September 2025 data from the Association of Equipment Manufacturers (AEM) brought positive news for the specialty light-duty agricultural sector, with overall U.S. farm tractor sales showing a 4.1% increase compared to September 2024, ending a year-long slump. However, the outlook for heavy-duty broad-acre farmers was less optimistic. A detailed analysis of the AEM report reveals a complex scenario, which in turn influences the flatbed truckload demand outlook.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

While the mid-range 2WD 40–100 hp segment experienced robust growth, increasing by 17.3%, higher-margin segments faced continued pressure. Sales of self-propelled combines and massive 4WD tractors both declined, dropping 21.9% and 32.7% respectively. This slump in heavy-duty equipment indicates reduced demand for specialized, oversize/overweight truckload carriers. Compared to the 5-year average sales of total farm tractors, September’s result is almost 22% lower, due to a slumping agricultural economy.

According to Curt Blades, senior vice president of the Association of Equipment Manufacturers, “farmers are hesitant to make purchases due uncertainty in the ag economy overall whether it’s related to trade, tariffs, biofuels, or soybean trade. Just go through the list, feed, fertilizer, crop protection, and let’s also throw equipment in there as well. There’s a lot of pressure on farmers’ bottom lines.”

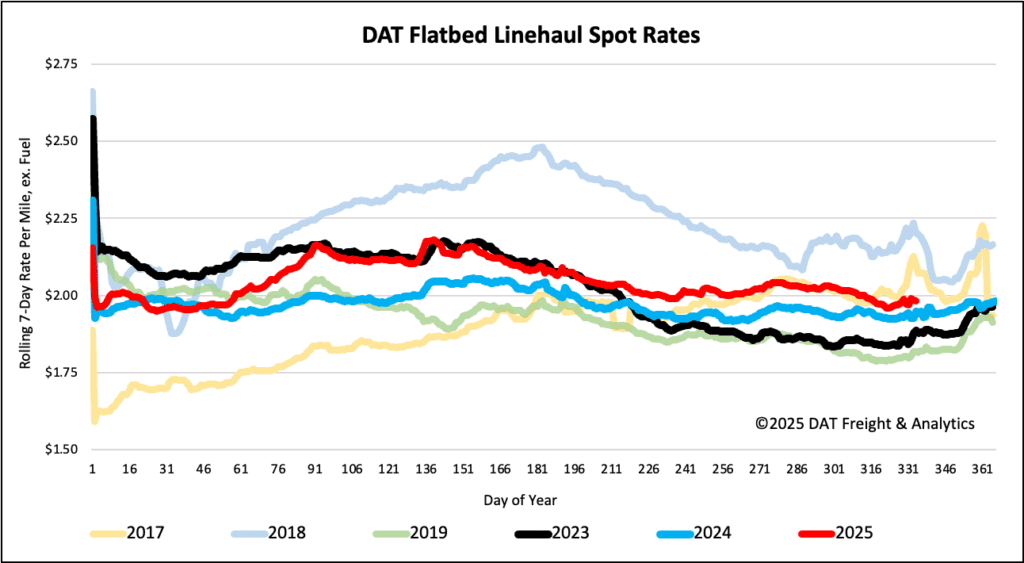

National flatbed spot rates

The national average flatbed spot rate held steady for the third consecutive week, remaining at $2.01 per mile. This rate is currently just 2%, or $0.03 per mile, above the rate recorded at the same time last year.