With Halloween just over two weeks away, Midwest retailer Meijer expects to sell more than 500,000 locally grown pumpkins for carving or decorating. More than 95% are expected to arrive at a Meijer store just a day or two after harvest from a nearby pumpkin patch.

“Michigan, Ohio and Illinois rank among top pumpkin harvesting states but the retailer works with more than 200 local growers across the Midwest to shorten the time and distance from the fields to the checkout lane,” says Sedric Wytch, Meijer Produce Buyer.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

According to the National Retail Federation, the top ways consumers are planning to celebrate this Halloween include:

- Handing out candy (66%)

- Decorating their home or yard (52%)

- Dressing in costumes (46%)

- Carving a pumpkin (44%)

- Hosting or attending a party (25%)

Halloween demand for decorative (carving) and processed pumpkins is peaking. Although pumpkins are grown in most states, 62% of production comes from just 10 states. Illinois produces twice as many pumpkins as any of the other top states and is consistently the nation’s largest producer of pumpkins for pies and other processed foods.

Domestic produce season wanes

We’re starting to see meaningful volumes of imported produce from South America landing in the Port of Philadelphia.

As grape production out of California starts to wind down, we begin to see grapes from Peru enter the market. Grape imports are forecasted to break previous import records for the 2021-22 season, which translates to around 12,000 truckloads of grapes in total.

We’ll also start to see production of leafy greens shift from Salinas, CA to Yuma, AZ (also known as the Winter Salad Bowl) where 90% of all lettuce is produced each winter.

Reefer rates in Philly were up $0.02/mile last week to an average $2.97/mile for outbound loads and around $2.74/mile for loads to Chicago — up $0.95/mile over the last year. Loads from Philly to Boston hit a record high of $5.47/mile for the 300-mile run. That’s close to $1.00/mile higher than the same week last year.

Reefer rates from Los Angeles to Las Vegas continue to climb, averaging $6.10/mile last week.

Fall produce volumes in the Yakima Valley are finding capacity tight on the Yakima to Los Angeles lane. Spot rates are almost $0.40/mile higher month-over-month to an average of $2.33/mile last week. Reefer loads from Yakima to Hunts Point, NY were up $0.07/mile last week to an average of $2.99/mile.

Spot rates

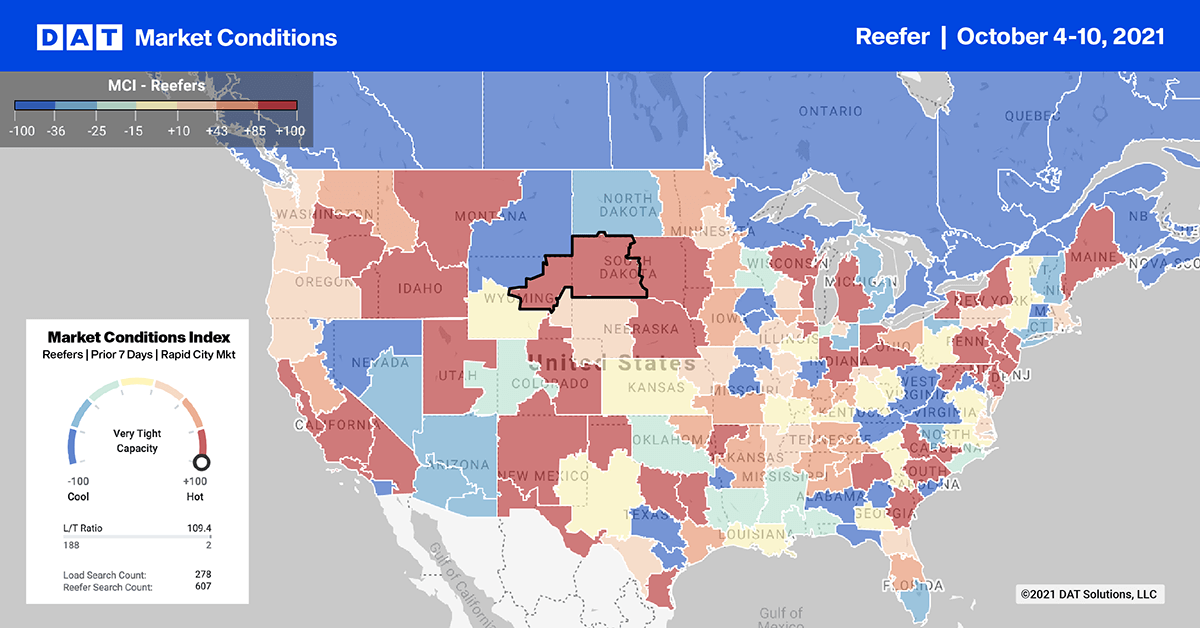

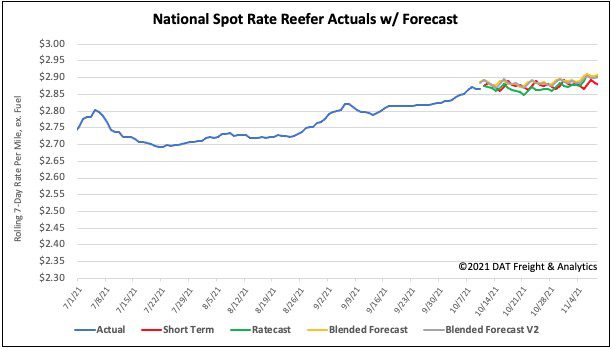

Reefer spot rates increased by another penny per mile last week. The national average now stands at $2.87/mile, which is 17% or $0.50/mile higher than this time last year. It’s also just over $1.00/mile higher than the 10-year average for the first shipping week of October.

Of our Top 70 lanes (for loads moved), spot rates:

- Increased on 28 lanes (compared to 17 the week prior)

- Remained neutral on 28 lanes (compared to 31)

- Decreased on 15 lanes (compared to 22)

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models