In 2024, Americans spent an impressive $8.5 billion on hot dogs and sausages at U.S. supermarkets, according to the National Hot Dog and Sausage Council. Los Angeles led the nation in hot dog consumption for over a decade, purchasing more than 27 million pounds, or nearly 650 refrigerated truckloads, of hot dogs. This significantly outpaced New York (18.7 million pounds) and Dallas (13.6 million pounds). Dodger Stadium alone sells approximately 2.5 million hot dogs per season, reflecting the city’s strong affinity for them.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Overall, Americans bought over 2 billion pounds of hot dogs and sausages last year, equivalent to almost 47,000 refrigerated truckloads. While Los Angeles dominated hot dog sales, New Yorkers led the sausage category, consuming over 35 million pounds compared to LA’s 34 million.

July is recognized as National Hot Dog Month, a tradition established by the U.S. Chamber of Commerce in 1956. This designation highlights the hot dog’s strong association with American summer traditions like grilling, baseball, and Independence Day celebrations, a connection continuously promoted by the National Hot Dog and Sausage Council.

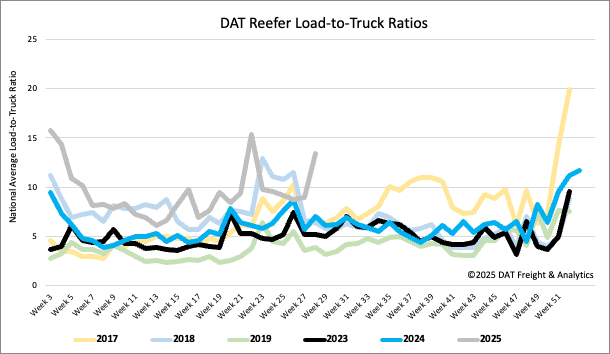

Load-to-Truck Ratio

Last week, reefer load post volume surged by 35% due to a last-minute rush in produce shipments. While overall fruit and vegetable volumes rose by 5% for the week, year-to-date figures remain 7% below last year. California, typically contributing around 25% of national volume in Week 26, only accounted for 19% this year, with its year-to-date volumes down by 22%. This increase in load volume, coupled with a 9% drop in reefer equipment postings, led to a 3% increase in the reefer load-to-truck ratio, which reached 13.41.

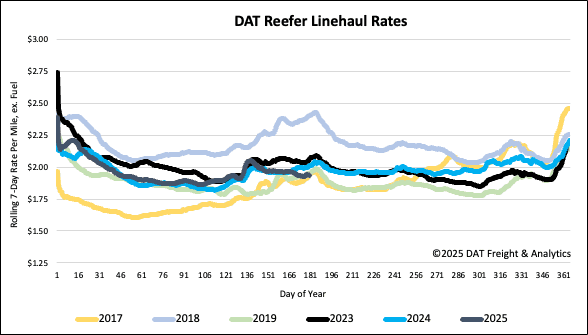

Spot rates

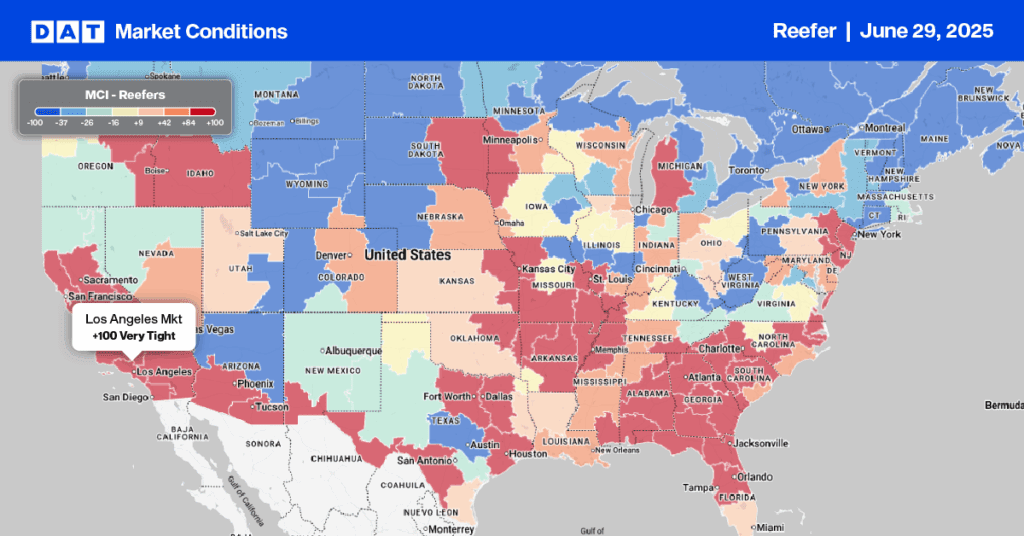

Reefer spot rates held steady last week, defying expectations by remaining flat at just over $1.95 per mile. This figure is $0.08 per mile lower than last year and only $0.02 per mile higher than the freight recessionary period of 2019. Looking ahead to the short workweek leading up to July Fourth, we anticipate a last-minute surge in produce volume. This, combined with the holiday, is likely to cause rate volatility and tighter capacity in key domestic produce growing regions such as California and Florida, as well as for imports from Mexico via the McAllen market in the Rio Grande Valley.