April 1 was the end of the “soft enforcement” period of the ELD mandate. That means that trucks can now be placed out of service if they don’t have an ELD installed. Before the deadline, we surveyed 645 carriers and found that 91% of them were already compliant with the new regulations, and it the April 1 deadline hasn’t had a big impact on the spot market so far.

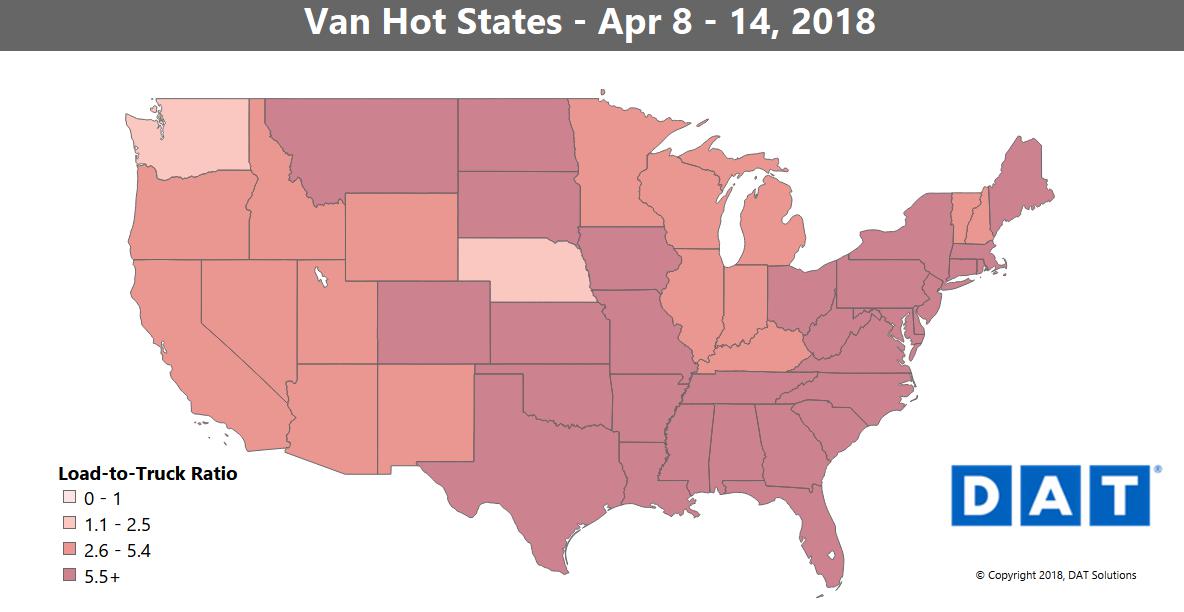

In fact, there were more trucks available last week compared the week before, which had a moderating effect on rates. Volumes rose on the top 100 van lanes, but the extra truckload capacity kept prices in check, at least for now.

Volumes rose on five of the six top markets for van loads, with the one exception being Los Angeles. Dallas had the highest load counts, while Stockton, CA, had the biggest improvement in volumes. No markets were up last week from a pricing standpoint, but almost all of the major markets are up from a month ago.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

RISING LANES

Rates were down out of Buffalo, but prices jumped up on a couple inbound lanes:

- Columbus, OH, to Buffalo was up 24¢ to an average of $3.84/mile

- Charlotte to Buffalo rose 20¢ to $2.98/mile

Out West, the lane from Seattle to Eugene, OR, gained 22¢ at $2.72/mile.

Snowstorms in Chicago might be messing with rail operations. The lane to Los Angeles is highly competitive with railroad, but truckload rates were up 16¢ to $1.75/mile.

FALLING LANES

Outbound rates from Buffalo fell the most. In Texas, prices adjusted to the higher volumes out of Dallas, with rates from Houston to Dallas down 16¢ to $2.54/mile.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.