Nearly $1 trillion in retail sales will result if analysts at Deloitte are correct in their forecast of 4.5% growth during the upcoming holiday season. Consumers have 2.6% more disposable income this year, according to Deloitte, due in part to declining fuel prices. Employment statistics are improving, as well, and the picture for Q4 will be even rosier with the addition of as many as 800,000 seasonal jobs in retail and related service sectors.

The National Retail Federation (NRF) projects a 4.1% increase in holiday sales, compared to 2013. If the industry organization’s forecast is correct, seasonal sales growth will exceed 4% for the first time since 2011.

A more Grinch-like forecast emerged from the Standard & Poor’s 500 Retailing Index, which declined 0.9% for the first eight months of 2014. That period included a weak back-to-school season. Consumer confidence fell in September, as well, according to the Conference Board.

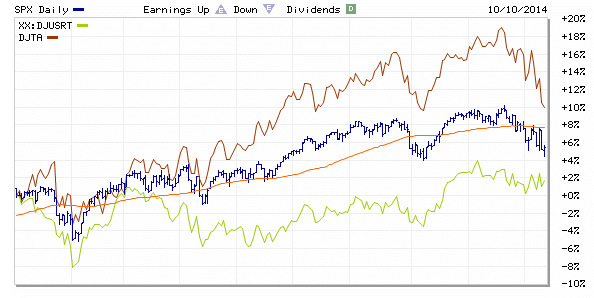

The transportation sector is flourishing, at least in part because of rate increases. The Dow Jones Transportation Index has been outperforming both the retail sector and the S&P 500 since March of this year, as seen in the graph below of 2014 to-date:

The Dow Jones Transportation Index (DJTA) has steadily outperformed both the Dow Jones Retail Index (DJUSRT) and the S&P 500 (SPX Daily) since March of this year. (Custom graph created on MarketWatch.com.)

Shippers expect to pay higher rates for truckload and rail intermodal transportation in the busy holiday season and well into 2015. A survey by Wolfe Research, according to Journal of Commerce, revealed that “52% of shippers plan to pay peak surcharges to move their truckload freight” in the fourth quarter. Another result of tight capacity: the shippers surveyed expect to rely increasingly on freight brokers to help find trucks.

Fourth-quarter freight volume was not expected to increase dramatically, according to previous estimates. because many shippers brought imports into the West Coast early. Concerns persisted about a potential labor strike at ports from Southern California up to British Columbia, but there has been no work stoppage even though contract negotiations are still not complete.

Freight is still arriving, and the highest-volume U.S. ports, in Los Angeles and Long Beach are busier than ever. A significant number of van loads are finding their way onto the spot market. This week’s activity on DAT Load Boards included more than 2,000 available van loads and 500 to 600 outbound trucks posted per day from the Los Angeles market, home to both ports. Spot market rates rose last week on the lanes from L.A. to the regional freight hubs of Stockton, Phoenix, Denver, Dallas and Atlanta, as recorded in DAT RateView.

Rates are atypically high outbound from L.A., including the lane to Phoenix. As depicted in the RateView screenshot below, rates on that lane are approaching the all-time peak average of $2.57 (not including the fuel surcharge, which was a few cents higher in June.) The current load-to-truck ratio is up to 4.3, indicating capacity pressure in October that resembles the June peak for vans outbound from L.A. This lane has seen high demand and atypically high rates since late May, when spot market rates surpassed the contract rates. That means that small and mid-sized carriers got more money per mile for one-time loads from freight brokers than the big, contract carriers received directly from shippers. During a slack season, the contract rate typically exceeds the spot market rate (paid to the truck) by 10% to 20%, and a portion of the margin goes to the broker.

Copyright © 2014 DAT Solutions. All rights reserved.

Job growth, consumer confidence and cheaper fuel add up to an optimistic outlook for the U.S. economy in Q4 and into 2015. GDP growth is estimated at 3.2% for the quarter that just ended, and economists predict 3% growth in Q4, according to a Wall Street Journal survey. The immediate result could be a 2.6% increase in consumer spending — and declining fuel prices mean more of that money can be allocated to Christmas gifts. Retailers are reading these forecasts too, and they are building inventories now.

This is shaping up to be a busy season — and hopefully a lucrative one — for freight transportation and logistics professionals.

To learn more about truckload capacity and rates in your lanes, consult DAT RateView. Need a demo? Contact our award-winning customer support team at 800.551.8847 or fill out an online inquiry form.