The Interstate 40 bridge over the Mississippi River in Memphis, TN may be open by the end of July according to the Arkansas Department of Transport (ARDOT). The contractor appointed by the Tennessee Department of Transport (TDOT) is progressing with the phase 2 repairs by drilling, bolting, and torquing the eight steel permanent repair plates.

A crack discovered during a routing inspection closed the 48-year-old six-lane bridge since May 11. Since then, traffic has been diverted to the nearby 71-year-old Interstate 55 bridge just three miles to the south.

“When the bridge first closed, delays were regularly exceeding an hour,” says Shannon Newton, President of the Arkansas Trucking Association. “Now thanks to ARDOT’s traffic engineering, implementing strategic lane shifts, that delay is down to only 15 minutes.”

The American Transportation Research Institute (ATRI) reveals truck traffic over the Mississippi River has decreased only slightly from 26,500 carriers per day to 23,500 due to the bridge closure and trucks rerouting.

“We estimate those 3,000 trucks that are rerouting 60 miles or more from the I-55 bridge are losing $513,000 per day in lost time and increased mileage while the cost of the 15-minute delay for the 23,500 trucks using the I-55 bridge is an estimated $423,000,” says Newton.

For carriers weighing their options, the next closest crossings over the Mississippi River are on I-155 near Dyersburg, TN (85 miles north) or on U.S. 49 in Helena, AR (65 miles south).

Find loads and trucks on the largest load board network in North America.

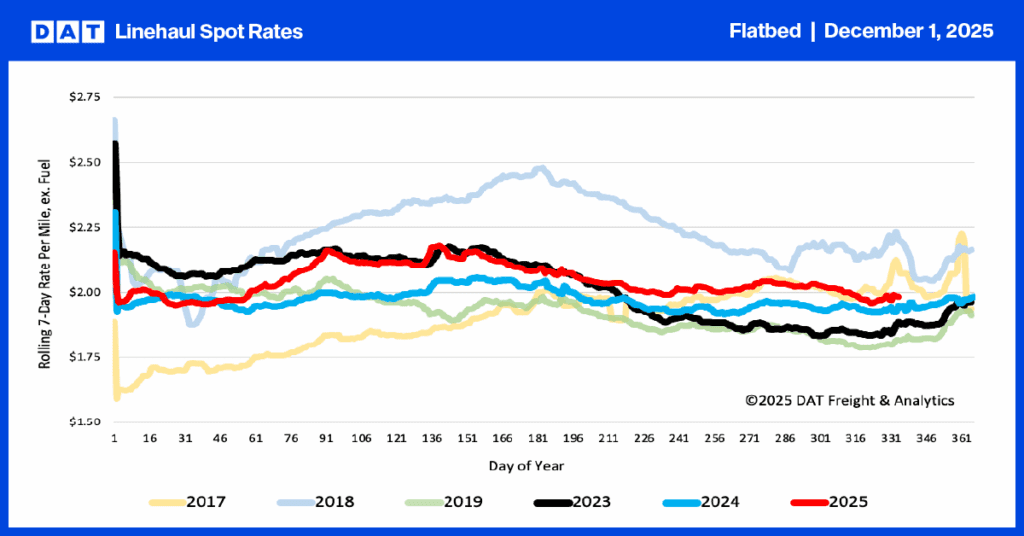

Note: All rates exclude fuel unless otherwise noted.

Outbound spot rates in Alabama were up $0.42/mile in Decatur last week, reaching an average of $4.08/mile to all destinations.

In nearby Montgomery, capacity was just as tight with spot rates increasing by $0.19/mile to $4.39/mile to all destinations. However, the 560-mile Montgomery-Cincinnati lane climbed to $4.43/mile. This is 67% higher compared to this time last year when rates averaged $2.65/mile.

On the 670-mile run from Birmingham to Chicago, rates were up $0.16/mile last week to an average of $3.68/mile. This is $1.33/mile higher than January this year.

Spot rates

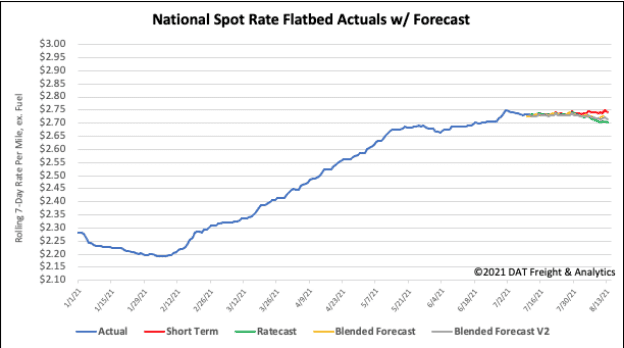

Flatbed spot rates dropped by $0.02/mile last week to an average of $2.73/mile after plateauing around this level since June 27. Rates are still $0.77/mile higher than the same week last year and $0.32/mile higher than the same time in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models