The economy has been sending mixed signals lately. Unemployment is low, but so is workforce participation. The ISM Manufacturing Index stabilized at 51.5 (modest growth) in April, but that result was preceded by a five-month decline.

Good News and Bad News of Changing Fuel Prices

Fuel prices are trending up seasonally, which adds to the good-news-bad-news scenario. From November until now, the rapid decline in fuel prices put more money back into consumers’ pockets. However, low prices made it less attractive for oil companies to explore and develop new drilling sites, which detracted from short-term growth in GDP and jobs.

The freight transportation sector experiences all the positive and negative effects of changing fuel prices. Truckers enjoy a reduction in one of their biggest operational costs, but they get lower rates on the spot market as well as directly from shippers, due to a declining fuel surcharge. There is less freight now than there was at this time last year, because of all that drilling equipment and steel pipe that is not going anywhere. Trains have more track capacity available, in part because of reduced coal traffic, so rail intermodal competes effectively again with trucks on certain long-haul lanes.

Freight Undergoes Geographic Shifts, Due to Economic and Seasonal Change

Is another sector of the economy poised for growth? There is substantial growth in non-manufacturing businesses. Also, auto manufacturing and related industries continue to show strong numbers. This will generate freight in broad swaths of the Southeast, Midwest and parts of Texas, especially for flatbeds.

That represents a geographic shift. As a direct result of changes in the energy sector, there is much less demand for flatbed freight from, say Houston to Bismarck, ND, which was a very strong lane for much of 2014. Other market forces have led to shifts in freight volume, as well. For example, last year’s persistent labor issues at West Coast ports led shippers to shift some import traffic to the East Coast, with an impact on freight movement throughout the U.S. Right now, freight volume is surging in the Southeastern U.S., as the long-awaited spring season begins in earnest.

Shippers are enjoying the lower costs resulting from a smaller fuel surcharge. Line haul rates on the spot market are generally higher than a year ago, mostly owing to the enhanced driver pay, but the increases don’t offset the fuel savings. So the industry is well positioned to handle the coming May-June peak season.

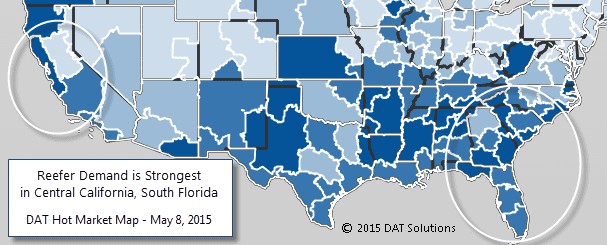

Demand for trucks outstripped capacity last week in many Southeastern markets. Vans outbound from Atlanta got paid 6¢ more per mile last week, for an average of $2.07, as well over 4,000 loads were offered on DAT Load Boards in a single day, when “only” 1,250 trucks were posted. The imbalance was even more pronounced in South and Central Florida, with more than 3,800 and 3,000 loads, respectively, and 8.3 loads per truck. Van rates are trending up modestly, but reefer rates are booming; outbound rates from Miami jumped 32¢ in the past week.

Capacity is Strong in Most Regions

Apart from the intense seasonal demand in the Southeast, there is more truckload capacity available across the country than there was in April and May of last year. There are two main reasons: first, key portions of the Hours of Service rules were rolled back, giving long-haul truckers more flexibility to deploy the 34-hour restart. Second, the trucking industry benefited from a new labor pool, as workers left the oil and gas fields. The construction industry is not hiring, but trucking companies are ramping up recruitment and improving driver compensation. Driver turnover is trending down. All those big fleets that bought Class 8 trucks in record numbers in 2014 can now put them on the road, which has a moderating impact on rates.

Hot Markets, by Equipment Type

VAN is currently tight in Alabama and Georgia, with surrounding states also showing solid demand. On the other hand, rates are not rising on the West Coast, Denver or much of the Midwest or in the Northeast, as capacity remains readily available in those areas.

FLATBED demand remains high across the U.S. Exceptions are California, Colorado, North Dakota, and parts of the Northeast. Now that the weather is reliably temperate, more commodities can travel via flatbed.

REEFER looks strong in Arkansas, Georgia, and Maine right now, in addition to Florida. The rest of the Southeast is also in play. Produce continues to move in Southern Texas, and Mexican border crossings are robust at Nogales, AZ and other points. Reefer freight out of California is lackluster, due to the multi-year drought, but seasonal volume is beginning to build in the Fresno and San Francisco markets. Overall, nationwide volumes are comparable to last year.

Generally speaking, 2015 represents a return to more normal business conditions, with strong seasonal freight and looser capacity. These indicators tell me that the economy, including the transportation sector, is somewhat less stressed than it has been in recent years, and it may be poised for renewed growth.

Load availability and capacity data are based on load and truck posts on DAT Load Boards, and rate information is derived from DAT RateView. To learn more, or to request a demo, please contact our award-winning customer service team at 800.551.8847 or complete this online form.