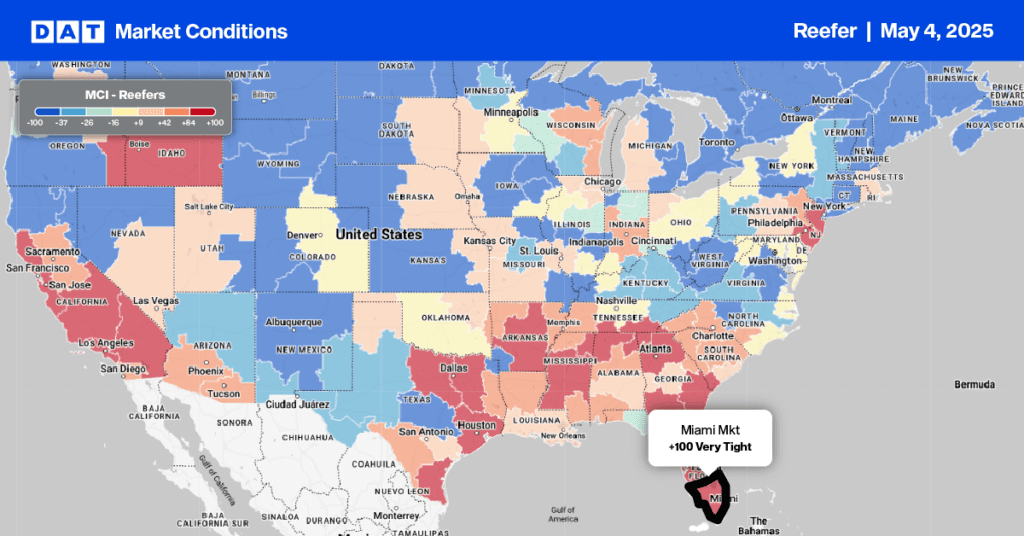

In the two weeks leading up to Mother’s Day on May 11, refrigerated truckload volumes begin to surge, typically marking the peak in outbound Miami volume for the year. Most floral shipments land in Miami before the momentous occasion, with truckload volumes doubling in the two weeks at the beginning of May. DAT typically sees outbound refrigerated spot rates double over the same time frame, jumping by 47% from $1.72/mile at the start of May last year to $2.52/mile on May 10.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Miami will be a hot market this week as shippers rush to fill last-minute orders, especially on the Atlanta and Dallas/Ft. Worth lanes. Last year, loads from Miami to Atlanta paid carriers an average of $2.64/mile, $1.18/mile, or 80% higher in the two weeks leading up to Mother’s Day.

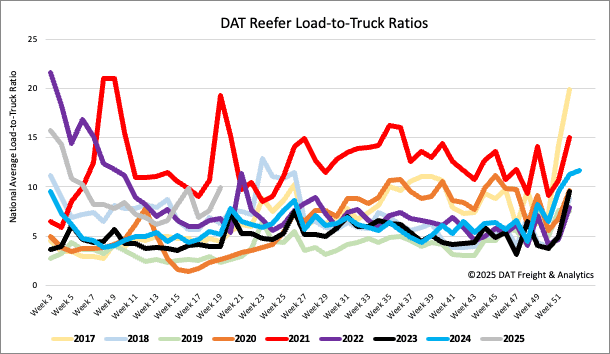

Load-to-Truck Ratio

Reefer load post volumes uncharacteristically dropped last week, at a time when they typically start to increase, especially at month-end when shippers clear their loading docks of inventory. Load and equipment posts were down 11% and 5% respectively last week, resulting in the reefer load-to-truck ratio (LTR) decreasing by 7% to 8.75.

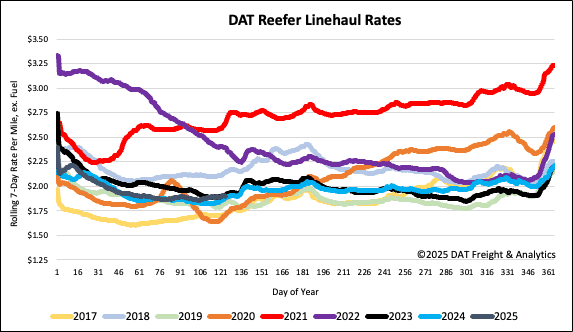

Spot rates

Available reefer capacity tightened slightly last week, with the national average reefer spot rate ending the week at $1.92/mile, up $0.02/mile boosted by a 2% w/w lift in produce and month-end shipping volumes. Reefer spot rates are $0.01/mile higher than last year and identical to the 90-day trailing average. Peak floral shipments and watermelon season is beginning to drive up spot rates in Miami; spot rates were up $0.21/mile to $2.16/mile last week on a 15% higher w/w volume. Last year they peaked on Mother’s Day at $2.52/mile.