As people in the Carolinas try their best to return to their normal routines, the freight markets have settled back down into typical seasonal trends following Hurricane Florence.

Unlike with Hurricanes Harvey and Irma, the impact from Florence on freight movements was mostly felt regionally. There wasn’t a cascading effect across the supply chain like what we saw last year. For one, there was plenty of warning ahead of the storm. Carriers moved their operations inland, which kept trucks available. Second, the area affected didn’t require the massive rerouting of supply chains like what we saw last year.

Last week, national trends resumed mostly uninterrupted, climbing slowly and steadily from the late summer declines.

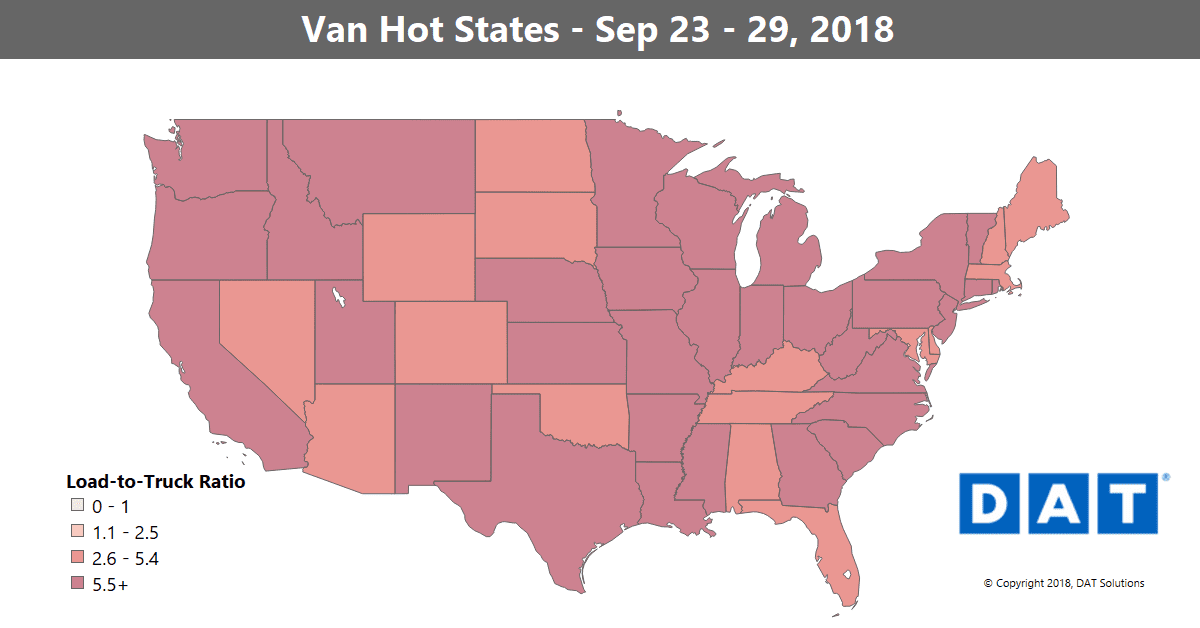

You can see in the Hot States Map above that van load-to-truck ratios spiked in the Carolinas last week, with pent-up demand coming from shipments that had been delayed by the flooding. Pricing has mostly been stable, though. We could see an uptick in flatbed demand into the area in the coming weeks for rebuilding and construction.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

RISING

Pricing out of the Midwest is still strong, and rates out of Columbus, OH, jumped up another 4% last week. On the top 100 van lanes, more were up than down, but most changes were slight.

- The biggest increase was from Buffalo to Allentown, PA, which added 22¢ to an average of $3.36/mile

- Rates were up out of Denver, and the lane to Houston rose 17¢ — but the average was still just $1.50/mile

- Texas has been quiet in recent weeks, but the lane from Houston to Oklahoma City rose 14¢ to $2.26/mile

FALLING

The biggest declines were on lanes that spiked due to Hurricane Florence.

- Buffalo to Charlotte was down 24¢ at $2.44/mile

- Atlanta to Charlotte fell 17¢ to $2.84/mile

- Allentown to Richmond, VA, was down 20¢ at $2.88/mile

All of those rates are still higher than they were before the storm.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.