Van rates stepped down for the sixth week in a row. That’s not to say they’re low. They’re still about 20% higher than last year at this time, but now they’ve returned to April/May levels after hitting a peak in early July.

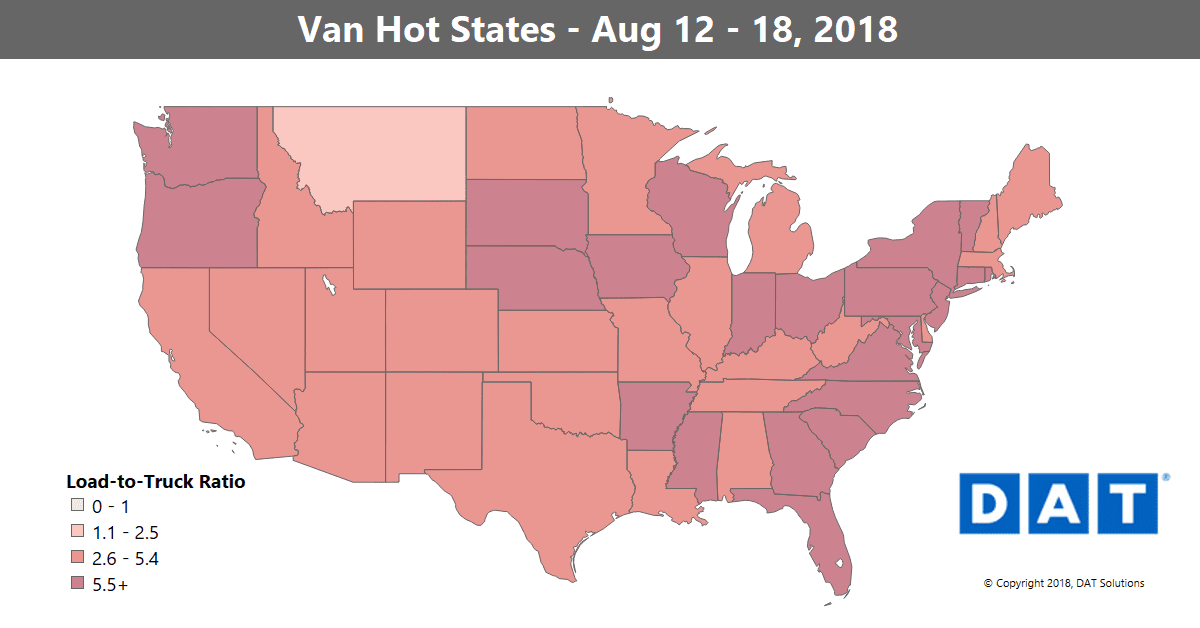

Many of the markets have looser capacity now than earlier in the summer. There’s been a slowdown in Texas, and volumes and rates are falling in Southern California, after frenzied activity a few weeks ago at the port of Los Angeles/Long Beach. Only 23 of the top 100 van lanes had rising rates last week, while 74 declined and 3 held steady. Confirming the trend, the national average van rate dipped 2¢ week over week to $2.16 per mile for the month to-date.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

RISING RATES

Although outbound prices were down in most markets, rates did rise on a handful of regional lanes:

- Seattle to Eugene, OR jumped up 13¢ to $3.10/mile

- Buffalo to Allentown, PA rose 7¢ to $3.53/mile

- Philadelphia to Boston also increased 7¢ to $4.14/mile

FALLING RATES

As mentioned earlier, rates coming out of Los Angeles took a hit last week. Here are a few examples:

- Los Angeles to Seattle fell 13¢ at $2.92/mile

- Los Angeles to Denver declined 8¢ to $3.07/mile

- Los Angeles to Atlanta also declined 8¢ to $1.95/mile

Rates into Buffalo, NY, also moved lower last week:

- Chicago to Buffalo plunged 27¢ to a still-decent $3.16/mile

- Charlotte to Buffalo fell 23¢ to $2.72/mile

- Columbus to Buffalo dropped 14¢ to $3.63/mile

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.