Following the record-high volumes of new tractor and combine sales in April, the Association of Equipment Manufacturer’s May report indicates volumes of two-wheel (2WD) and four-wheel drive (4WD) tractors are down 3.9% since last year.

However, a different trend emerges when looking at this year’s sales volumes for 2WD tractors. Volumes are actually up 25.8% since the start of the year, or a total of 27,981 additional tractor sales this year. Sales of the larger 4WD tractors more suited to drop-deck or low-boy trailers are up 19.9% YTD along with self-propelled combine harvesters, which are up 13.1% YTD.

Digging a little deeper into the data at the import level, roll-on/roll-off (RoRo) tonnage in Baltimore decreased 11% from April to May. This is an important demand barometer for flatbed and specialized carriers to monitor.

Baltimore handles the majority of the U.S. East coast market’s share of RoRo cargo annually. It’s also perfectly positioned to the Midwest’s major farm and construction equipment manufacturers for combines, tractors, hay balers and in importing excavators and backhoes.

According to the PIERS import database, imported RoRo tonnage for construction and agricultural equipment translated to an average of almost 500 truckloads per week this May, compared to just 260 in last May.

Compared to May of last year, RoRo import tonnage in Baltimore is up 81%. This has resulted in higher flatbed spot rates this year, which are currently averaging $3.19/mile to all destinations and as high as $4.97/mile for loads to Allentown, PA.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

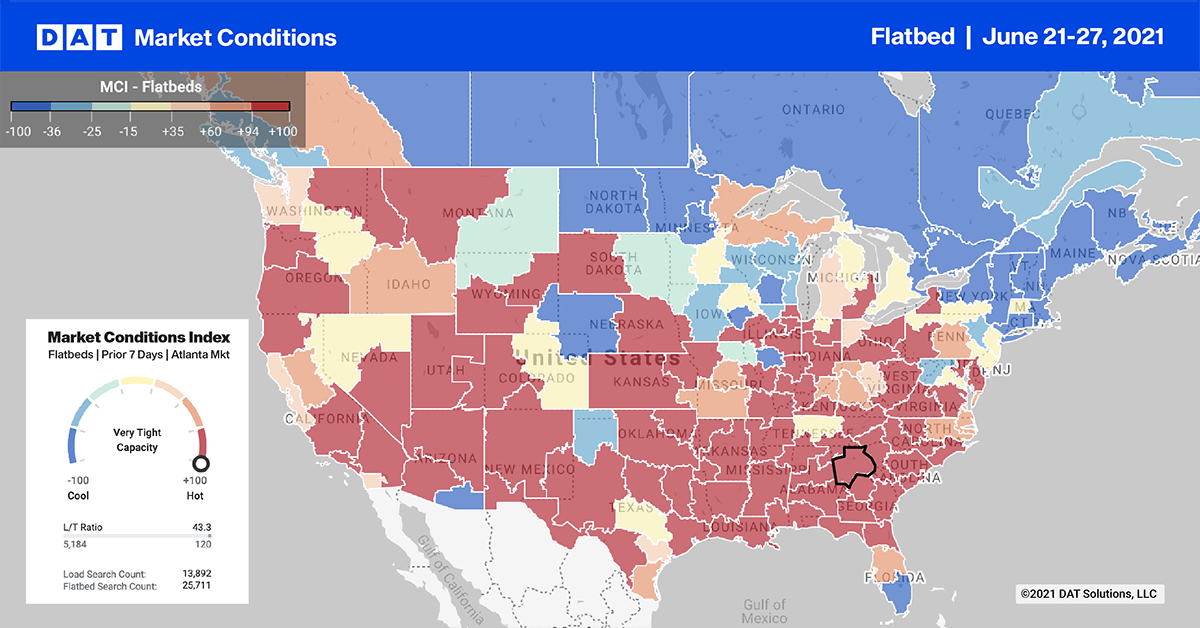

Flatbed rates have taken off in Las Vegas for 292-mile loads to Salt Lake City, reaching $3.96/mile this week. This represents an increase of $1.19/mile since February this year.

Loads from Houston to Lubbock in the Permian Basin — our number one spot market volume lane for loads moved each year — are currently at $3.32/mile and up $1.62/mile since this time last year. That’s more than doubled in 12 months.

The Baker Hughes drilling rig count in Texas stands at 221 oil rigs this week, which is also more than double this time last year. We can expect a lot of drill pipes, casings and other products being hauled west out of Houston at the moment.

Spot rates

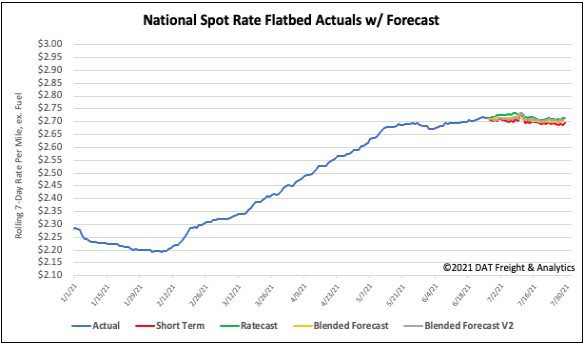

For the last three weeks, flatbed spot rates have been working in a very tight band between $2.70/mile and $2.71/mile. Last week spot rates increased by just under $0.01/mile to $2.71/mile. Flatbed rates are still $0.78/mile higher than the same week last year and $0.25/mile higher than the same time in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models