It’s not uncommon for us to see a slump in rates after Memorial Day, but that wasn’t the case last week. Spot market rates continued their upward trend after the holiday, and retail shipments boosted prices on a few lanes. The Sun Belt is still strong, the Midwest continues to improve, and California volumes are holding. On the top 80 highest-volume van lanes, rate increases far outnumbered lanes with falling prices.

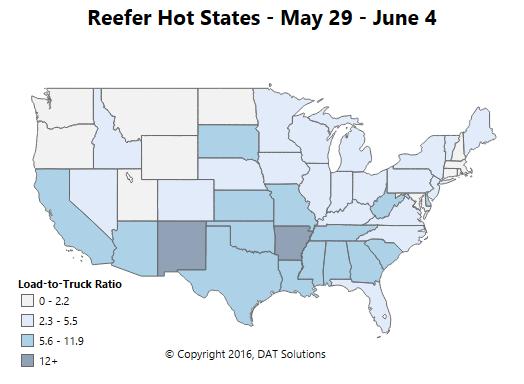

Darker states in the map above show where there’s stronger demand for trucks.

The southern band of states still have the highest demand for trucks, but the Midwest and Northeast continue to heat up. Buffalo rates have been climbing for the past four weeks, while Chicago has been improving on what had been a disappointing spring up to this point. Atlanta is the top market for load posts on DAT Load Boards, and tighter capacity has led to higher rates there.

Retail shipments also kept pace after Memorial Day and boosted prices on these lanes:

- Columbus to Buffalo paid 24¢ better at $2.62/mile

- Chicago to Detroit rose 18¢ to $2.47/mile on average

- Memphis to Indianapolis added 22¢ to $1.88/mile.

Darker states in the map above show where there’s strong demand for trucks

Most major reefer markets trended upward last week, with the exception of Florida and Northern California. Prices fell sharply in Lakeland, FL, and Miami, but there were big gains in Atlanta, Dallas, and near the Mexican border in Nogales, AZ. The best news was out of Fresno, where volumes stayed steady from the previous week, even though last week was just a 4-day work week. Outbound rates tumbled in Sacramento, so you’d be better off hauling out of Fresno this time of year.

Daily maps, along with detailed information on demand, capacity and rates for individual markets and lanes, can be found in the DAT Power load board. Rates are derived from actual rate agreements and contracts, as reported in DAT RateView.