Each state has crops that dominate annual production and generate thousands of truckloads of freight, but few do so to such an extent as peanuts and almonds.

All of the commercial almonds in North America are grown in California, which also account for 80% of commercial almonds around the world. Peanuts are the official state crop of Georgia, which produces almost 50% of the total U.S. peanut crop. Both states lead the nation in their respective almond and peanut exports.

That’s also an enormous amount of freight for truckers to haul — both short and long-haul.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

West Coast’s almond harvest requires more than 150,000 truckloads

California almond orchards are expected to produce 3.2 billion pounds of nuts this year. This is up 3% from last year’s 3.12 billion-pound crop, which was worth an estimated $6.5 billion.

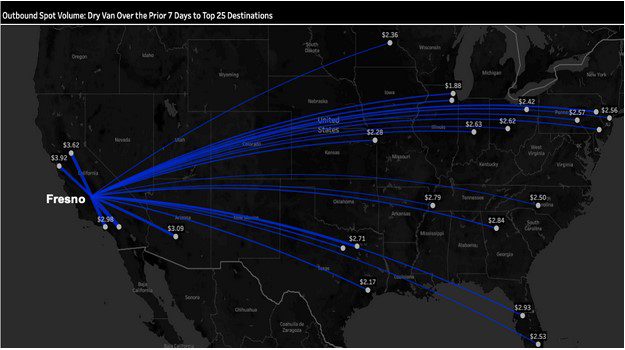

The majority of the almond crop is grown in California’s Central Valley, which includes the Fresno freight market in the south and the Stockton market in the north. This makes for a short trip to Los Angeles, where most export containers are loaded.

“Local drayage carriers take loaded 20-foot or 40-foot dry containers to the port each day and bring an empty one back to be loaded,” says Jonathan Meyer, CEO of Treehouse Almonds.

Based on the 2020 crop tonnage, approximately 70% of almond production — or the equivalent just under 1,000 40-foot export containers per week — are hauled by drayage carriers for export. The almond export market involves port destinations to over 90 countries with India being the top export market.

The almond freight task is larger than one might expect. First, 80,000-pound short-haul loads (in double combination hopper trailers) of freshly harvested almonds are shipped from the orchard to the huller or sheller facility. Once the almonds are shelled, they’re shipped again to the handler for sizing, processing, storage and shipping.

Both steps combine for 150,000 truckloads — and that’s before export or domestic loads are hauled. Domestic loads within the U.S. average just over 21,000 loads each year, which makes a combined total of approximately 141,000 truckloads of almonds annually.

Peanuts required about 263,000 truckloads in 2020

Georgia accounted for 3.28 billion pounds of peanuts in 2020, and Alabama came in second at 637 million pounds.

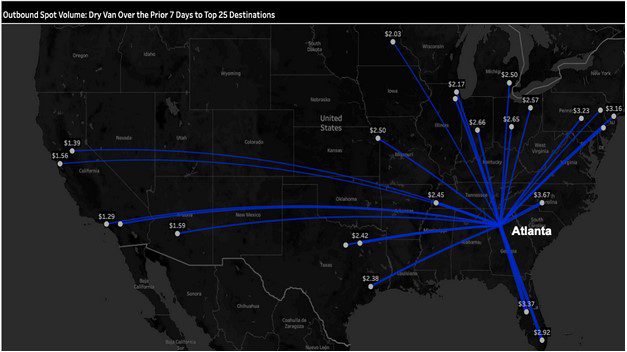

While Georgia is known as the leading producer of peanuts, approximately half of the peanuts produced in the United States are grown within a 100-mile radius of Dothan, AL. In terms of national production, the vast majority of peanuts are grown in the Southeast Region (Georgia, Florida, Alabama and Mississippi). This region produces approximately 65% of all U.S.-grown peanuts.

Globally, the U.S. was the fourth largest producer last year at 6.134 billion pounds with exports accounting for 25-30% of production.

Once harvested, the peanut crop is shipped in dump trucks to the shelling plant. It’s then processed and packed for shipment a second time to consumer markets and other peanut-based manufacturers (peanut butter, peanut oil, candy, etc.).

Based on the 2020 crop production of 6.134 billion pounds, the freight task involves the equivalent of 123,000 truckloads of bulk peanuts from farm to sheller. And then another estimated 140,000 truckloads are needed to ship to domestic retail consumer markets, intermediate manufacturers or export markets via ports.

That makes an estimated total of 260,000 truckloads of peanuts before we even get to the shipping stage for products like peanut butter, which accounts for around half of all edible peanuts produced in the U.S.

Tighter capacity and higher spot rates

Like all freight types, both almond and peanut shipping right now is impacted by tight capacity, mostly in the longer-haul truckload market.

“The current shortage of trucks is driving us nuts,” a grower told DAT.

In the Southeast Region, DAT dry van spot rates have been steadily climbing for the last four weeks to reach an average of $2.72/mile to all destinations this week. Southern Georgia, the heart of peanut country, is seeing even higher rates.

Using Douglas, GA as the center of peanut production, spot rates to Orlando are currently averaging $4.17/mile. This is up $1.05/mile since February after averaging $3.30/mile for the second half of last year.

On the West Coast in the Fresno market, capacity is tight for long-haul almond shippers. Dry van outbound spot rates are averaging $2.78/mile. On the 922-mile run to Seattle, spot rates are currently $4.01/mile after increasing $1.29/mile since the start of this year.