linehaul spot rates

Dry van linehaul rates decreased by almost $0.02/mile last week to a national average of $1.60/mile on a 1% lower volume of loads moved. At $1.60/mile, linehaul rates remained $0.03/mile higher than last year and almost identical to 2024.

On DAT’s Top 50 lanes, ranked by the volume of loads moved, carriers were paid an average of $1.89/mile, down a penny-per-mile and $0.29/mile higher than the national 7-day rolling average spot rate.

In our Midwest Region bellwether states (n=13), which account for 45% of loads moved nationally last week and have the highest correlation to the national average, outbound spot rates were down $0.02/mile on a 1% lower volume of outbound loads moved. Carriers were paid an average of $1.72/mile, $0.12/mile higher than the national 7-day rolling average.