It’s looking more and more like you won’t have to sweat much of a summer slowdown this year. This would typically be a down time for freight, and while rates in July and August are lower than they were in June, they’re still 25 to 30% higher than last year.

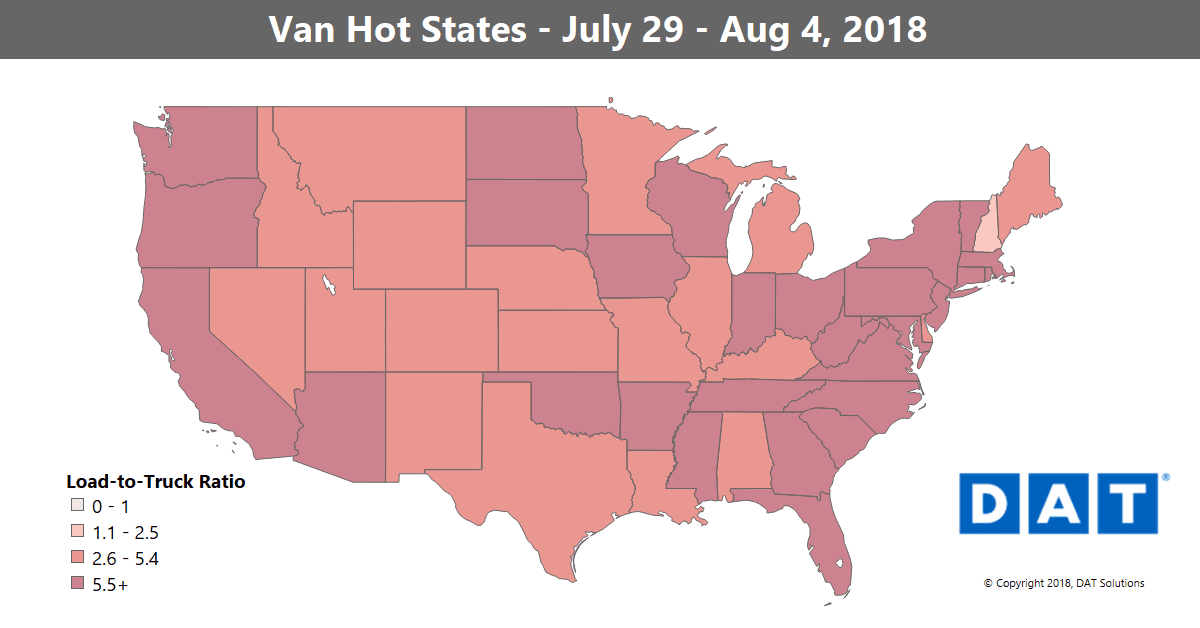

That steady decline from the June peak might be ending soon, though. Van volumes rose in key places like Atlanta, Los Angeles and Houston, which kept outbound rates stable and could be an early sign that prices are turning a corner.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

RISING RATES

Buffalo and Seattle made big gains last week, with rates up 6% and 4% respectively. On a lane-by-lane basis, all the big increases were on trips in and out of Buffalo.

- Chicago to Buffalo surged 33¢ to an average of $3.33/mile

- Buffalo to Chicago also added 15¢ at an even $2/mile

- Philadelphia to Buffalo jumped up to $2.96/mile

- Buffalo to Charlotte gained 27¢ to $2.56/mile

FALLING RATES

Outbound rates were down quite a bit from Memphis, Dallas and Charlotte

- Memphis to Dallas lost 21¢ at $2.69/mile

- Memphis to Chicago fell 15¢ to $2.56/mile

- Not all lanes into Buffalo were up: Rates to there from Columbus fell 17¢ but still averaged $3.54/mile

- Atlanta to Chicago also lost 16¢ at $1.85/mile

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.