VAN

The second quarter ended on Saturday with a typical rate bump, as shippers pushed freight out the door. Van rates rose 1.6% for the week, capping a 4.2% increase for the month of June.

Trucks were especially tight in Charlotte, where rates shot up 7.8% in one week. Smaller increases of 2.5% in Chicago and Columbus, 2.4% in Stockton and 2.1% in Dallas, and Philadelphia were also due to increased volume in high-traffic lanes.

Even the one-week declines in Memphis (down 1.1%) and Atlanta (down 0.7%) were small setbacks against a background of steadily rising rates in those markets for the month of June. Denver, with an abundant supply of inbound trucks, was the only major market with a 1.9% dip in van rates for the week and a 6.9% drop for the month.

Last week’s best lane rate for vans was $3.21 per mile including fuel, from Charlotte to Philadelphia, up $0.37 (13%) for the week. Lowest rate was $1.00 per mile from Denver to Los Angeles, due to a combination of weak demand and declining fuel costs.

Van rates increased (green) in most major markets last week. Memphis and Atlanta rates slipped by about 1% but both markets rose for the month of June. Of the top ten van markets, only Denver declined for both the week and the month. (Source: DAT Truckload Rate Index)

REEFER

In the final week of Q2, reefer rates slipped from mid-June highs, with volume down 2.8% and rates off by 0.8% compared to the previous week. Of the top 64 lanes, rates rose in 31 and declined in 30, with big variation from one market to the next.

Among the major markets, Sacramento rates rose the most, with a 12.6% hike to $2.89 per mile including fuel. Atlanta gained 4.9% to $2.38, and increased demand boosted rates on the eastbound lane between the two cities.

Denver rates slipped 12.7%, mirroring the decline in van rates, but reefer volume picked up late in the week from the Mile High City.

Highest-paying reefer lanes included Atlanta to Joliet (Chicago), up $0.54 (26%) to $2.63 per mile including fuel. Sacramento to Los Angeles was another top pick, at $2.31, up $0.52 (29%.) Sacramento to Portland OR picked up speed, with a $0.39 (12%) boost to $3.79 per mile, but the return trip is not attractively priced.

The lane from Twin Falls ID to Los Angeles lost $0.17 and hardly covered the truck’s cost last week at $1.21 per mile. Fort Worth to Denver lost the most, down $0.40 (13%) to $2.66. As Denver’s outbound rates decline, however, truckers may push for higher rates on inbound lanes.

Big price jumps like these highlight the importance of understanding dynamic market conditions when pricing reefer lanes at this point in the season. The spot market rates in Truckload Rate Index are updated daily, so you can view today’s rates as well as a 13-month trend for every major lane in the country.

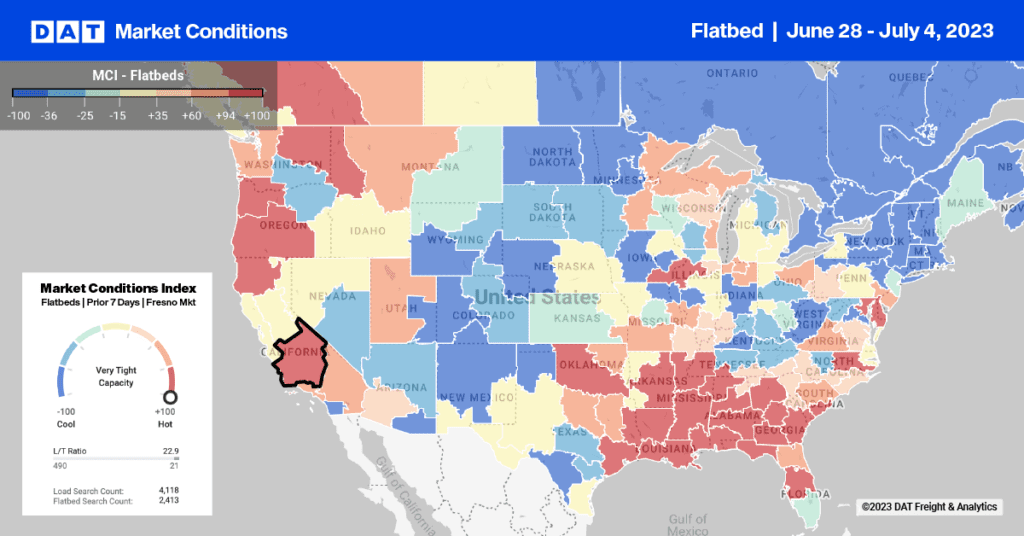

FLATBED

Flatbed rates remain high, with a slight 0.5% decline in the final week of June. Of the top 76 lanes, 35 gained in price and 40 declined, indicating many markets that still face tight capacity. For the month, rates rose 3.3% in the high-demand lanes.

Memphis continues to be a leader with high rates, despite a 2.2% slip to $2.79 per mile last week, based on a 470-mile average length of haul. In Raleigh, rates dipped 1.9% to $2.72 with an average length of haul at 434 miles. Phoenix was most improved, with a 13% leap to $2.11, on higher volumes to Southern California. The lane from Phoenix to Ontario, CA jumped $0.73 (40%) to $2.57.

Ft. Worth paid the least among high-volume markets, at $1.90 per mile for a 492-mile average length of haul. One of the lanes with declining prices, Birmingham to Chicago, lost $0.41 (16%) to $2.09 per mile, while other declines were more modest, in keeping with normal seasonal trends as we move from June to July.