Even with a 35% increase in headcount, freight brokers enjoyed a 20X spike in profit per employee, 25% higher revenue per employee, and a 75% increase in total revenue, against last year’s Q2.

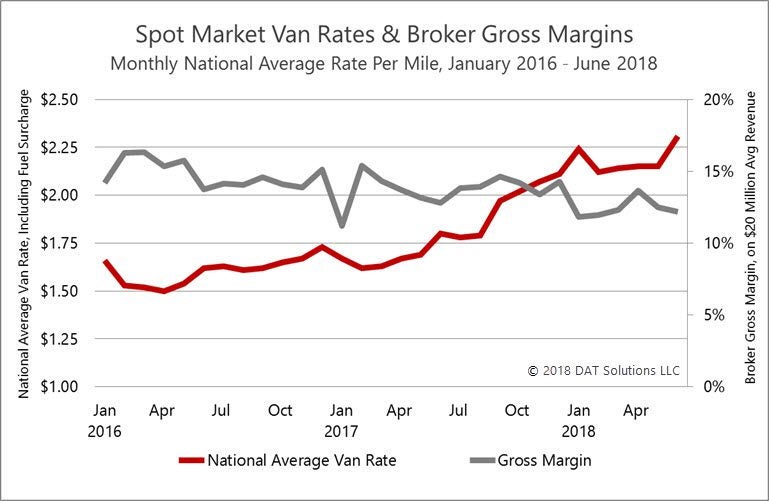

Gross margins averaged a disappointing 12.8%, and continuing high freight rates mean that margin compression could continue to be an issue through the second half of the year, especially on longer-term contracts.

This benchmark report draws data from an aggregate of more than 100 freight brokerage companies, whose 2017 average annual revenue of $19.5 million rose 70% in the first half of 2018, compared to the same period last year.

Brokers achieved a net operating profit above 23% in Q2, due to a healthy balance between revenue and expenses. Labor expenses were held to 55% of net revenue, 19% went to non-labor expense, and 2.9% to interest, taxes, depreciation and amortization.

Get the full monthly report, delivered to your inbox. Subscribe to the DAT Broker Benchmark Report.

Profit per employee rose 20X higher in Q2 on 25% more revenue, compared to the same period in 2017. All per-employee metrics showed dramatic improvement, even though average headcount rose 35%, year over year. Compared to Q1, profit per employee quadrupled, and revenue rose 8%, on a per-employee basis.

Brokers in the group moved an average of 38% more loads in Q2, compared to the same period last year, to set another new record. Load volume rose 18% compared to Q1.

A record $47.08 in profit per load rose more than 19X against last year’s Q2 average of $2.43. Revenue per load jumped 27% for the quarter. Compared to Q1, profit tripled while revenue slipped 1% on a per-load basis.

The only disappointment in Q2 was an uninspiring 12.8% average gross margin, a slight improvement over 12.0% in Q1, but not quite up to Q2 2017 at 13.2%. Spot market rates have risen steeply, boosting the cost of purchased transportation by 37% for dry van freight since Q2 2017. Rates are expected to remain elevated through the second half of the year, so margin compression may continue to be a factor.

Get the full monthly report, delivered to your inbox. Subscribe to the DAT Broker Benchmark Report.