In the heart of the Permian Basin, the once-frenetic energy of Midland, Texas, is cooling as oil prices hover stubbornly around $60 per barrel. For the trucking industry, which serves as the lifeblood of the oil patch, this price stagnation feels more like a slow leak than a sudden blowout. As exploration and production companies tighten their belts and scale back drilling schedules to protect profit margins, the immediate casualty is the demand for heavy-haul logistics. Truckers who specialize in moving massive drilling rigs, heavy machinery, and miles of drill pipe and casing are seeing their backlogs evaporate. With fewer new wells being “spudded,” the constant conveyor belt of equipment moving west has slowed, down 19% in the Permian Basin from a year ago according to the latest survey from Baker Hughes.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The ripple effect of this slump extends far beyond the oil rigs themselves, hitting the specialized carriers whose entire business models are built on the volatility of West Texas. When prices threaten to dip even further, the “maintenance mode” mindset takes over, where operators focus on existing wells rather than the equipment-intensive process of expansion. For a trucker hauling casing or drill pipe, this means fewer turns and more time spent sitting in empty parking lots that were bustling just months ago. As the cost of fuel and insurance remains high, the thinning margins of hauling into the Permian are becoming a survival test. In Midland, the story is no longer about the gold rush of the boom years, and more about survival until the good times return…maybe.

A similar situation is unfolding in North Dakota’s Bakken oilfield, where Continental Resources, for the first time in over 30 years, has halted drilling. Harold Hamm, the billionaire wildcatter, founder, and executive chairman of Continental Resources—a figure who helped spark America’s shale revolution—recently told Bloomberg in a phone interview, “There’s no need to drill it when margins are basically gone.” This decision represents a historic shift for the US shale industry and highlights the conflict between the Trump Administration’s desire for cheap $50 oil and the economic pressures facing domestic drillers.

Flatbed Market Conditions

Although the coldest part of winter often continues for a few weeks due to thermal inertia, Valentine’s Day often brings a psychological anticipation of spring. This shift is relevant for flatbed carriers in February because it precedes the seasonal rise in demand for construction, manufacturing, and other outdoor projects that require longer, warmer days. While the full demand increase typically arrives in March, this initial psychological and physical change is already creating the groundwork for the spring freight volume we are beginning to observe in the DAT freight network.

Flatbed load post volume continues its upward trend, marking the fourth consecutive weekly rise, building on last week’s 10% increase. Over the past month, volumes have grown by 10% and are now substantially higher than historical figures—74% above last year and 44% above the 10-year average (excluding the 2021 and 2022 pandemic years). This strong upward surge led to a 16% jump in the load-to-truck ratio, which closed last week at 57.77.

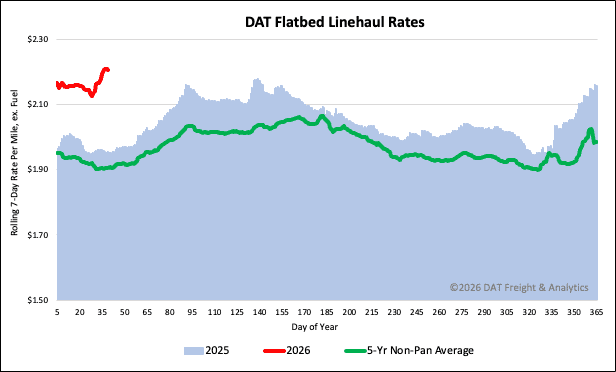

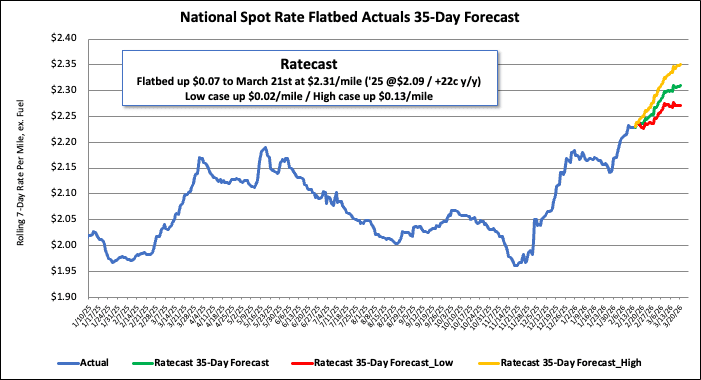

National flatbed spot rates

Flatbed linehaul rates are continuing their upward trend, with the national average spot rate rising for the third consecutive week. Last week, the rate settled at $2.24 per mile, building on the previous week’s $0.02 per mile gain. This current rate is notably strong: it is 13% ($0.26 per mile) higher than the rate during the same period last year, $0.18 per mile higher than the 2018 level, and 14% ($0.31 per mile) above the 5-year average (excluding pandemic years).