June couldn’t get here fast enough. Not that anyone didn’t already know, but the U.S. economy officially entered into recession back in February, according to the National Bureau of Economic Research.

Of course, the official announcement is more of a formality. Anyone close to transportation during the COVID-19 pandemic can tell you how steeply business dropped off. We’ve thankfully been rebounding in recent weeks, giving us some momentum as we shift into what’s usually a peak month on the truckload spot market.

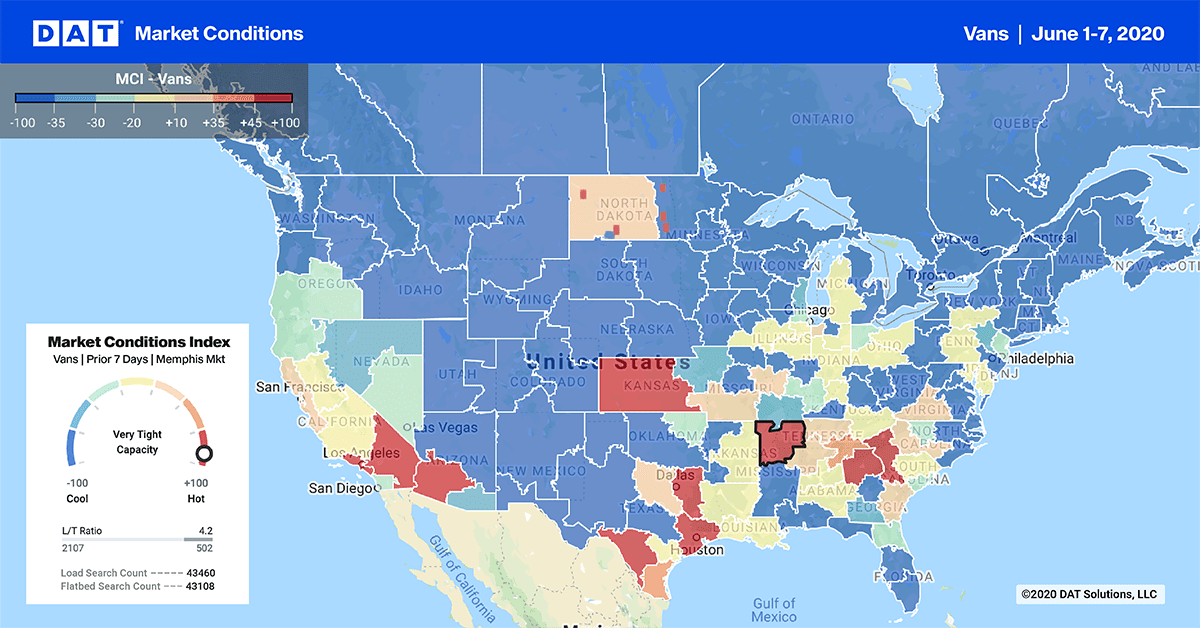

Market Conditions maps are available in the DAT Power load board and DAT RateView, our standalone freight pricing tool.

The glass-half-empty read of the Market Conditions map above is that there’s still an awful lot of blue considering that it’s June, indicating markets where truckload capacity is loose. The glass-half-full version: Activity continues to climb, with volumes building as businesses regain their footing. Manufacturing is coming back online in many areas, while produce season also creates truckload demand.

Biggest increases

Los Angeles and Chicago continue to make strong gains, with large increases in rates on several high-volume lanes.

Note: The rates listed below are averages from last week, based on actual transactions between carriers, brokers and shippers.

- Chicago to Columbus, OH, rose 19 cents to $2.34 per mile

- Chicago to Detroit gained 15 cents to $2.78

- Chicago to Allentown, PA, was up 13 cents to $2.32

- Los Angeles to Denver jumped up another 25 cents to $3.09

- L.A. to Seattle climbed up to $2.74

Aside from those, the other major increase was on the lane from Charlotte, NC, to Buffalo, NY. That’s a relatively low-volume lane, but the average rate shot up 20 cents to $2.31 per mile.

Prices from Atlanta down into Florida are also trending up. Produce season is winding down in Florida, so demand is shifting from outbound back to inbound. Atlanta to Lakeland, FL, was up to an average of $2.41 per mile last week.

Overall, 72 out of the top 100 van lanes saw higher rates, while 16 others held steady.

Get regular updates on how the coronavirus is affecting freight markets at DAT.com/COVID-19.

Biggest declines

Prices retreated a bit out of Stockton, CA, which ended a steady streak of increases out of that market. On a lane-by-lane basis, those declines were fairly small. Overall, only 12 out of the top 100 van lanes had lower prices last week, with the biggest drop on the lane from Seattle to Salt Lake City. That lane fell 9 cents to $1.61.