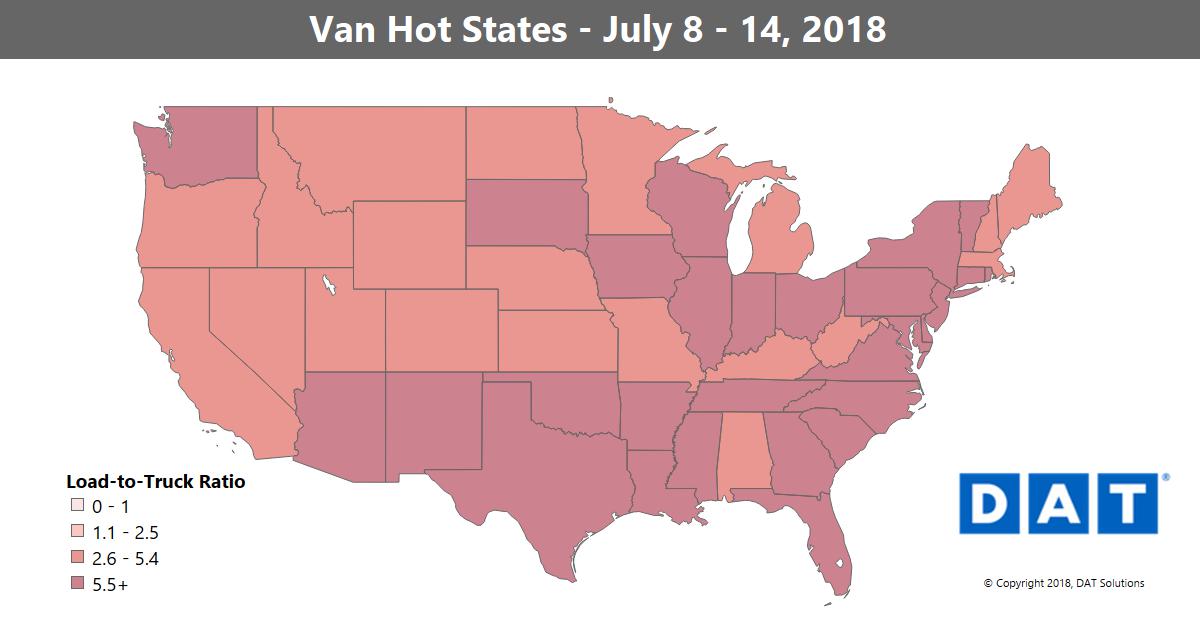

It’s typical for freight markets to slump in mid-July, and last week’s national metrics fell in line with that seasonal trend. Everyone was back to work after a taking some time off for the Fourth of July, which meant that there was more load board activity last week, but load posts outpaced truck posts.

That’s a signal that the red-hot demand we’ve seen in recent weeks has cooled a bit, but it’s probably a stretch to call this a “slump.” Prices in many areas are still historically high, even though rates moved lower on a whopping 81 of the top 100 van lanes.

The five lanes with the biggest declines last week were all lanes closely associated with retail demand (all rates below include fuel surcharges and are based on real transactions between brokers and carriers).

- Columbus, OH, to Buffalo, down 53¢ to an average of $3.71/mile

- Atlanta to Columbus, down 48¢ to $2.53

- Memphis to Columbus, down 46¢ to $2.92

- Columbus to Memphis, down 44¢ to $1.93

- Memphis to Chicago, down 38¢ to $2.88

Beyond those five big declines, rates were down mostly everywhere. There were big increases in volumes out of Los Angeles, Chicago, and Memphis, however, which could lead to more stable pricing. This is also a big week for e-commerce promotions, designed to boost retail sales during what’s typically the off-season. In years past, that’s boosted truckload volumes as well.

RISING RATES

Only a couple lanes had significant price increases:

- Stockton, CA, to Salt Lake City ran counter to national trends, up 17¢ to an average of $3.34/mile

- The Pacific Northwest has been the weakest region for outbound rates, but last week the rate from Seattle to Los Angeles climbed 9¢, but it’s still low at $1.28/mile