The February 10 USDA Specialty Crops Truck Rate Report paints a split market: Florida is tightening fast while South Texas is loosening, and California remains capacity-constrained on lower volumes.

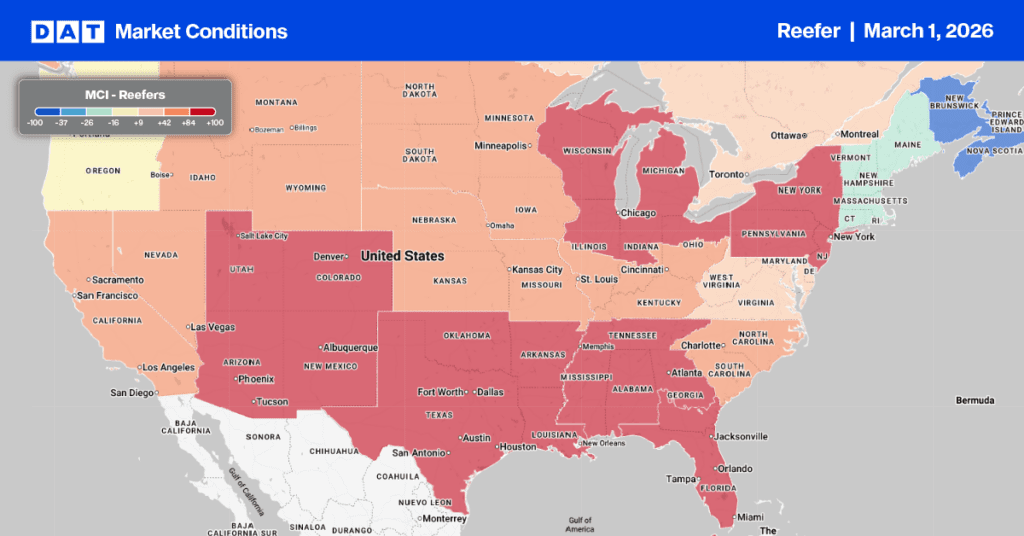

Central and South Florida is the hottest origin in the report. Rates to Baltimore jumped +23% week-over-week, with Boston (+15%), New York (+11%), Chicago (+9%), and Philadelphia (+8%) all posting significant increases. Truck availability in Florida has moved to Shortage on most lanes and Slight Shortage into Atlanta. This is being driven by strong winter produce volumes — tomatoes, peppers, strawberries, squash, and sweet corn — colliding with tighter reefer availability in the Southeast. Carriers with capacity in Florida have pricing power right now.

Key Florida rates (per load):

- Florida → Baltimore: $4,200–$4,400

- Florida → Boston: $5,400–$5,600

- Florida → New York: $4,900–$5,100

- Florida → Chicago: $3,400–$3,600

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Mexico crossings through South Texas saw broad-based rate declines across nearly every destination, ranging from -7% to -17%. Truck availability shifted to Slight Surplus on most outbound lanes (except Atlanta, which remains Slight Shortage). The Philadelphia lane dropped the most at -17%, followed by Baltimore at -16%. This suggests a capacity rebalance after recent tightness, and brokers sourcing loads out of the McAllen/Laredo corridor may find more negotiating room this week.

California’s produce regions — Imperial/Coachella, Kern, Oxnard, Santa Maria, and South/Central districts — are reporting Shortage to Slight Shortage conditions on reefer capacity, particularly for eastbound loads to Baltimore and Philadelphia. Despite the tight trucks, rates were mostly flat to slightly lower week-over-week (-1% to -2% on most lanes). The exception: Kern District to Philadelphia ticked up +1%.

Citrus out of South/Central California (oranges, grapefruit, lemons) showed moderate softening of -1% to -5%, with adequate truck supply. Long-haul rates remain elevated — expect $7,500–$9,200+ to East Coast markets.

Mexico crossings through Nogales, AZ are running at Adequate truck availability with modest rate declines of -1% to -5% depending on destination. The longest lanes (Boston at $8,800–$9,100, New York at $8,100–$8,300) are still commanding premium rates, but the week-over-week trend is softening slightly.

Other Markets at a Glance

- San Luis Valley, CO (potatoes): Flat week-over-week. Adequate capacity. Rates stable.

- New York (apples): Adequate supply, no rate movement. Short-haul lanes ($1,800–$2,500) remain soft.

- Yakima Valley, WA (apples/pears): Mostly flat with adequate capacity. LA lane ticked up +7%, likely reflecting repositioning demand.

Source: USDA AMS Specialty Crops National Truck Rate Report, February 11, 2026. Rates represent open (spot) market per-load prices including broker fees for 48–53 ft. refrigerated trailers.

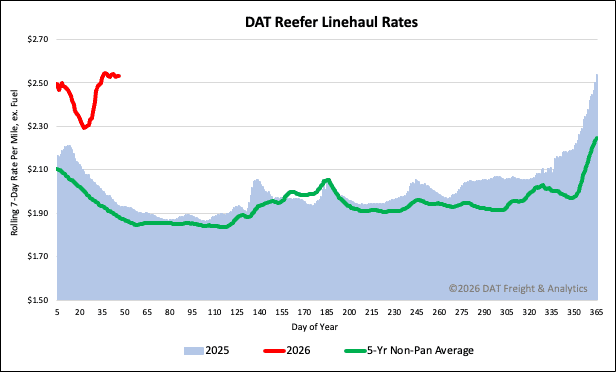

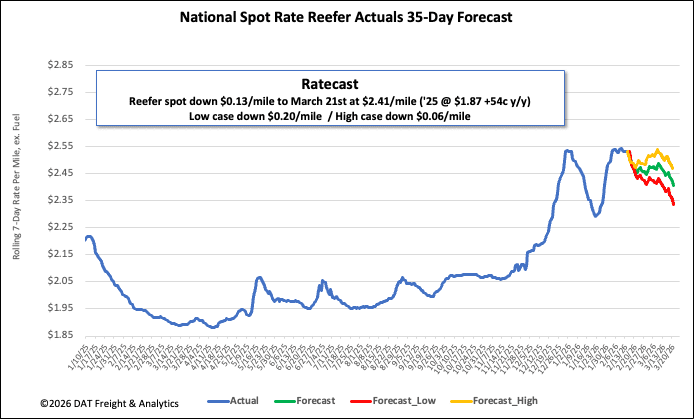

Reefer Market Conditions

The reefer market saw a significant drop in national load posts last week, plummeting 33%. Despite this decrease, volumes are still robust, sitting 78% above last year and doubling the 10-year average (excluding the pandemic years of 2021 and 2022). Simultaneously, available equipment posts declined by 14% week over week and 19% year over year. As a result of these shifts, the reefer load-to-truck ratio fell by 22% to 17.41.

National reefer linehaul spot rates

Reefer posted rates cooled last week, dropping $0.04 per mile to a national average of $2.53 per mile last week. This followed a significant $0.23 per mile (10%) jump over the preceding two weeks, which was caused by Winter Storms Fern and Gianna. Despite the recent dip, the current rate remains high. It is $0.59 per mile (31%) above the rate for the same period last year. Historically, the current rate is also substantially elevated, surpassing the 5-year average (excluding pandemic years) by $0.65 per mile, or 26%.