Record import volumes in 2021 and the resulting port congestion on the West Coast substantially impacted refrigerated exports last year. According to data from IHS Markit PIERS, reefer exports were 2% lower last year compared to 2020, although not as bad as total export container volumes recording almost a 4% decline over the same timeframe. Last year, the East Coast exported just under half of all containers (dry and reefer), with Savanah at 11% of the annual volume but just 8% of reefer volume.

The number one port for export reefer containers in 2021 was Oakland, with 20% of annual volume, followed by Los Angeles (9%) and Long Beach (8%). While total dry and reefer volumes were down 13% y/y in Oakland, reefer volumes increased by 4% y/y, exporting 4,162 more containers in 2021 than the previous year. The top destinations for Oakland exports were Japan (32%), followed by Korea (11%) and China (9%). Beef and pork were the dominant export commodity at 31% of export volume, followed by edible nuts at 24%. Milk, eggs, and other dairy products came in third at 6% of volume.

The coastal disparity in port congestion resulted in East Coast reefer export volumes increasing 1% y/y in 2021 compared to the West Coast, where volumes dropped by 6% y/y. Even though the number of container vessels is currently around half what it was on January 9 this year when a record 109 vessels were waiting to unload, the impact on 2021 exports has been substantial.

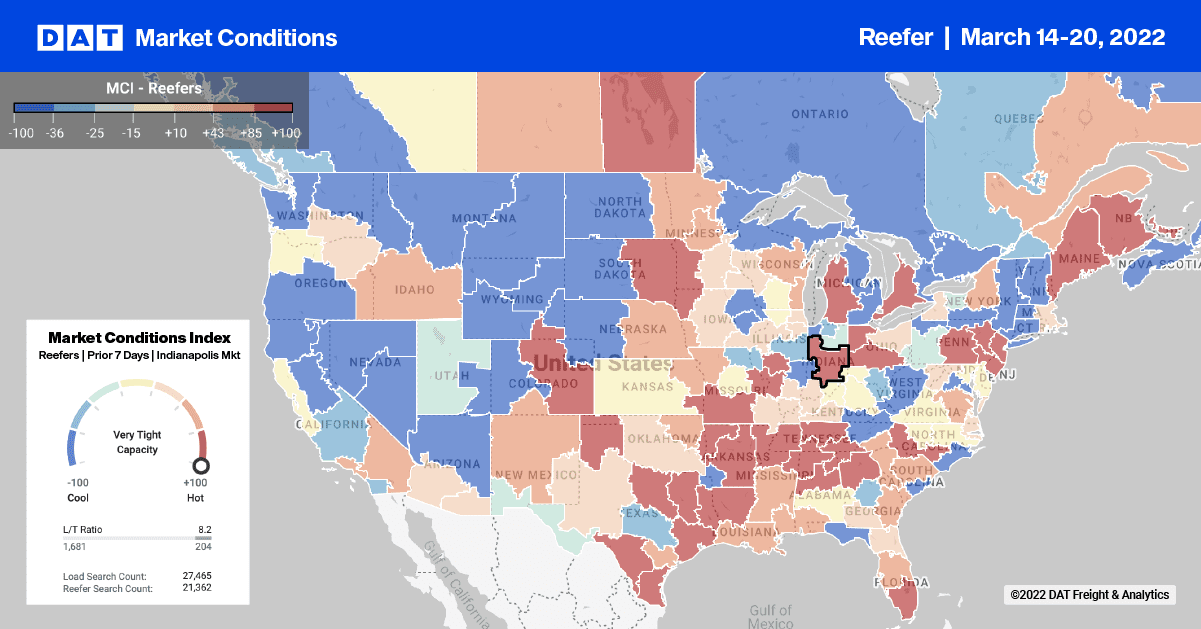

Reefer capacity was noticeably tight in Southern Texas last week, where outbound spot rates increased by $0.18/mile to an average of $2.86/mile excl. FSC in Houston, San Antonio, and Austin combined. In Houston, load post volumes have jumped 24% since the start of March, with capacity very tight on the 1,200-mile haul west to Phoenix. Spot rates have increased by $0.45/mile over the February average to $2.17/mile excl. FSC. Higher demand for cabbage for last week’s St Patrick’s Day celebrations pushed outbound rates in Jacksonville up by $0.07/mile to $2.61/mile excl. FSC while capacity eased in Lakeland, FL, with reefer rates dropping by $0.10/mile to $1.85/mile.

Outbound capacity tightened last week in the Las Vegas market, driving up spot rates by $0.39/mile to an average outbound rate of $3.44/miler excl. FSC. Spot rates in neighboring Reno increased by the same amount last week to an average of $2.94/mile excl. FSC.

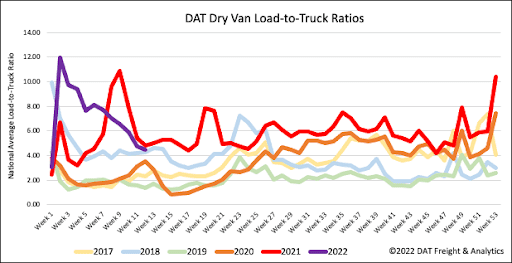

Reefer load post volumes decreased 9% w/w and are now 15% lower than the previous year. Last week, carrier equipment posts remained relatively flat, leaving the reefer load-to-truck ratio down slightly from 8.88 to 8.09.

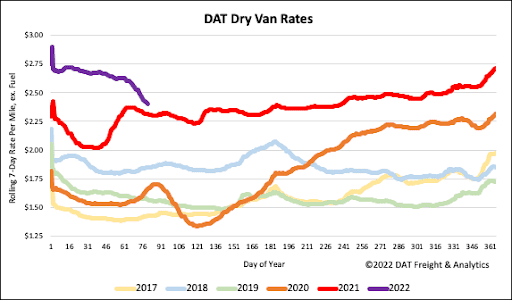

Reefer spot rates have dropped by $0.28/mile in the last four weeks after plunging $0.13/mile the previous week. Like the dry van sector, this is the most significant w/w decrease since the start of 2020, including the drop in spot rates at the beginning of the pandemic in April 2020. The reefer national period last year and $0.62/mile higher than in 2018.