Once again, the supply chains were dealt a major disruption last week from Mother Nature.

With Hurricane Florence, the advanced warning allowed businesses to plan ahead, reschedule shipments and reposition their trucks. Hurricane Michael, on the other hand, went from a tropical depression to a Category 4 storm in just two days. That caught many people and businesses off guard, and the storm left near-total destruction in many coastal towns.

Florida Department of Transportation Damage Assessment Teams inspect damage along US 98 in Mexico Beach. Photo from FDOT.

Nationwide, truck load volumes declined 10%, largely due to the storm. Road closures halted shipments on major trade routes like I-10 between Houston, New Orleans and Jacksonville, and I-75 up from Florida to Atlanta. Tariffs also probably contributed to the decline, since volumes have slowed on West Coast ports.

Demand for trucks will likely increase in the coming weeks, with FEMA loads and emergency freight heading to the Florida Panhandle, Georgia and the Carolinas. We should also see an increase in flatbed loads heading to that region when rebuilding hits full steam.

How to find FEMA loads and trucks, and what to consider when handling emergency freight.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

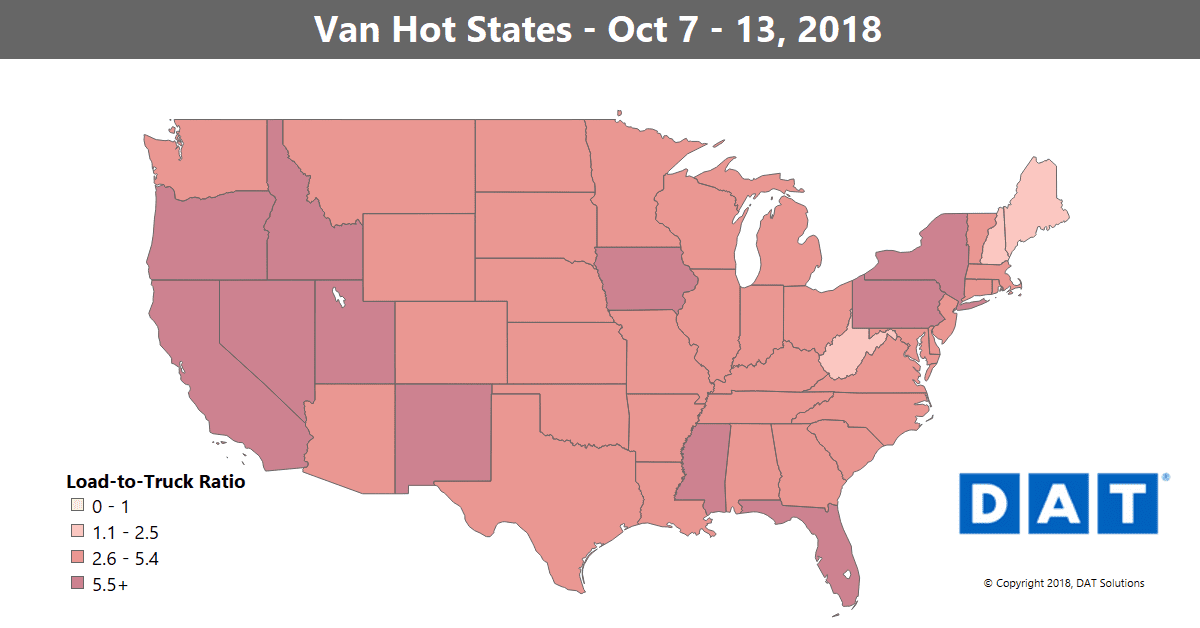

Pretty much all markets were down last week, with lots of shipments canceled due to the storm. Rates fell on 70 of the top 100 van lanes. One noteworthy thing was that pricing out of Atlanta and Charlotte was mostly neutral despite all the canceled shipments from there to Florida.

One of the few lanes that was not hurt by the storm was Memphis to Columbus, OH, up 10¢ to an average of $2.32mile.

FALLING LANES

Again, prices were down pretty much everywhere, but here are three that fell for reasons unrelated to the storm:

- Buffalo to Allentown, PA was down 21¢ to $3.30/mile – still high, but trade with Canada is down, which affects demand out of Buffalo. That could hopefully pick back up soon, as the U.S. and Canada reached a trade agreement a couple of weeks ago, even though it hasn’t gone into effect yet

- Houston to Oklahoma City dropped 19¢ to $2.04/mile

- Seattle to Salt Lake City lost 18¢ at $2.18, with fewer imports hitting the Seattle port

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.