Even though rates are slow to respond, freight volumes are rising as we get closer to the fall holidays of Halloween and Thanksgiving. Most parts of California are shipping more loads, especially the Fresno market in central California. Activity is also up from the Nogales, AZ, market, as well as Florida and South Texas. Offsetting this are declines out of Atlanta, Grand Rapids and Sacramento.

Last week the top 72 reefer lanes were mostly balanced, with 33 lanes up, 35 lanes down, and 4 neutral.

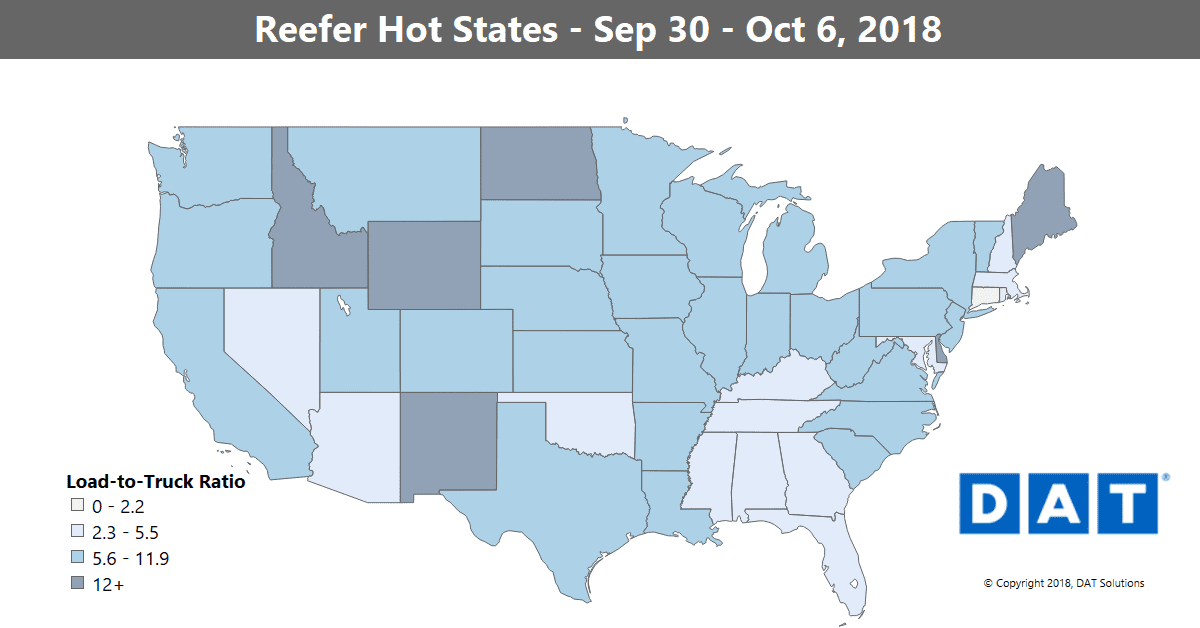

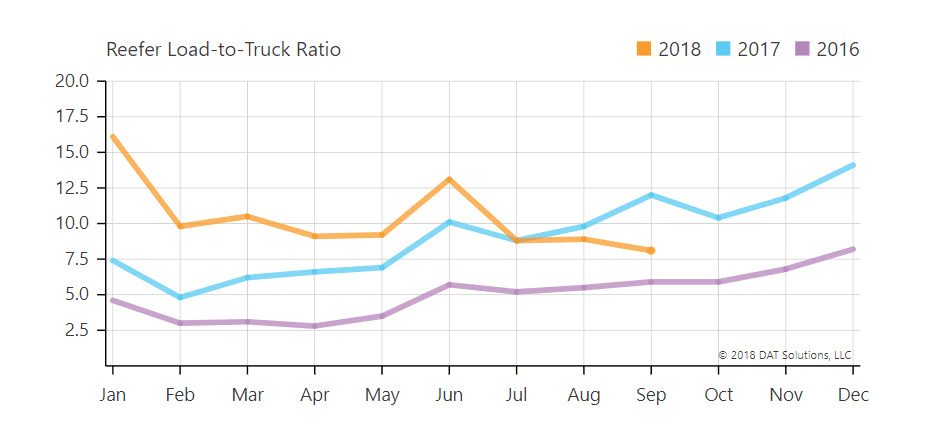

The national load-to-truck ratio for reefers dropped 18% last week, to 6.9 loads per truck, with areas of tight capacity in a few northern states. The load-to-truck ratio represents the number of loads posted for every truck posted on DAT load boards. The ratio is a sensitive, real-time indicator of the balance between demand and capacity. Changes in the ratio often signal impending changes in freight rates.

Rising markets

Only Nogales, AZ showed a strong upward change, with outbound rates gaining 3%.

- Nogales to Dallas was up 15¢ to $2.24/mile

In the Midwest, a pair of lanes spiked higher.

- Grand Rapids, MI to Madison, WI added 16¢, rising to $3.25/mile

- Chicago to Philadelphia increased 15¢ to hit $3.58/mile

Falling markets

A hallmark of 2018 has been when high-priced lanes start coming down, it takes weeks or months to normalize. Here are three very high-priced lanes in that process:

- Green Bay to Joliet, IL tumbled 48¢ to $3.48/mile

- Philadelphia to Boston lost 24¢, falling to $4.20/mile

- Elizabeth, NJ, to Boston dropped 20¢ to $4.79/mile

After hovering above 2017 levels for most of the year, the reefer load-to-truck ratio is now lower than it was last year at the beginning of October.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.