The spring home-building season has begun on a challenging note. Recent data from the Census Bureau shows that housing starts, which track new home construction, fell by 11.4% in March compared to February. This decline represents the steepest drop in a year.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Persistently high home prices and mortgage rates have kept many potential buyers from entering the market for months. As a result, builders are resorting to offering incentives and discounts in an effort to secure contracts. This reduced demand has discouraged builders from initiating new projects.

Single-family home construction saw the most significant slowdown, experiencing a 14.2% decline from February and a 9.7% drop compared to the same time last year. In the Southeast, where 56% of single-family homes were started in March, volumes fell 17.6% m/m. While the prices of new homes have slightly decreased from their peak as builders offer mortgage-rate buydowns and other incentives to reduce their inventory, the current levels of newly built homes remain the highest they have been in 16 years.

Additionally, a monthly survey conducted by the National Association of Home Builders (NAHB) revealed that builders’ expectations for single-family home sales in the next six months have dropped by four points in April.

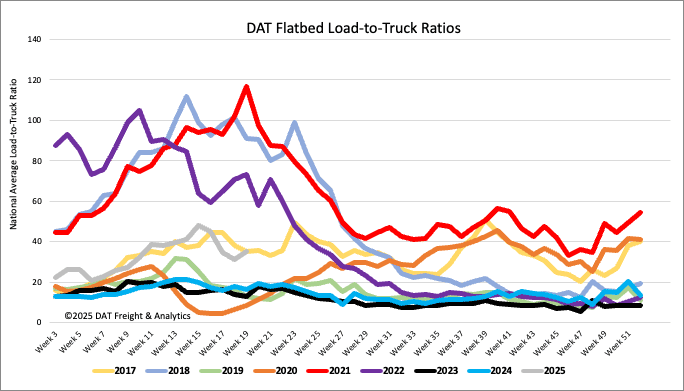

Load-to-Truck Ratio

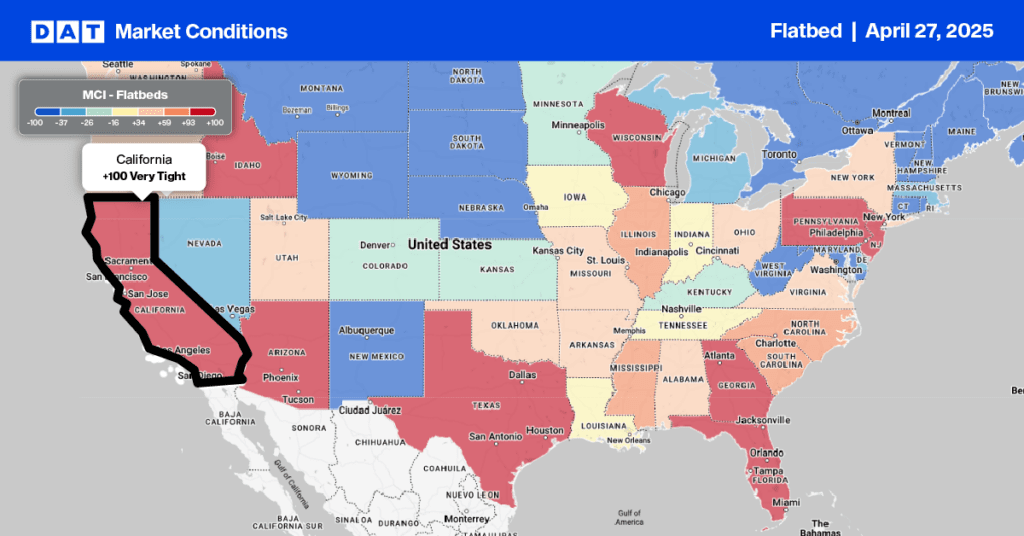

After dropping for most of April, flatbed load post volumes reversed course last week, increasing by 5%. Volumes are 23% higher than last year. Last week’s flatbed load-to-truck ratio (LTR) ended at 35.37, up 13% w/w.

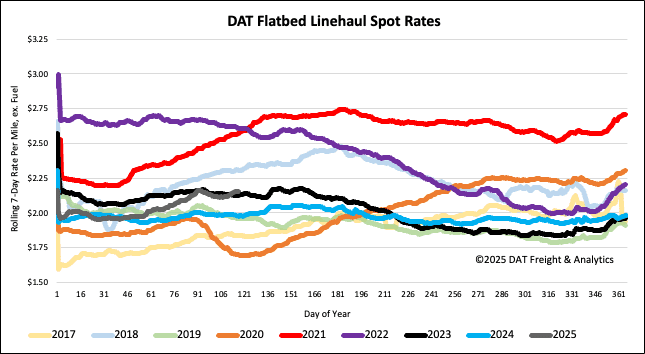

Spot rates

Flatbed spot rates have been mostly flat throughout April, although available capacity tightened slightly last week, increasing by almost a penny-per-mile to just under $2.17/mile. Compared to last year, the flatbed 7-day rolling average is $0.18/mile higher and for the first time this year, are now $0.03/mile higher than 2023.