U.S. single-family homebuilding saw a slight increase in May, but the overall housing market remains subdued. This is largely due to a significant decline in single-family permits for future construction, down 7% compared to May last year, alongside challenges posed by tariffs and an abundance of unsold homes.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Single-family housing starts, which are the most freight intensive and represent the majority of homebuilding activity, rose by 0.4% last month to a seasonally adjusted annual rate of 924,000 units, as reported by the Commerce Department’s Census Bureau on Wednesday.

Home builders are scaling back considerably, anticipating a decrease in sales. This slowdown in new home construction is primarily a response to reduced buyer demand. Elevated inventory levels and sluggish demand have led to homes remaining on the market for extended periods. Consequently, more builders are resorting to price reductions to attract buyers. Additionally, increased import duties on materials like lumber, aluminum, and steel are driving up construction costs.

The uncertainty in the economy, exacerbated by these tariffs, has prompted the Federal Reserve to halt its interest rate cutting cycle. The U.S. central bank is expected to maintain its benchmark overnight interest rate within the 4.25%-4.50% range, where it has been since December. A recent survey by the National Association of Home Builders (NAHB) indicated that sentiment among single-family homebuilders plunged to a 2.5-year low in June.

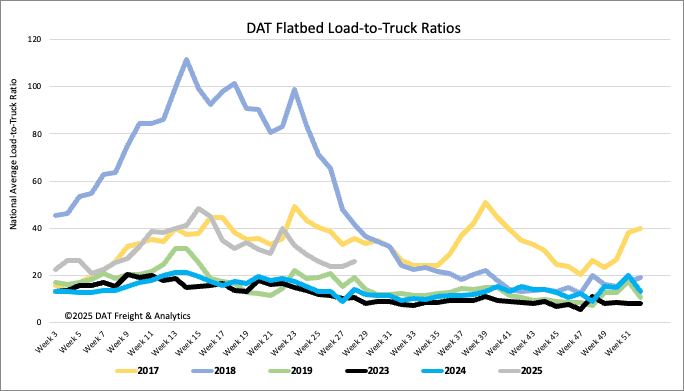

Load-to-Truck Ratio

Flatbed volume remained largely consistent last week, showing a 13% increase year-over-year. Despite an 8% decrease in carrier equipment posts, the flatbed load-to-truck ratio held steady at 25.68.

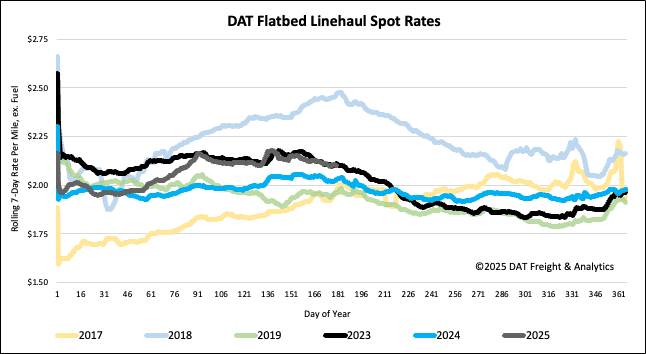

Spot rates

For the second consecutive week, the national average flatbed spot rate, excluding fuel, experienced a $0.02 per mile decline, settling just under $2.12/mile. Despite this drop, the current rate remains $0.07 per mile higher than the corresponding week in 2024.