The outlook for used truck prices looks great if you’re a seller. It’s not so good if you are one of the many fleet owners scrambling to add capacity to meet demand.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

According to Chris Visser, Sr. Analyst and Product Manager, Commercial Vehicles at J.D. Power:

“Shipping backlogs and parts shortages are as bad as they’ve ever been, and mainstream media outlets are already talking about critical conditions leading into the holidays. Inflation — and the Fed’s response to it — is probably the biggest factor on our minds at the moment. In terms of the used truck market, we expect conditions to remain hot into next year, barring any unforeseen economic changes.”

Sleeper tractors sold at auction

Since last September, auction volumes of the three most commonly used sleeper cab tractors (3-7 years) are down 53%. And since the record-high of 1,054 vehicles sold at auction in June last year, volumes are down 74%.

However, the volume of used sleeper cab tractors sold through the two largest nationwide no-reserve auctions jumped by 171% between August and September. The increase in this September’s volume was due to a combination of more auctions on the calendar and slightly more trucks returning off trade.

| Truck model year | Average sell price | Month-over-month change | Year-over-year change |

| 2019 | $106,110 | +8% | +87% |

| 2018 | $83,809 | +17% | +63% |

| 2017 | $62,475 | +12% | +94% |

| 2016 | $58,792 | +28% | +128% |

“This doesn’t mean the market is changing though, as pricing increased dramatically despite the uptick in volume,” says Visser. “The sense of urgency is as strong as ever in the auction lanes, with buyers continuing to pay essentially retail pricing for desirable trucks. Expect the rest of the year to feel similar.”

For the first nine months of this year, this benchmark group of tractors are selling 87% higher compared to the first 9 months of 2020. On average, buyers are paying close to $15,000 more per tractor this year compared to 2020.

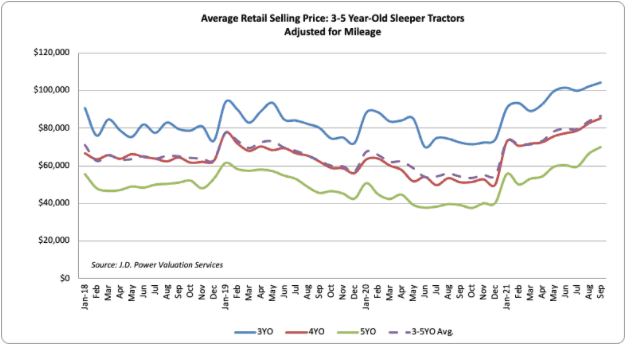

What about retail truck prices?

The J.D. Power report noted that September resulted in another record month for pricing while the supply of desirable trucks remains inadequate. The average sleeper tractor retailed in September was 74 months old, had 459,393 miles, and sold at $78,207.

Compared to August, this average sleeper was one month older, had 6,506 (1.4%) more miles, and cost $3,788 (5.1%) more. Compared to September 2020, this average sleeper was 5 months older, had 10,465 (2.2%) fewer miles, and cost $36,141 (85.9%) more.

Retail inquiries were healthy in September, but many potential buyers walked away empty-handed as there were just not enough trucks available to sell. Dealers retailed an average of 4.4 trucks per rooftop in September, 0.4 trucks lower than August.