Van and reefer rates continued to rise in the first week of January, a sign that there’s still some momentum in freight transportation in the new year.

The national average van rate hit $1.98 for dry vans last week. That’s 4¢ per mile above the December average and higher than any monthly rate since 2018. Reefer rates rose, as well, but flatbeds lost 4¢ per mile.

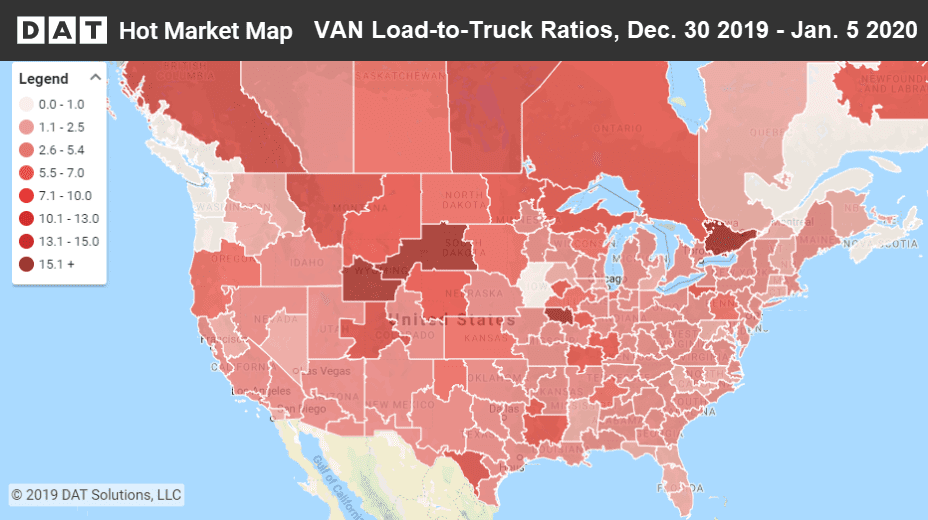

Hot Market Maps, an interactive feature in the DAT Power load board and DAT RateView, depict load-to-truck ratios in 135 freight markets in the U.S.

Freight volumes rose on half of the top 100 van lanes, while load counts declined on half of the top reefer lanes, compared to the previous week. Volumes were much lower for both equipment types than in the run-up to Christmas, however.

Rates rise in key markets and lanes

Van rates gained traction on high-volume lanes originating in 6 major freight hubs: Dallas, Chicago, Cleveland, Philadelphia, Atlanta, and Stockton, CA. Atlanta and Chicago were also destinations for some of the lanes where rates rose the most:

- Dallas to Houston was up 18¢ to $2.47 per mile, and truckers got $2.04 back to Dallas, an increase of 3¢

- Chicago to Allentown, PA, added 12¢ to $2.95, while the return trip paid $1.40, down 2¢

- Cleveland to Chicago rose 9¢ to $2.04

- Atlanta to Charlotte gained 7¢ to $2.67. Other outbound rates rose from Atlanta to Miami (up 14¢ to $2.66) and there were smaller but significant gains from Atlanta to Memphis and to Dallas.

- Philadelphia to Boston rates rose 5¢ to $3.98 per mile

- Stockton, CA to Ontario, CA added 13¢ to $1.76 per mile, and the lane from Stockton to L.A. got a 7¢ boost to $1.85

Some retail-dominated lanes lost traction

Some lanes that had big increases a couple of weeks ago reverted to slow-season rates, including lanes with destinations in Memphis, Columbus, and Chicago, that are associated with retail freight:

- Columbus to Memphis rates dropped like a rock, from $2.07 to $1.79, a 28¢ loss, while Memphis to Columbus fell “only” 15¢ to $2.09.

- Denver to Los Angeles lost 16¢ to $1.20 per mile

- Seattle to Salt Lake City plummeted to $2.00 from a $2.26 average in the previous week

- Buffalo to Chicago fell 18¢ to $1.65

- L.A. to Atlanta declined 10¢ to $1.69

Looking ahead to the rest of this week, snow, sleet, and freezing rain could be headed for the Midwest and Northeast regions, so watch the forecasts and avoid hazardous road conditions. Typically, bad weather drives local rates up temporarily, as fewer trucks are available in the affected regions. When the weather is bad across large swaths of the continent, however, rates tend to go up everywhere. Then rates will stay elevated until conditions have improved and backlogged freight makes its way through the supply chain.