Rates shot up in major markets last week, and then on Monday they rose some more. Timing was a big factor. Monday, June 30 was the last day of the quarter, as well as the last chance to move perishable goods to market before the Fourth of July. That last little spike pushed national average rates for June to $2.09 for van, $2.43 for reefer and $2.44 for flatbed on the spot market. Rates for vans and reefers added a penny per mile between Saturday, June 28 and close of business on Monday, June 30.

Freight availability and rates usually peak in June on the spot market for both vans and reefers , and this year’s flatbed volume was elevated in June, as well. As depicted in the Hot Market Map, below, load availability was high and truck capacity was tight throughout the country, yielding high load-to-truck ratios — dark red areas on the map — on DAT Load Boards. The Midwest and Southeast are very hot, but truckload rates rose last week in major freight markets across all regions of the U.S. The regional trends were exemplified with sharp increases on outbound van rates from L.A., Chicago, Dallas, Philadelphia and Atlanta.

Hot Market Maps display the relationship between load posts and truck posts on DAT Load Boards. The maps, which are available in DAT RateView and DAT Power Load Boards, enable transportation and logistics professionals to assess spot market demand and capacity, and anticipate changes in truckload rates.

WEST COAST – Outbound van rates rise in L.A., reefer rates decline in Fresno

Strike avoidance at the ports may have caused some of the atypical demand. Shippers accelerated their import schedules from Asia to avoid delays at West Coast ports. Unions representing dockworkers and other port employees are still in negotiations to renew a two-year contract that was to expire on Monday. The contract was extended for two weeks, but shippers had already moved some freight early, to reduce exposure in the event of a port strike.

Van rates rose 3¢ last week, outbound from the Los Angeles market, which includes the Ports of Los Angeles and Long Beach, by far the largest on the West Coast. The average rate rose 15¢ on the lane from L.A. to Denver, to $3.22 per mile. The rate dropped 17¢ for the return trip, which now pays only $1.13, but if truckers find a load without much deadhead or detention, the round-trip average of $2.18 is above the national market rate. Seattle rates dropped, in part due to a 30¢ decline on the lane from Seattle to Spokane. In that case, the rate increased for the return trip, and the lane offers a nice opportunity for truckers: $2.93 on the eastbound leg and $2.18 per mile to return.

Reefer freight volume in the Golden State is driven by produce harvests, and Southern California is just past its peak. Central California is not picking up the missing volume because of the drought conditions. (Cherries and other fruit crops are having an exceptionally good year in Oregon and Washington, making up for the shortfalls in California.) For now, outbound rates remain elevated in the freight markets surrounding Los Angeles (up 6¢ last week, to an average of $3.15 per mile) and Ontario (up 7¢, to $2.79) but volume and rates are beginning to slip in Fresno (down 6¢, to $2.62.)

MIDWEST – Chicago rates rise on long-haul van freight

Van rates spiked 31¢ per mile on the lane from Chicago to Philadelphia last week. Average rates have been bouncing around between $2.48 and $2.80 per mile on that lane for the entire month, with consistently high demand for trucks. The cargo on this lane includes consumer goods, and the Philly market is home to some major retail distribution centers, so this looks like an encouraging trend for the economy. Rates rose 3¢ on the return trip to Chicago, as well, but westbound rates from Philly still average only $1.35 per mile, which is below the break-even level for many fleets. Round-trip average is between $1.91 and $2.08.

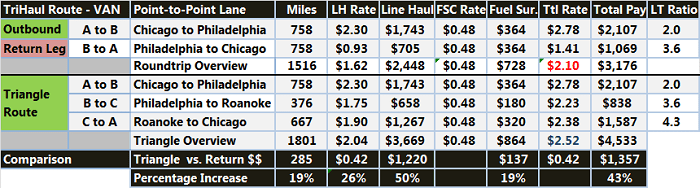

This is a good opportunity for a triangular route, or TriHaul. If the driver and truck can make a stop on the way back to Chicago, look for loads from Philly to Roanoke, VA, and take advantage of demand there to find a second load to Chicago. This stop could add a day to the roundtrip, because it’s not exactly on route, but the truck can make almost 50¢ more per mile on average, and the driver can fill out a whole week of HOS on this one trip. Here’s how it looks in a spreadsheet:

SOUTH CENTRAL – Dallas expands role as a hub for van and reefer freight

Dallas was home to the biggest rate increase last week, adding 8¢ (3.6%) to an average of $2.15 per mile outbound. Intrastate rates declined from Dallas to both Houston and Laredo, but the lane from Dallas to Atlanta added 10¢ per mile and the lane from Dallas to Denver rose a whopping 25¢, to $2.80. Rates dropped only 5¢ to $1.49 per mile on the return trip from Denver to Dallas, so the truck will average $2.15 on loaded miles for the round trip.

SOUTHEAST – Atlanta is hot for vans and reefers, as Florida harvests cool off

Atlanta was awash in freight for vans and reefers, for most of the month of June. Outbound rates are up to $2.45 per mile for vans and $2.56 for reefers, thanks to big increases on lane rates in most directions. Lane rates rose from Atlanta into Lakeland and other Florida markets, as harvests wane in the Sunshine State and the southbound leg returns to head haul status. Atlanta is also playing the role of regional hub for cargo that originates in agricultural and industrial zones as well as freight bound to and from Savannah and other sea ports in the Southeast.

NORTHEAST – Philadelphia van rates rise in both directions, but outbound reefer rates slip

Inbound van rates rose into Philadelphia last week from at least three major markets: Chicago (Chicago to Philadelphia, up 31¢), Atlanta (up 28¢) and Buffalo (up 6¢.) Some outbound lane rates rose from Philly, as well: to Boston (up 8¢), to Buffalo (up 4¢) and to Chicago (up 3¢). Those last two are unusual because rates rose in both directions of the round trip.

Reefers lost an average of 4¢ per mile leaving the City of Brotherly Love last week. That average includes an 11¢ hike in the rate from Philly to Miami, balanced by declining rates on higher-volume, westbound lanes to Chicago and Columbus.